Answered step by step

Verified Expert Solution

Question

1 Approved Answer

will post information for questions which may be found in previous problems. PLEASE DO PROBLEMS 5 AND 6 clearly with FORMULAS USED AND CALCULATIONS SHOWN.

will post information for questions which may be found in previous problems. PLEASE DO PROBLEMS 5 AND 6 clearly with FORMULAS USED AND CALCULATIONS SHOWN. PLEASE ONLY DO PROBLEMS 5 and 6 other questions are posted in case information is needed.

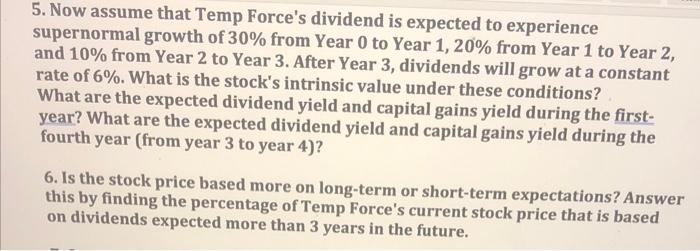

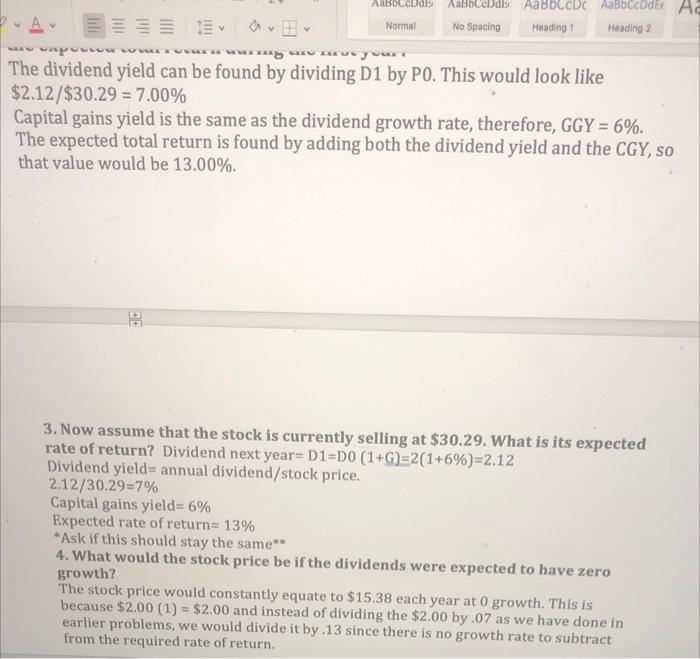

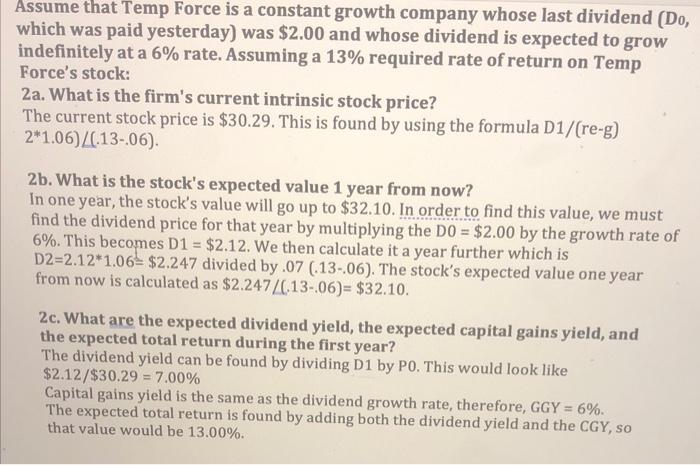

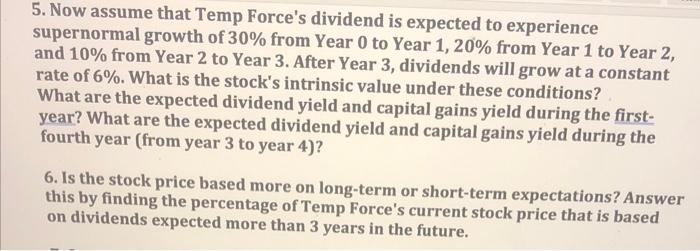

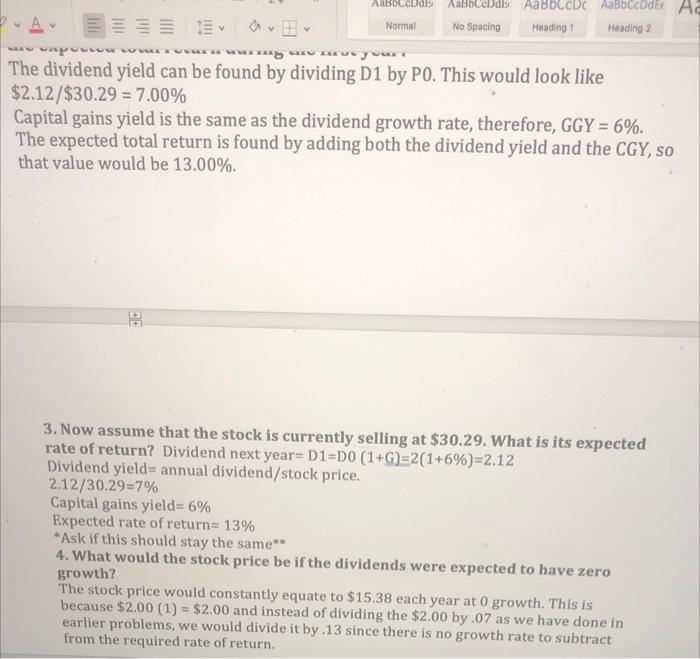

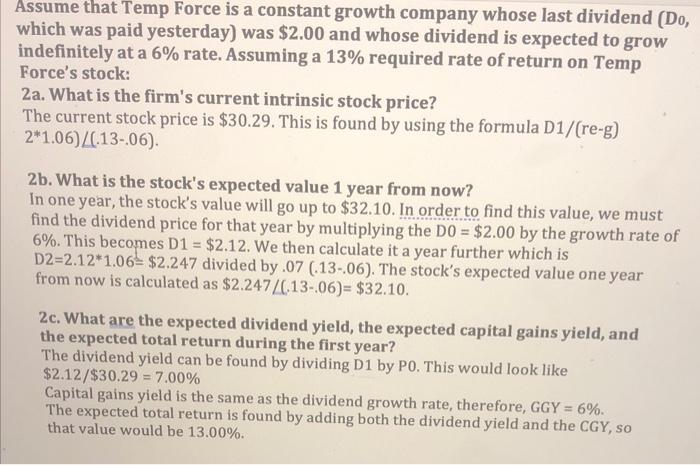

5. Now assume that Temp Force's dividend is expected to experience supernormal growth of 30% from Year 0 to Year 1, 20% from Year 1 to Year 2, and 10% from Year 2 to Year 3. After Year 3, dividends will grow at a constant rate of 6%. What is the stock's intrinsic value under these conditions? What are the expected dividend yield and capital gains yield during the first- year? What are the expected dividend yield and capital gains yield during the fourth year (from year 3 to year 4)? 6. Is the stock price based more on long-term or short-term expectations? Answer this by finding the percentage of Temp Force's current stock price that is based on dividends expected more than 3 years in the future. ABCD AaBbccball AaBbccbe AaBoccbd No Spacing Heading 1 Honding 2 Normal The dividend yield can be found by dividing D1 by PO. This would look like $2.12/$30.29 = 7.00% Capital gains yield is the same as the dividend growth rate, therefore, GGY = 6%. The expected total return is found by adding both the dividend yield and the CGY, SO that value would be 13.00%. : 3. Now assume that the stock is currently selling at $30.29. What is its expected rate of return? Dividend next year=D1=DO (1+G)=2(1+6%)=2.12 Dividend yield=annual dividend/stock price. 2.12/30.29=7% Capital gains yield=6% Expected rate of return= 13% *Ask if this should stay the same** 4. What would the stock price be if the dividends were expected to have zero growth? The stock price would constantly equate to $15.38 each year at 0 growth. This is because $2.00 (1) = $2.00 and instead of dividing the $2.00 by .07 as we have done in earlier problems, we would divide it by.13 since there is no growth rate to subtract from the required rate of return Assume that Temp Force is a constant growth company whose last dividend (Do, which was paid yesterday) was $2.00 and whose dividend is expected to grow indefinitely at a 6% rate. Assuming a 13% required rate of return on Temp Force's stock: 2a. What is the firm's current intrinsic stock price? The current stock price is $30.29. This is found by using the formula D1/(re-g) 2*1.06)/(.13-.06) 2b. What is the stock's expected value 1 year from now? In one year, the stock's value will go up to $32.10. In order to find this value, we must find the dividend price for that year by multiplying the DO = $2.00 by the growth rate of 6%. This becomes D1 = $2.12. We then calculate it a year further which is D2=2.12*1.06 $2.247 divided by .07 (13-.06). The stock's expected value one year from now is calculated as $2.247/(13-.06)= $32.10. 2c. What are the expected dividend yield, the expected capital gains yield, and the expected total return during the first year? The dividend yield can be found by dividing D1 by PO. This would look like $2.12/$30.29 = 7.00% Capital gains yield is the same as the dividend growth rate, therefore, GGY = 6%. The expected total return is found by adding both the dividend yield and the CGY, so that value would be 13.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started