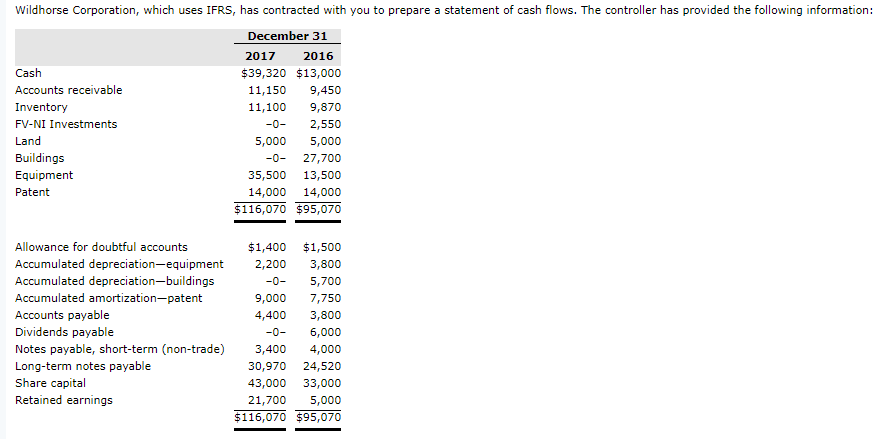

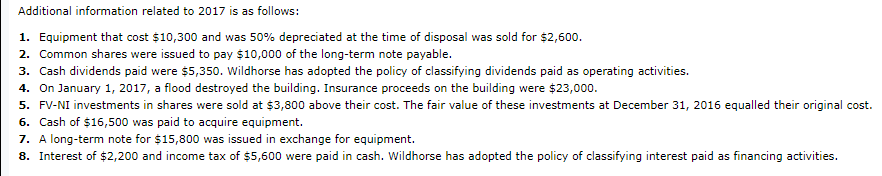

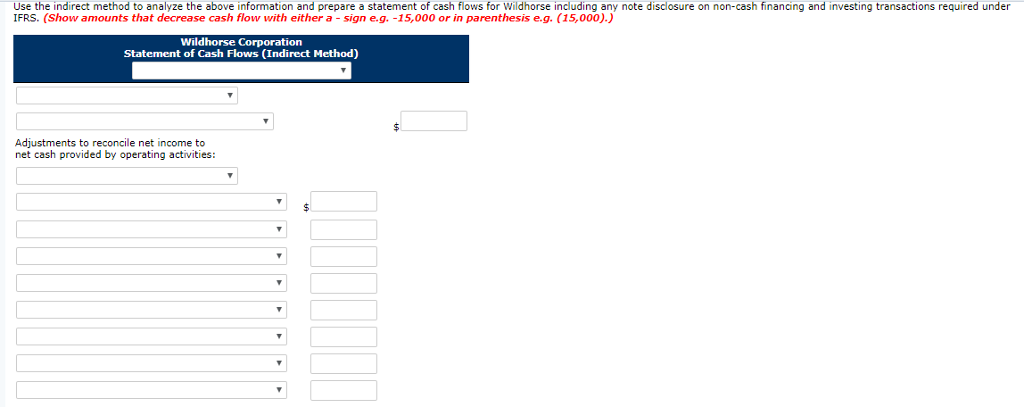

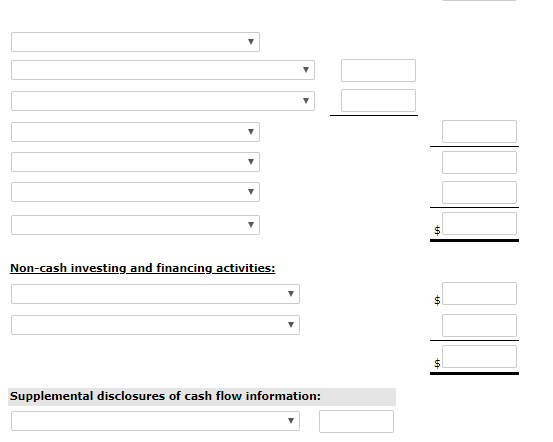

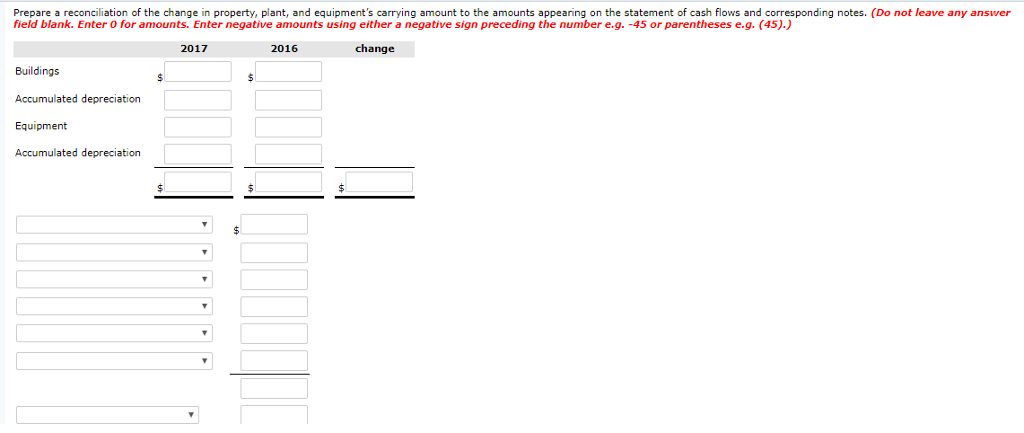

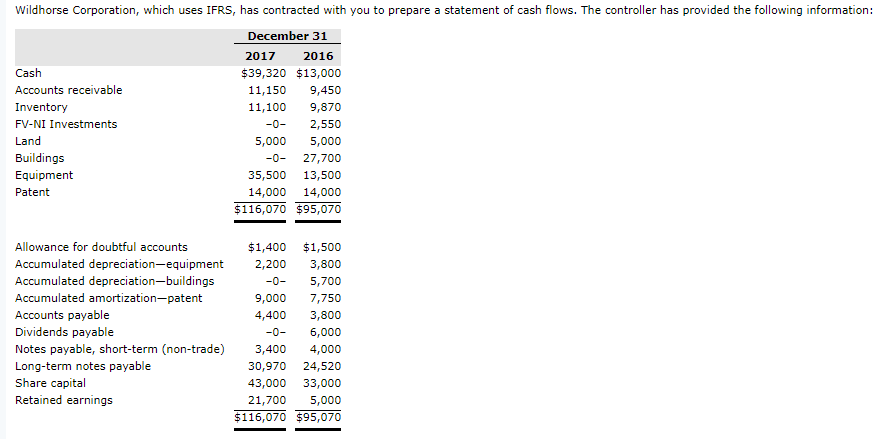

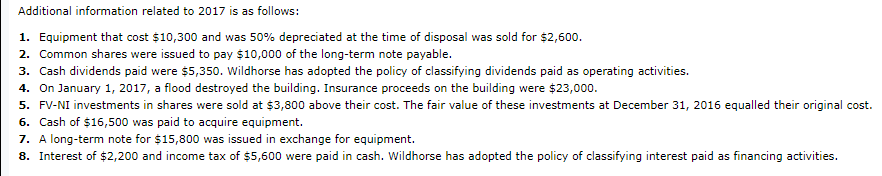

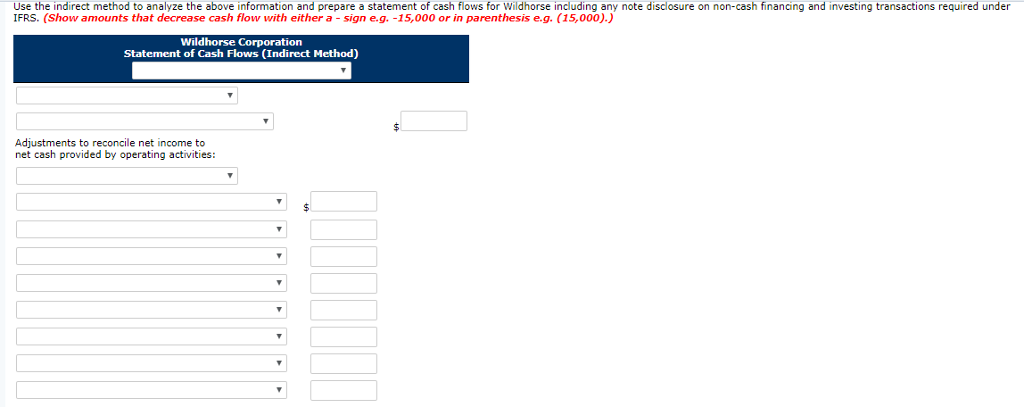

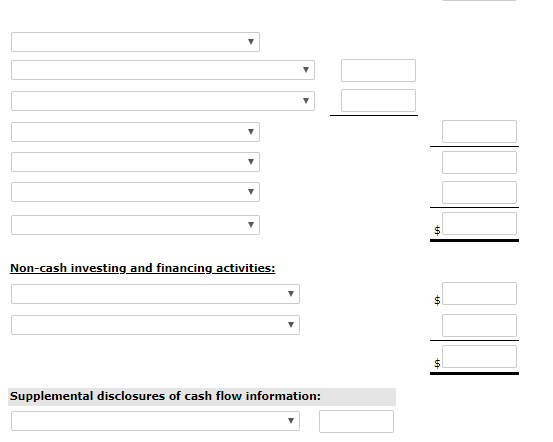

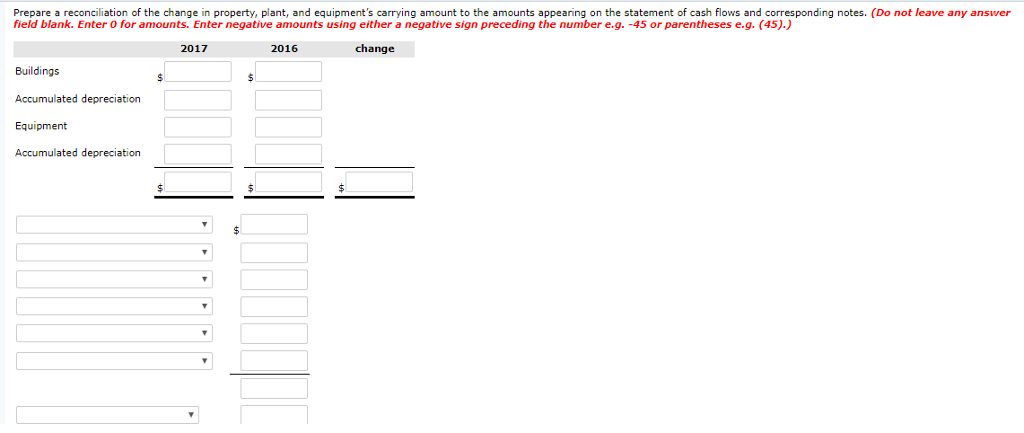

Wildhorse Corporation, which uses IFRS, has contracted with you to prepare a statement of cash flows. The controller has provided the following information: December 31 2017 2016 Cash Accounts receivable Inventory FV-NI Investments Land Buildings Equipment Patent $39,320 $13,000 11,150 9,450 11,100 9,870 -0-2,550 5,000 5,000 -0 27,700 35,500 13,500 14,000 14,000 $116,070 $95,070 Allowance for doubtful accounts $1,400 $1,500 Accumulated depreciation-equipment ,200 3,800 -0 5,700 9,000 7,750 4,400 3,800 -0 6,000 Notes payable, short-term (non-trade) 3,400 4,000 30,970 24,520 43,000 33,000 21,700 5,000 $116,070 $95,070 Accumulated depreciation buildings Accumulated amortization-patent Accounts payable Dividends payable Long-term notes payable Share capital Retained earnings Additional information related to 2017 is as follows: 1. Equipment that cost $10,300 and was 50% depreciated at the time of disposal was sold for $2,600. 2. Common shares were issued to pay $10,000 of the long-term note payable. 3. Cash dividends paid were $5,350. Wildhorse has adopted the policy of classifying dividends paid as operating activities 4. On January 1, 2017, a flood destroyed the building. Insurance proceeds on the building were $23,000. 5. FV-NI investments in shares were sold at $3,800 above their cost. The fair value of these investments at December 31, 2016 equalled their original cost. 6. Cash of $16,500 was paid to acquire equipment. 7. A long-term note for $15,800 was issued in exchange for equipment. 8. Interest of $2,200 and income tax of $5,600 were paid in cash. Wildhorse has adopted the policy of classifying interest paid as financing activities Use the indirect method to analyze the above information and prepare a statement of cash flows for Wildhorse including any note disclosure on non-cash financing and investing transactions required under IFRS. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Wildhorse Corporation Statement of Cash Flows (Indirect Method) Adjustments to reconcile net income to net cash provided by operating activities Non-cash investing and financing activities: Supplemental disclosures of cash flow information: Prepare a reconciliation of the change in property, plant, and equipment's carrying amount to the amounts appearing on the statement of cash flows and corresponding notes. (Do not leave any answer field blank. Enter 0 for amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2017 2016 change Buildings Accumulated depreciation Equipment Accumulated depreciation