Answered step by step

Verified Expert Solution

Question

1 Approved Answer

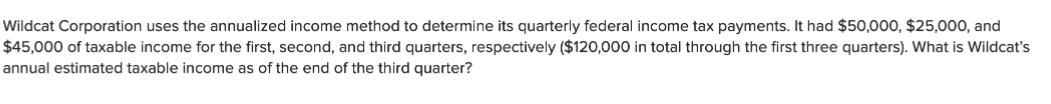

Wildcat Corporation uses the annualized income method to determine its quarterly federal income tax payments. It had $50,000, $25,000, and $45,000 of taxable income

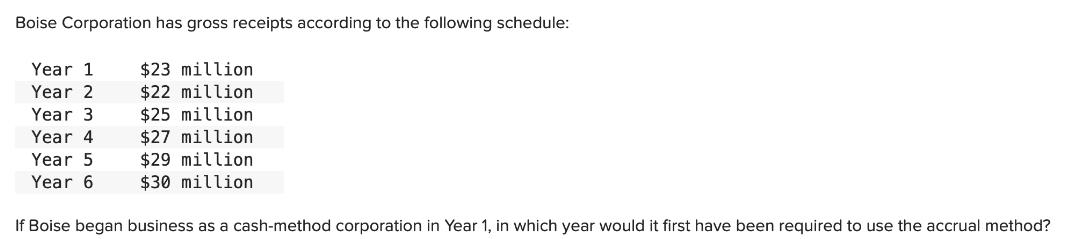

Wildcat Corporation uses the annualized income method to determine its quarterly federal income tax payments. It had $50,000, $25,000, and $45,000 of taxable income for the first, second, and third quarters, respectively ($120,000 in total through the first three quarters). What is Wildcat's annual estimated taxable income as of the end of the third quarter? Boise Corporation has gross receipts according to the following schedule: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $23 million $22 million $25 million $27 million $29 million $30 million If Boise began business as a cash-method corporation in Year 1, in which year would it first have been required to use the accrual method?

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To determine Wildcat Corporations annual estimated taxable income as of the end of the third quart...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started