Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wildhorse Land Inc. is a producer and retailer of high-end custom-designed furniture and uses the contract-based approach to revenue recognition. The company produces only

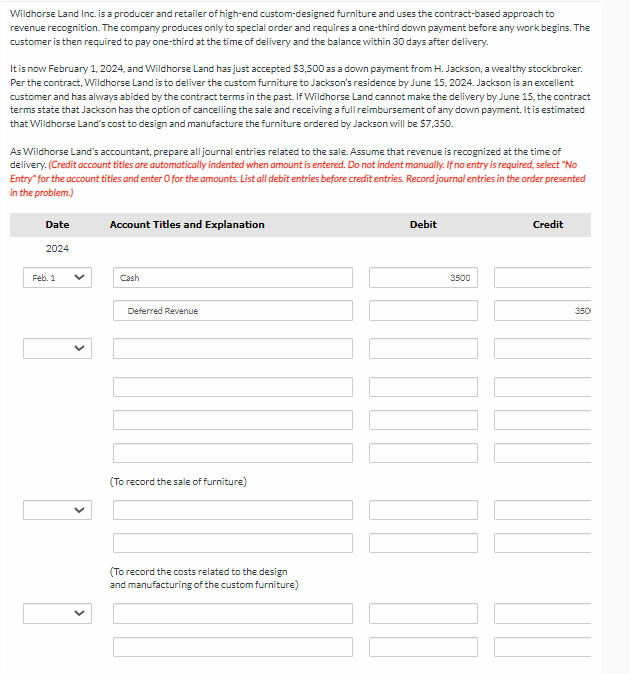

Wildhorse Land Inc. is a producer and retailer of high-end custom-designed furniture and uses the contract-based approach to revenue recognition. The company produces only to special order and requires a one-third down payment before any work begins. The customer is then required to pay one-third at the time of delivery and the balance within 30 days after delivery. It is now February 1, 2024, and Wildhorse Land has just accepted $3,500 as a down payment from H. Jackson, a wealthy stockbroker. Per the contract, Wildhorse Land is to deliver the custom furniture to Jackson's residence by June 15, 2024. Jackson is an excellent customer and has always abided by the contract terms in the past. If Wildhorse Land cannot make the delivery by June 15, the contract terms state that Jackson has the option of cancelling the sale and receiving a full reimbursement of any down payment. It is estimated that Wildhorse Land's cost to design and manufacture the furniture ordered by Jackson will be $7,350. As Wildhorse Land's accountant, prepare all journal entries related to the sale. Assume that revenue is recognized at the time of delivery. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date 2024 Feb. 1 Account Titles and Explanation Cash Deferred Revenue (To record the sale of furniture) (To record the costs related to the design and manufacturing of the custom furniture) Debit 3500 Credit 350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started