Answered step by step

Verified Expert Solution

Question

1 Approved Answer

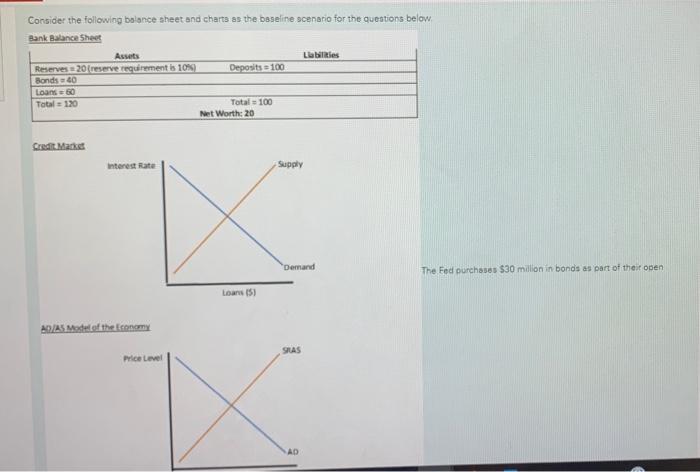

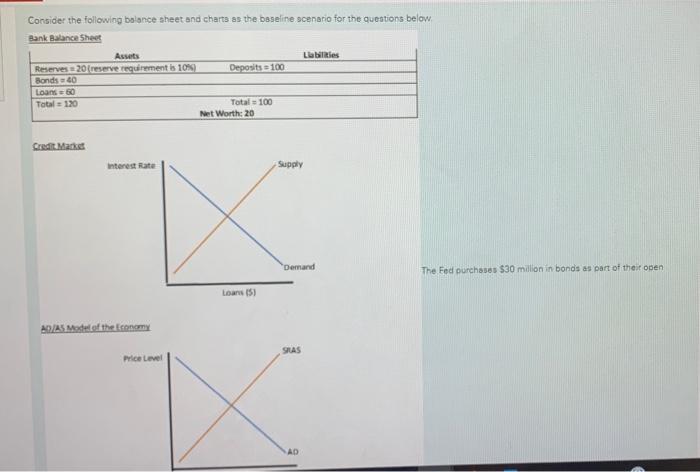

will rate correct answers Consider the following balance sheet and charts as the baseline scenario for the questions below. Bank Balance Sheet Labies Deposits a

will rate correct answers

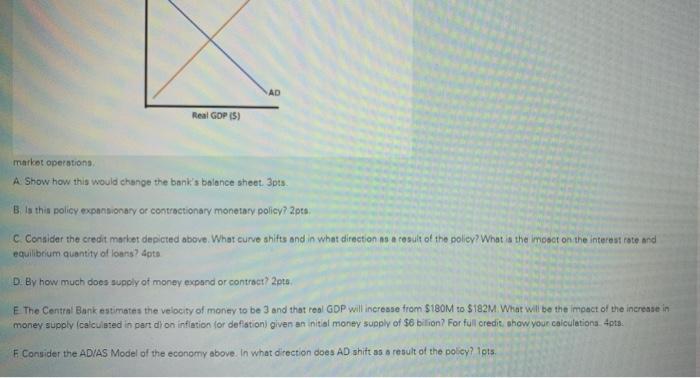

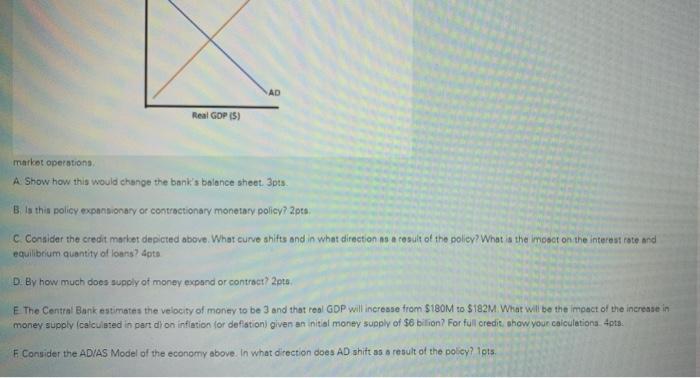

Consider the following balance sheet and charts as the baseline scenario for the questions below. Bank Balance Sheet Labies Deposits a 100 Assets Reserves 20 reserve requirement is 10% Bonds -20 Loans 60 Total = 120 Total = 100 Net Worth: 20 Credit Market Interest Rate Supply Demand The Fed purchases $30 milion in bonds as part of their open Loans 153 AD/A Mateof the Economy SLAS Price Level AD AD Real GOP 15) market operations A Show how this would change the bank's balance sheet 3pts. Blathin policy expansionary or contractionary monetary policy? 2pca; C Consider the credit market depicted above. What curve shifts and in what direction as a result of the policy? What is the moact on the interest rate and equilibrium quantity of loans 4pts D. By how much does supply of money expand or contract? 2.pt E The Central Bank estimates the velocity of money to be 3 and that real GDP will increase from $180M to $182M What will be the impact of the increase in money supply calculated in part dron inflation for defiation given an initial money supply of $6 bilion? For full credit. show your calculations pts F Consider the AD/AS Model of the economy above. In what direction does AD shift as a result of the policy? lots. Consider the following balance sheet and charts as the baseline scenario for the questions below. Bank Balance Sheet Labies Deposits a 100 Assets Reserves 20 reserve requirement is 10% Bonds -20 Loans 60 Total = 120 Total = 100 Net Worth: 20 Credit Market Interest Rate Supply Demand The Fed purchases $30 milion in bonds as part of their open Loans 153 AD/A Mateof the Economy SLAS Price Level AD AD Real GOP 15) market operations A Show how this would change the bank's balance sheet 3pts. Blathin policy expansionary or contractionary monetary policy? 2pca; C Consider the credit market depicted above. What curve shifts and in what direction as a result of the policy? What is the moact on the interest rate and equilibrium quantity of loans 4pts D. By how much does supply of money expand or contract? 2.pt E The Central Bank estimates the velocity of money to be 3 and that real GDP will increase from $180M to $182M What will be the impact of the increase in money supply calculated in part dron inflation for defiation given an initial money supply of $6 bilion? For full credit. show your calculations pts F Consider the AD/AS Model of the economy above. In what direction does AD shift as a result of the policy? lots

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started