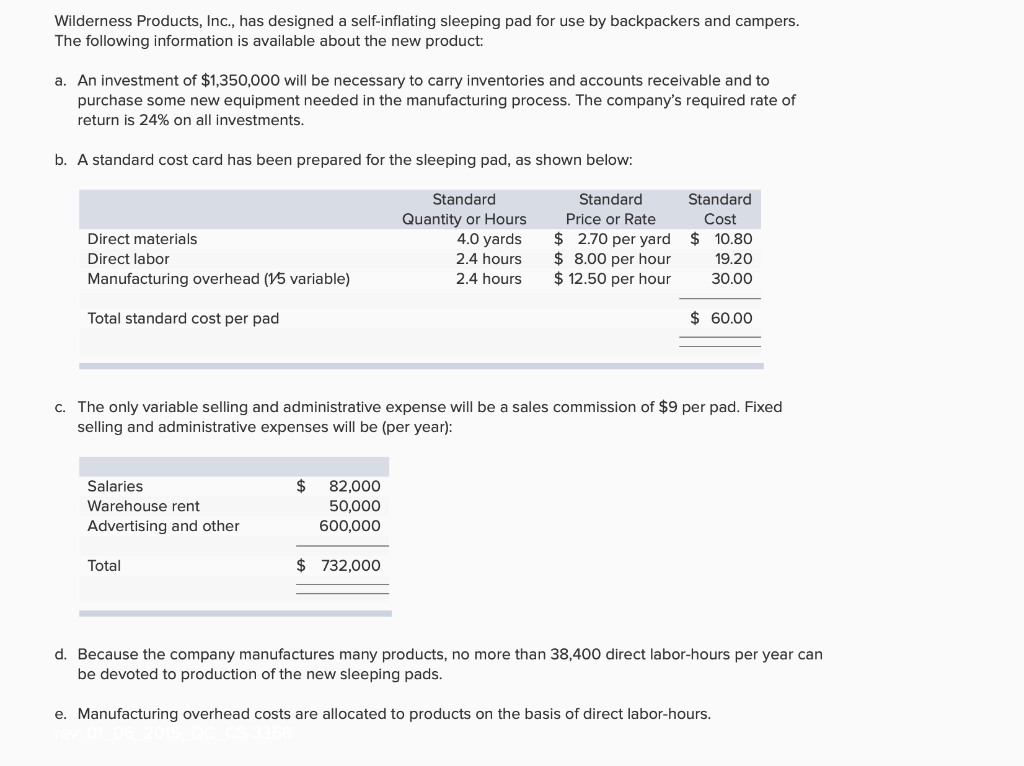

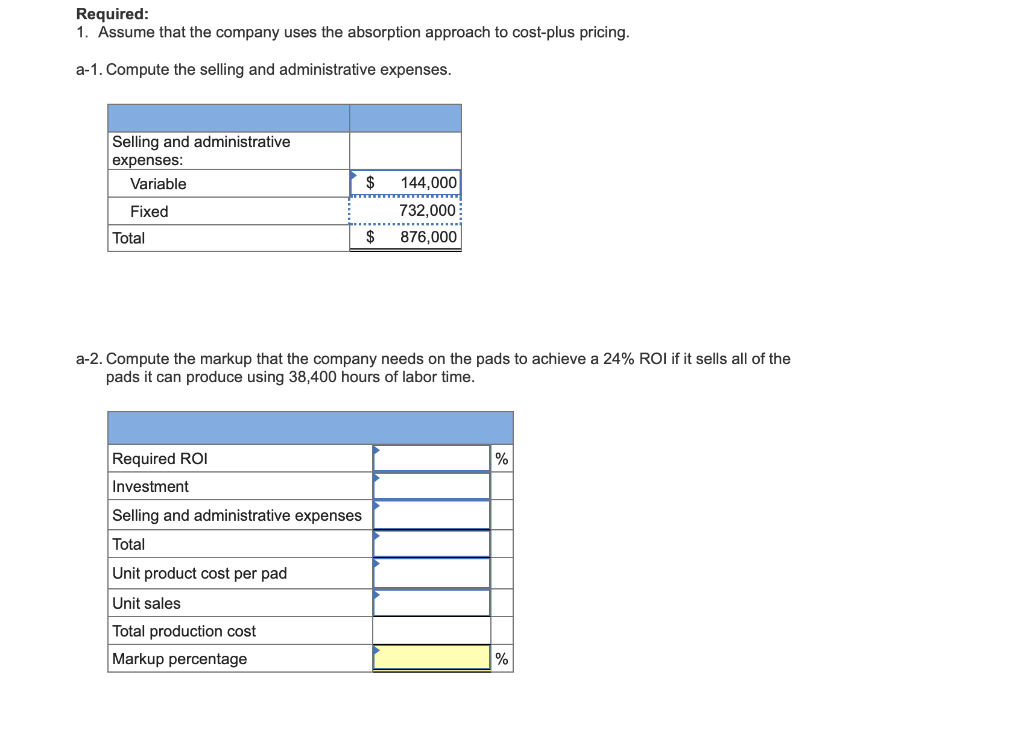

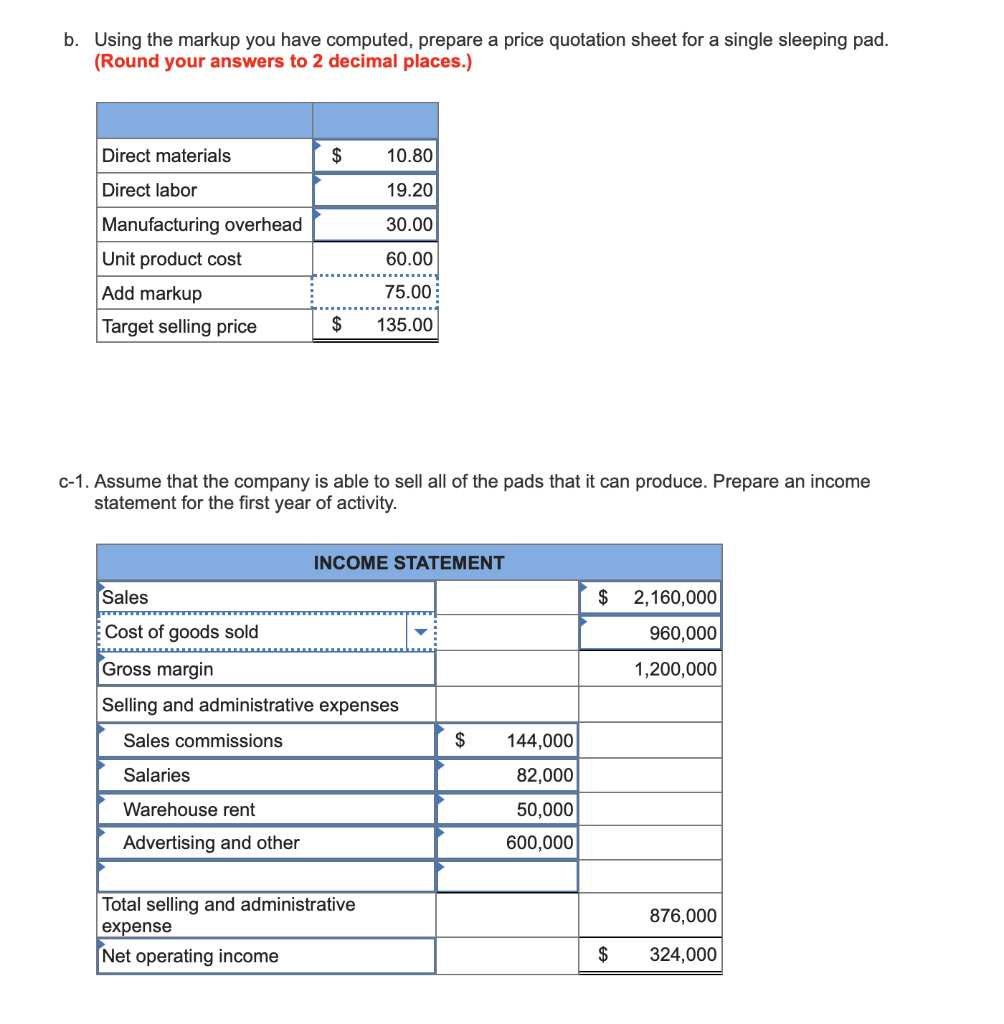

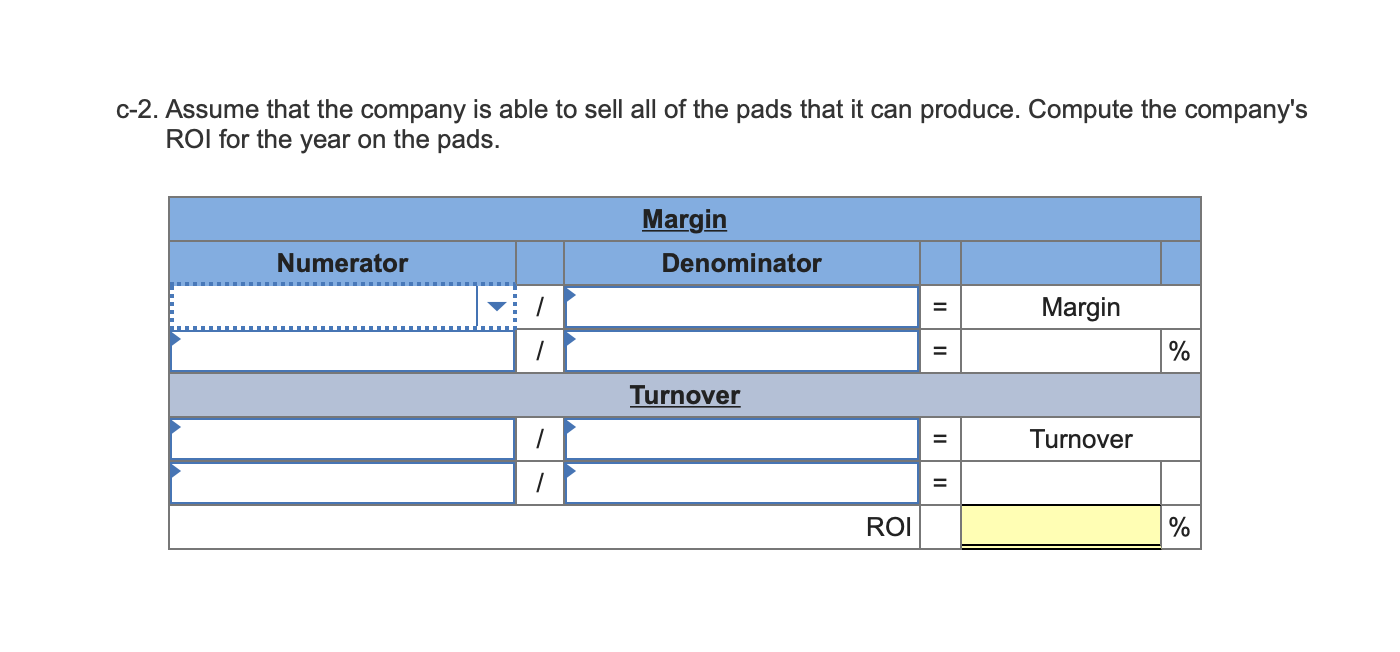

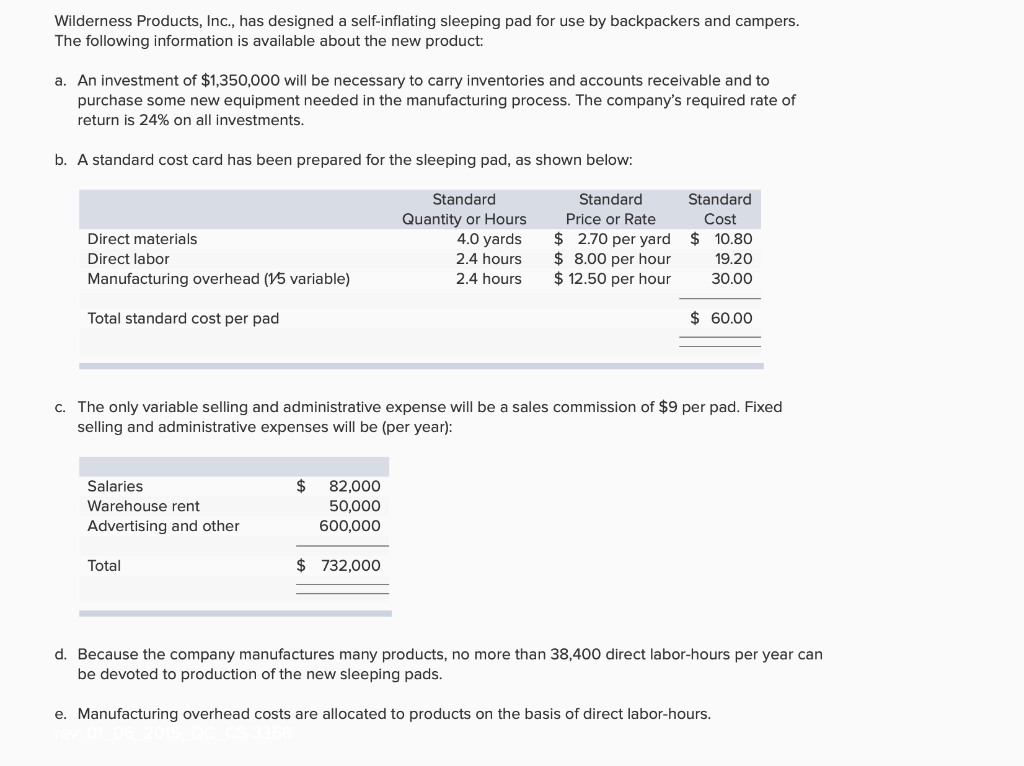

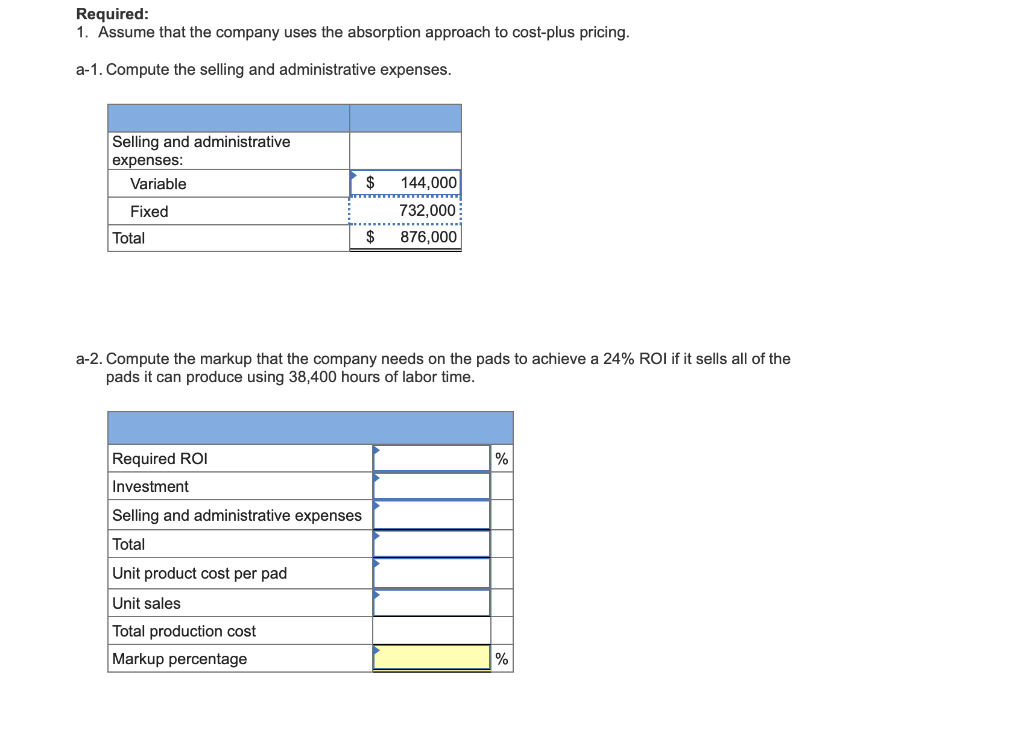

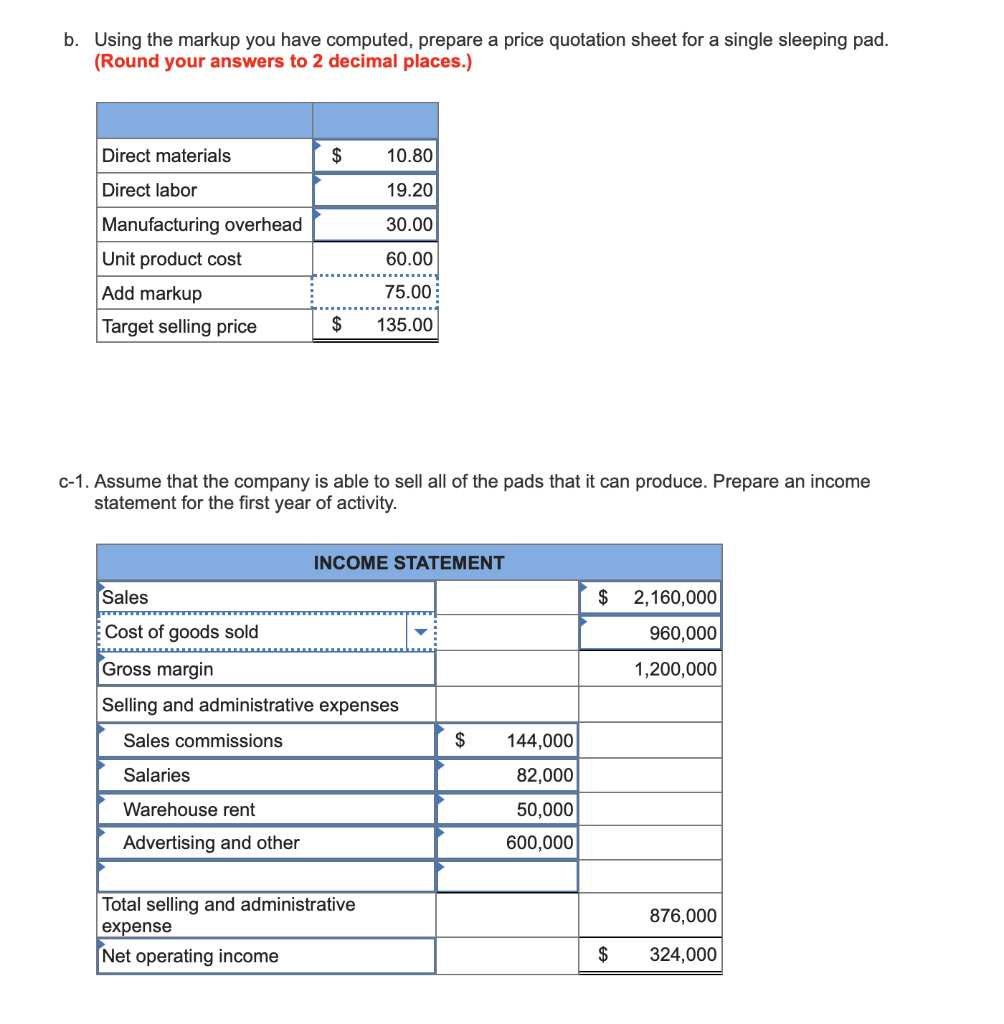

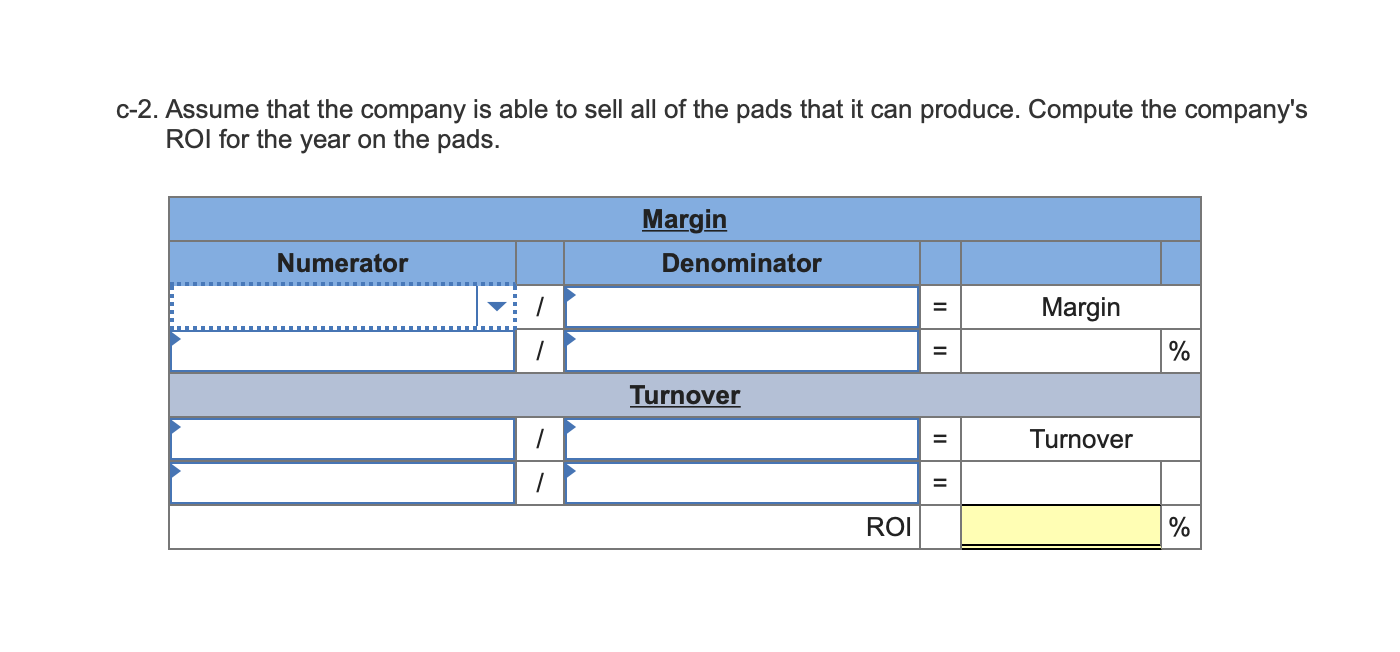

Wilderness Products, Inc., has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is available about the new product: a. An investment of $1,350,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment needed in the manufacturing process. The company's required rate of return is 24% on all investments. b. A standard cost card has been prepared for the sleeping pad, as shown below: Direct materials Direct labor Manufacturing overhead (15 variable) Standard Quantity or Hours 4.0 yards 2.4 hours 2.4 hours Standard Standard Price or Rate Cost $ 2.70 per yard $ 10.80 $ 8.00 per hour 19.20 $ 12.50 per hour 30.00 Total standard cost per pad $ 60.00 C. The only variable selling and administrative expense will be a sales commission of $9 per pad. Fixed selling and administrative expenses will be (per year): $ Salaries Warehouse rent Advertising and other 82,000 50,000 600,000 Total $ 732,000 d. Because the company manufactures many products, no more than 38,400 direct labor-hours per year can be devoted to production of the new sleeping pads. e. Manufacturing overhead costs are allocated to products on the basis of direct labor-hours. Required: 1. Assume that the company uses the absorption approach to cost-plus pricing. a-1. Compute the selling and administrative expenses. Selling and administrative expenses: Variable 144,000 Fixed 732,000 876,000 Total $ a-2. Compute the markup that the company needs on the pads to achieve a 24% ROI if it sells all of the pads it can produce using 38,400 hours of labor time. Required ROI % Investment Selling and administrative expenses Total Unit product cost per pad Unit sales Total production cost Markup percentage % b. Using the markup you have computed, prepare a price quotation sheet for a single sleeping pad. (Round your answers to 2 decimal places.) Direct materials $ 10.80 19.20 30.00 Direct labor Manufacturing overhead Unit product cost Add markup Target selling price 60.00 75.00 $ 135.00 C-1. Assume that the company is able to sell all of the pads that it can produce. Prepare an income statement for the first year of activity. INCOME STATEMENT Sales $ 2,160,000 Cost of goods sold 960,000 Gross margin 1,200,000 Selling and administrative expenses Sales commissions $ 144,000 Salaries 82,000 Warehouse rent 50,000 600,000 Advertising and other 876,000 Total selling and administrative expense Net operating income $ 324,000 C-2. Assume that the company is able to sell all of the pads that it can produce. Compute the company's ROI for the year on the pads. Margin Denominator Numerator Margin = % Turnover / = Turnover 7 = ROI % Wilderness Products, Inc., has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is available about the new product: a. An investment of $1,350,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment needed in the manufacturing process. The company's required rate of return is 24% on all investments. b. A standard cost card has been prepared for the sleeping pad, as shown below: Direct materials Direct labor Manufacturing overhead (15 variable) Standard Quantity or Hours 4.0 yards 2.4 hours 2.4 hours Standard Standard Price or Rate Cost $ 2.70 per yard $ 10.80 $ 8.00 per hour 19.20 $ 12.50 per hour 30.00 Total standard cost per pad $ 60.00 C. The only variable selling and administrative expense will be a sales commission of $9 per pad. Fixed selling and administrative expenses will be (per year): $ Salaries Warehouse rent Advertising and other 82,000 50,000 600,000 Total $ 732,000 d. Because the company manufactures many products, no more than 38,400 direct labor-hours per year can be devoted to production of the new sleeping pads. e. Manufacturing overhead costs are allocated to products on the basis of direct labor-hours. Required: 1. Assume that the company uses the absorption approach to cost-plus pricing. a-1. Compute the selling and administrative expenses. Selling and administrative expenses: Variable 144,000 Fixed 732,000 876,000 Total $ a-2. Compute the markup that the company needs on the pads to achieve a 24% ROI if it sells all of the pads it can produce using 38,400 hours of labor time. Required ROI % Investment Selling and administrative expenses Total Unit product cost per pad Unit sales Total production cost Markup percentage % b. Using the markup you have computed, prepare a price quotation sheet for a single sleeping pad. (Round your answers to 2 decimal places.) Direct materials $ 10.80 19.20 30.00 Direct labor Manufacturing overhead Unit product cost Add markup Target selling price 60.00 75.00 $ 135.00 C-1. Assume that the company is able to sell all of the pads that it can produce. Prepare an income statement for the first year of activity. INCOME STATEMENT Sales $ 2,160,000 Cost of goods sold 960,000 Gross margin 1,200,000 Selling and administrative expenses Sales commissions $ 144,000 Salaries 82,000 Warehouse rent 50,000 600,000 Advertising and other 876,000 Total selling and administrative expense Net operating income $ 324,000 C-2. Assume that the company is able to sell all of the pads that it can produce. Compute the company's ROI for the year on the pads. Margin Denominator Numerator Margin = % Turnover / = Turnover 7 = ROI %