Answered step by step

Verified Expert Solution

Question

1 Approved Answer

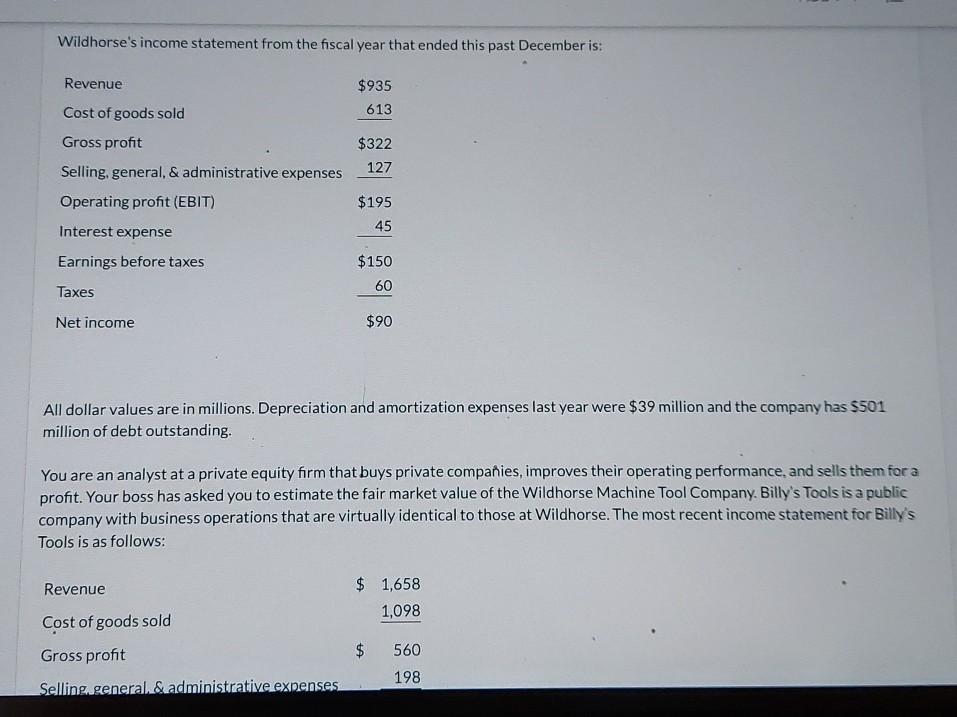

Wildhorse's income statement from the fiscal year that ended this past December is: Revenue $935 613 Cost of goods sold Gross profit Selling, general, &

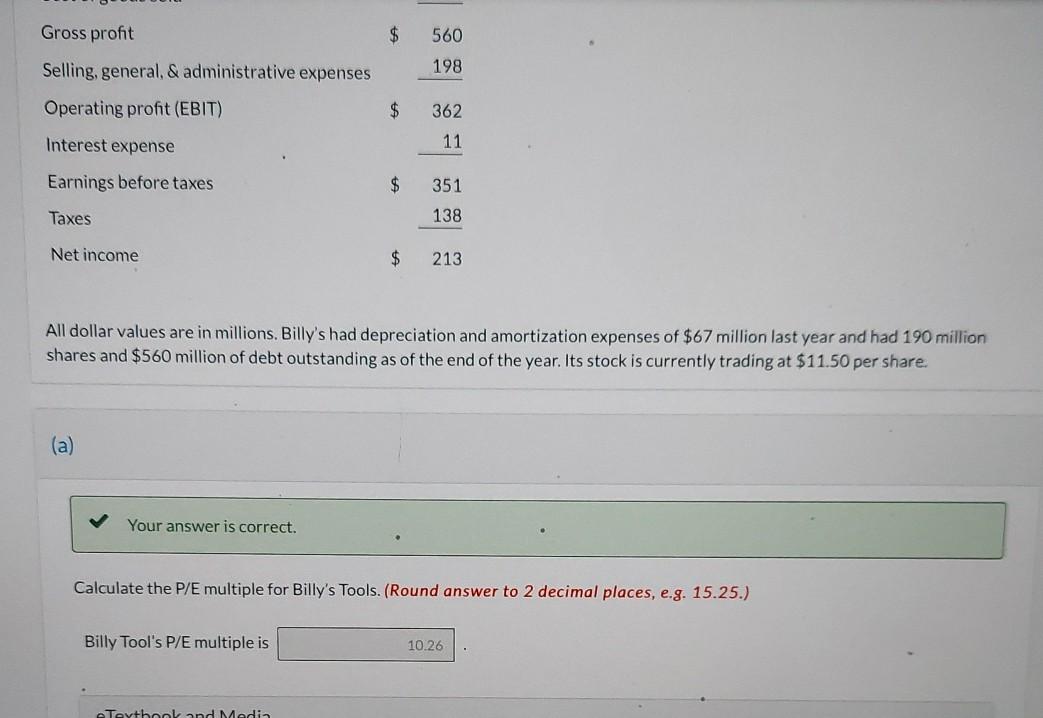

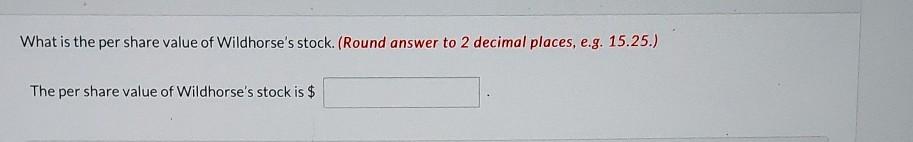

Wildhorse's income statement from the fiscal year that ended this past December is: Revenue $935 613 Cost of goods sold Gross profit Selling, general, & administrative expenses Operating profit (EBIT) $322 127 $195 45 Interest expense Earnings before taxes Taxes $150 60 Net income $90 All dollar values are in millions. Depreciation and amortization expenses last year were $39 million and the company has $501 million of debt outstanding. You are an analyst at a private equity firm that buys private companies, improves their operating performance, and sells them for a profit. Your boss has asked you to estimate the fair market value of the Wildhorse Machine Tool Company. Billy's Tools is a public company with business operations that are virtually identical to those at Wildhorse. The most recent income statement for Billy's Tools is as follows: Revenue $ 1,658 1,098 Cost of goods sold 560 Gross profit Selling general & administrative expenses 198 Gross profit $ 560 Selling, general, & administrative expenses 198 Operating profit (EBIT) $ 362 Interest expense 11 Earnings before taxes $ 351 Taxes 138 Net income $ 213 All dollar values are in millions. Billy's had depreciation and amortization expenses of $67 million last year and had 190 million shares and $560 million of debt outstanding as of the end of the year. Its stock is currently trading at $11.50 per share. (a) Your answer is correct. Calculate the P/E multiple for Billy's Tools. (Round answer to 2 decimal places, e.g. 15.25.) Billy Tool's P/E multiple is 10.26 Tevtbonland Media What is the per share value of Wildhorse's stock. (Round answer to 2 decimal places, e.g. 15.25.) The per share value of Wildhorse's stock is $ Wildhorse's income statement from the fiscal year that ended this past December is: Revenue $935 613 Cost of goods sold Gross profit Selling, general, & administrative expenses Operating profit (EBIT) $322 127 $195 45 Interest expense Earnings before taxes Taxes $150 60 Net income $90 All dollar values are in millions. Depreciation and amortization expenses last year were $39 million and the company has $501 million of debt outstanding. You are an analyst at a private equity firm that buys private companies, improves their operating performance, and sells them for a profit. Your boss has asked you to estimate the fair market value of the Wildhorse Machine Tool Company. Billy's Tools is a public company with business operations that are virtually identical to those at Wildhorse. The most recent income statement for Billy's Tools is as follows: Revenue $ 1,658 1,098 Cost of goods sold 560 Gross profit Selling general & administrative expenses 198 Gross profit $ 560 Selling, general, & administrative expenses 198 Operating profit (EBIT) $ 362 Interest expense 11 Earnings before taxes $ 351 Taxes 138 Net income $ 213 All dollar values are in millions. Billy's had depreciation and amortization expenses of $67 million last year and had 190 million shares and $560 million of debt outstanding as of the end of the year. Its stock is currently trading at $11.50 per share. (a) Your answer is correct. Calculate the P/E multiple for Billy's Tools. (Round answer to 2 decimal places, e.g. 15.25.) Billy Tool's P/E multiple is 10.26 Tevtbonland Media What is the per share value of Wildhorse's stock. (Round answer to 2 decimal places, e.g. 15.25.) The per share value of Wildhorse's stock is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started