Answered step by step

Verified Expert Solution

Question

1 Approved Answer

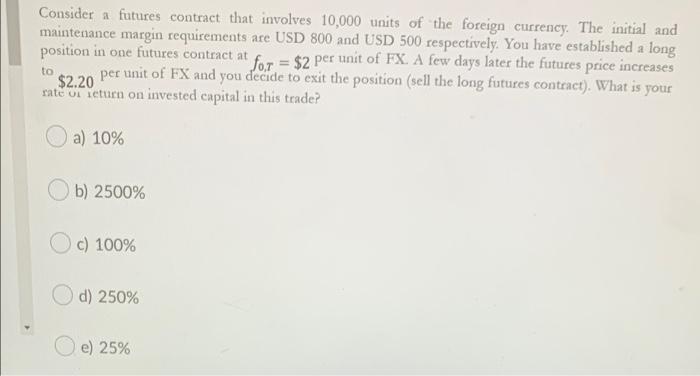

will give thumbs thanks in advance Consider a futures contract that involves 10,000 units of the foreign currency. The initial and maintenance margin requirements are

will give thumbs thanks in advance

Consider a futures contract that involves 10,000 units of the foreign currency. The initial and maintenance margin requirements are USD 800 and USD 500 respectively. You have established a long position in one futures contract at for = $2 per unit of FX. A few days later the futures price increases $2.20 per unit of FX and you decide to exit the position (sell the long futures contract). What is your rate or turn on invested capital in this trade? to a) 10% b) 2500% Oc) 100% d) 250% e) 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started