Will give a like

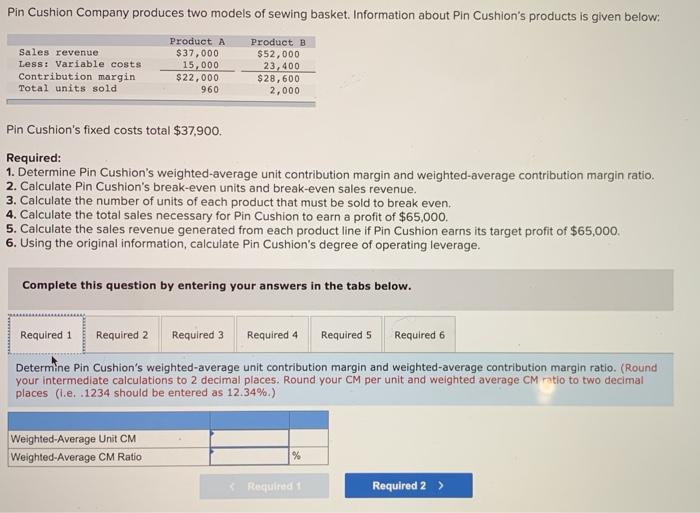

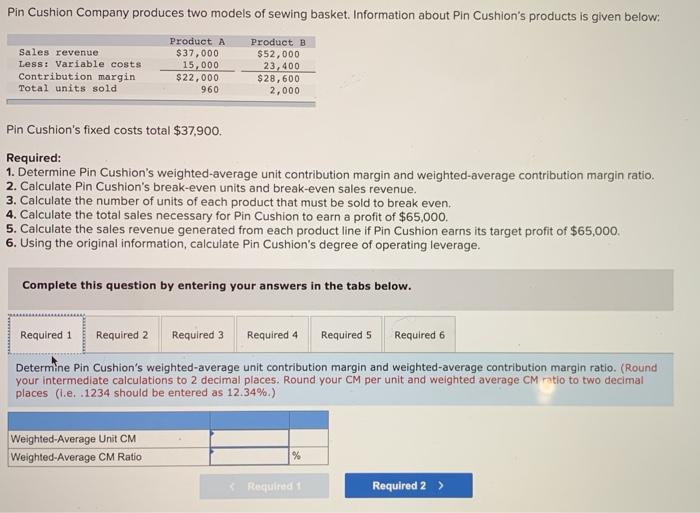

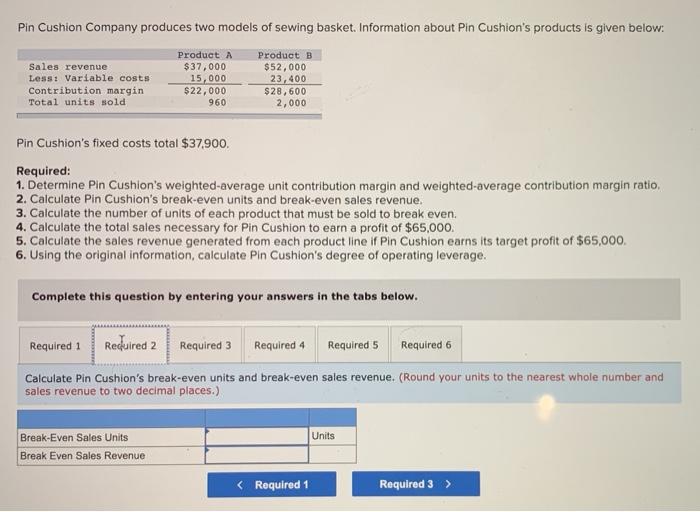

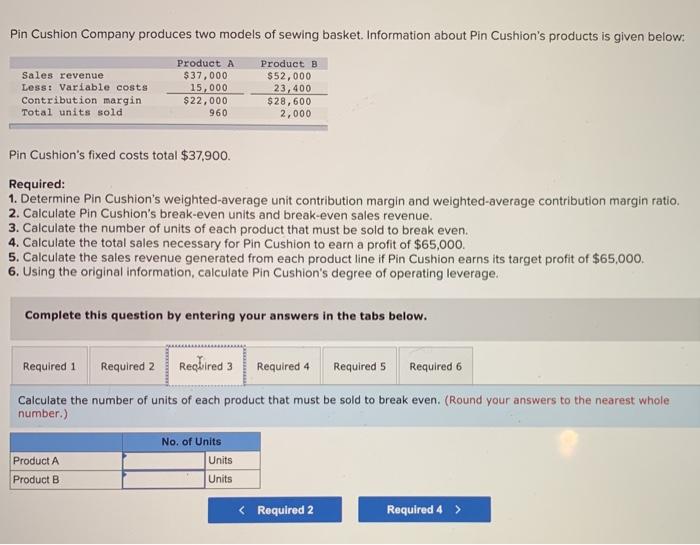

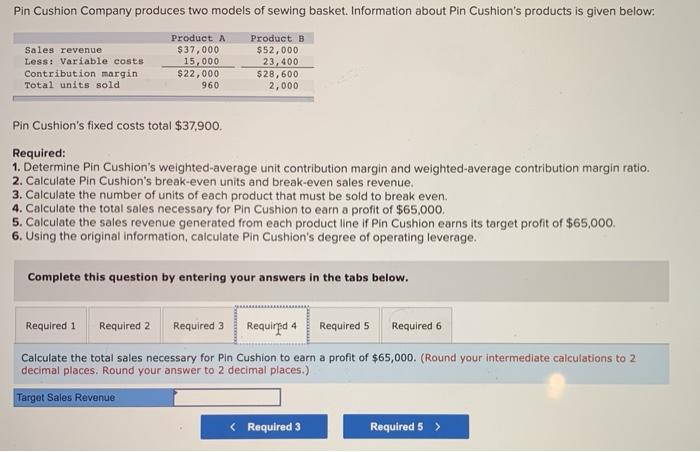

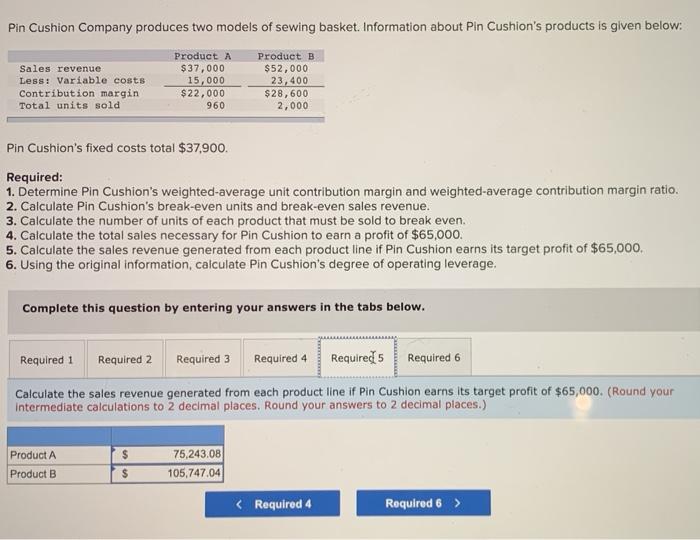

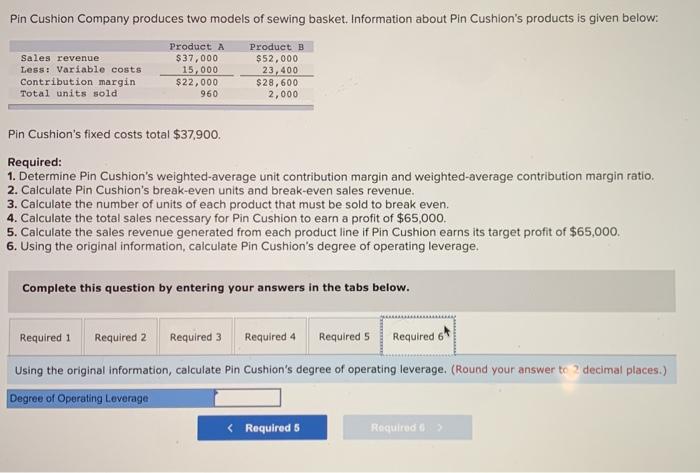

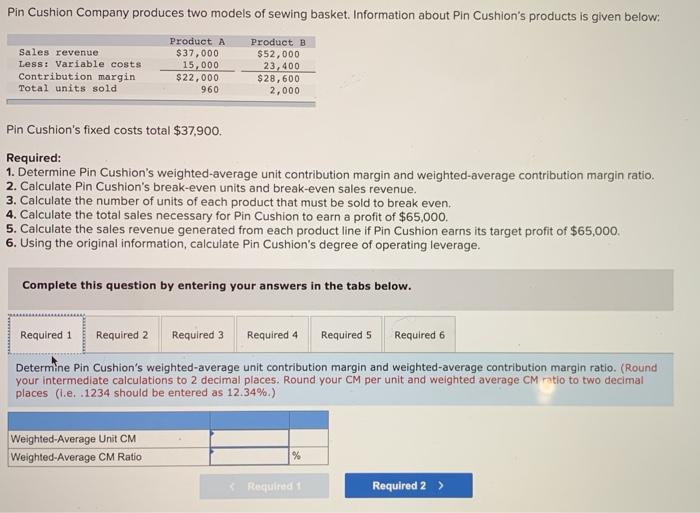

Pin Cushion Company produces two models of sewing basket. Information about Pin Cushion's products is given below: Sales revenue Less: Variable costs Contribution margin Total units sold Product A $37,000 15,000 $ 22,000 960 Product B $52,000 23,400 $28,600 2,000 Pin Cushion's fixed costs total $37,900. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Determine Pin Cushion's weighted-average unit contribution margin and weighted average contribution margin ratio. (Round your intermediate calculations to 2 decimal places. Round your CM per unit and weighted average CM ratio to two decimal places (.e. .1234 should be entered as 12.34%.) Weighted-Average Unit CM Weighted-Average CM Ratio % Required Required 2 > Pin Cushion Company produces two models of sewing basket. Information about Pin Cushion's products is given below: Sales revenue Less: Variable costs Contribution margin Total units sold Product A $37,000 15,000 $22,000 960 Product B $ 52,000 23,400 $28,600 2,000 Pin Cushion's fixed costs total $37,900. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted average contribution margin ratio 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Calculate Pin Cushion's break-even units and break-even sales revenue. (Round your units to the nearest whole number and sales revenue to two decimal places.) Units Break-Even Sales Break Even Sales Revenue Required Pin Cushion Company produces two models of sewing basket. Information about Pin Cushion's products is given below: Sales revenue Less: Variable costs Contribution margin Total units sold Product A $37,000 15,000 $22,000 960 Product B $52,000 23,400 $28,600 2,000 Pin Cushion's fixed costs total $37,900. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Reollred 3 Required 4 Required 5 Required 6 Calculate the number of units of each product that must be sold to break even. (Round your answers to the nearest whole number.) No. of Units Units Product A Product B Units (Required 2 Required 4 > Pin Cushion Company produces two models of sewing basket. Information about Pin Cushion's products is given below: Sales revenue Less: Variable costs Contribution margin Total units sold Product A $37,000 15,000 $22,000 960 Product B $52,000 23,400 $28,600 2,000 Pin Cushion's fixed costs total $37,900. Required: 1. Determine Pin Cushion's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000. (Round your intermediate calculations to 2 decimal places. Round your answer to 2 decimal places.) Target Sales Revenue Pin Cushion Company produces two models of sewing basket. Information about Pin Cushion's products is given below: Sales revenue Less: Variable costs Contribution margin Total units sold Product A $37,000 15,000 $ 22,000 960 Product B $52,000 23,400 $28,600 2,000 Pin Cushion's fixed costs total $37,900. Required: 1. Determine Pin Cushion's weighted average unit contribution margin and weighted average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000. (Round your intermediate calculations to 2 decimal places. Round your answers to 2 decimal places.) Product A $ 75,243.08 105,747.04 Product B $ Pin Cushion Company produces two models of sewing basket. Information about Pin Cushion's products is given below: Sales revenue Less: Variable costs Contribution margin Total units sold Product A $37,000 15,000 $ 22,000 960 Product B $52,000 23, 400 $28,600 2,000 Pin Cushion's fixed costs total $37,900. Required: 1. Determine Pin Cushion's weighted average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Pin Cushion's break-even units and break-even sales revenue. 3. Calculate the number of units of each product that must be sold to break even. 4. Calculate the total sales necessary for Pin Cushion to earn a profit of $65,000. 5. Calculate the sales revenue generated from each product line if Pin Cushion earns its target profit of $65,000. 6. Using the original information, calculate Pin Cushion's degree of operating leverage. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 64 Using the original information, calculate Pin Cushion's degree of operating leverage. (Round your answer to decimal places.) Degree of Operating Leverage