Answered step by step

Verified Expert Solution

Question

1 Approved Answer

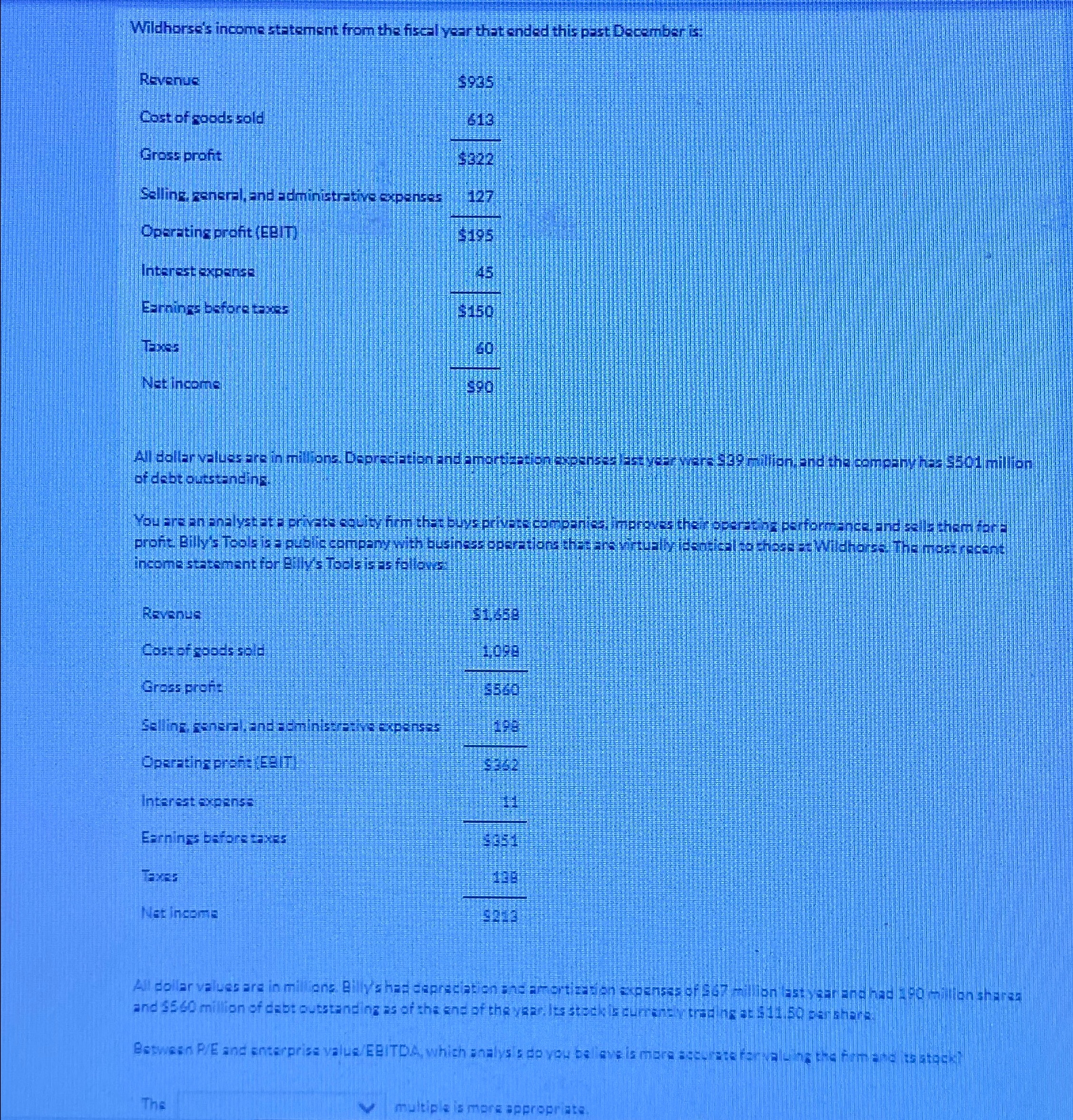

Wildhorse's income statement from the fiscal year that ended this past December is: Revenue $935 Cost of goods sold 613 Gross profit $322 Selling,

Wildhorse's income statement from the fiscal year that ended this past December is: Revenue $935 Cost of goods sold 613 Gross profit $322 Selling, general, and administrative expenses 127 Operating profit (EBIT) $195 Interest expense 46 Earnings before taxes $150 TEXSS 60 Net income 590 All dollar values are in millions. Depreciation and amortization expenses last year were $39 million, and the company has 9501 million of debt outstanding. You are an analyst at a private equity firm that buys private companies improves their operating performance, and sells them for profit. Billy's Tools is a public company with business operations theaters inrtually identical to those at Wildhorse. The most recent income statement for Billy's Tools is as follows Revenus Cost of goods sold Gross profie! Selling, general, and administrative expenses Operating prefi: (EBIT) Interest expense Earnings before taxes TAXES Net income 1,099 2560 19962 11 All dollar values are in millions. Billy's had depreciation and amortization expenses of 567 million last year and had 190 million shares and $560 million of dabt outstanding as of the end of the year. Its stock is currently trading at $11.50 per share. Between P/E and enterprise value/EBITDA, which analysis do you believe is more accurate forvaluing the firm and to stock? The multiple is more appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which valuation metric is more appropriate for valuing Billys Tools we need to consider the characteristics of the company its industry a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started