Answered step by step

Verified Expert Solution

Question

1 Approved Answer

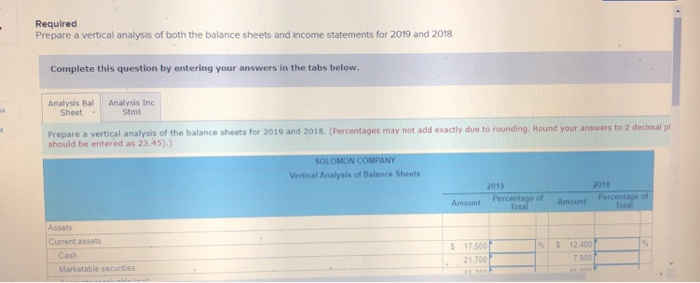

will rate!! show good work plz balance sheet income statement a Required Prepare a vertical analysis of both the balance sheets and income statements for

will rate!!

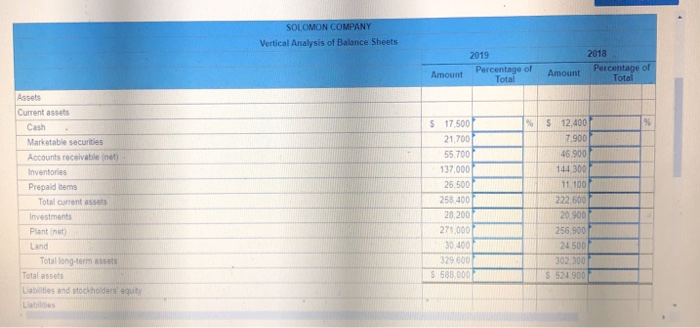

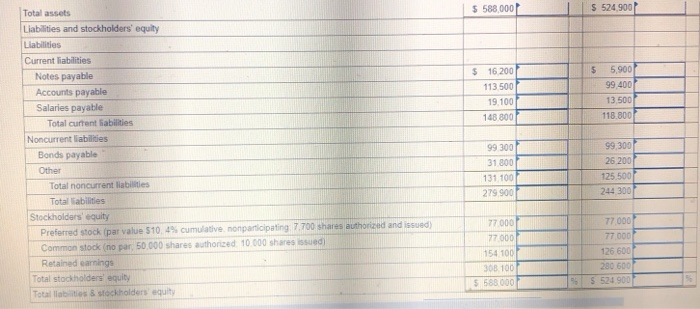

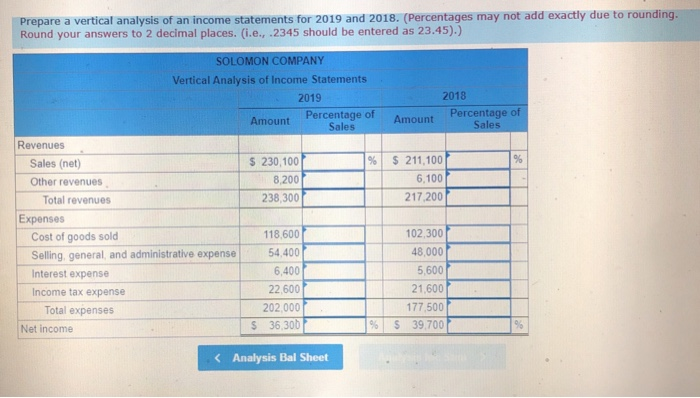

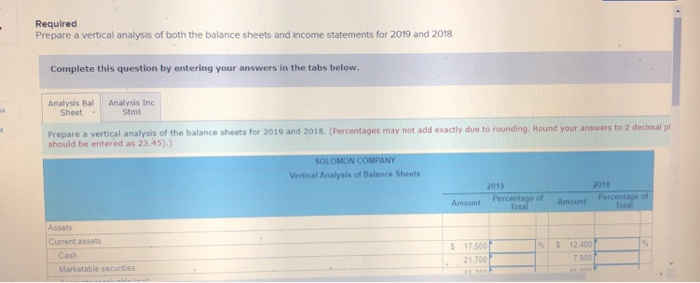

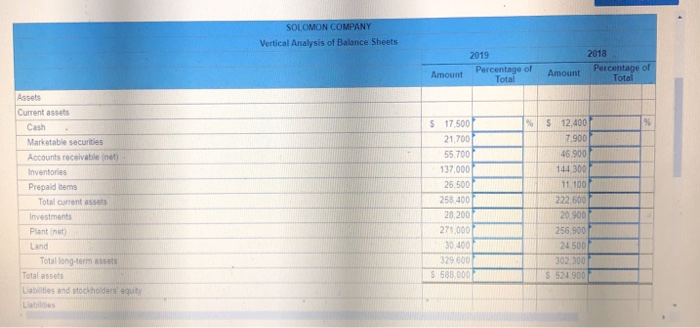

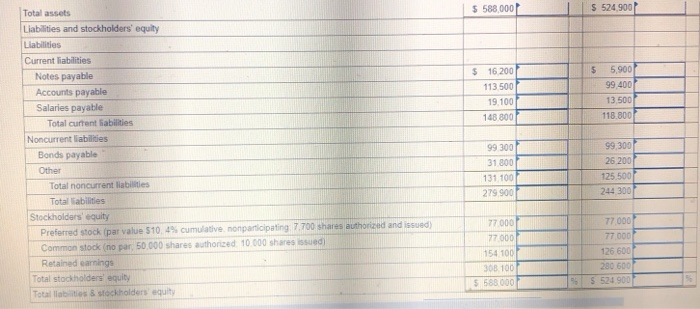

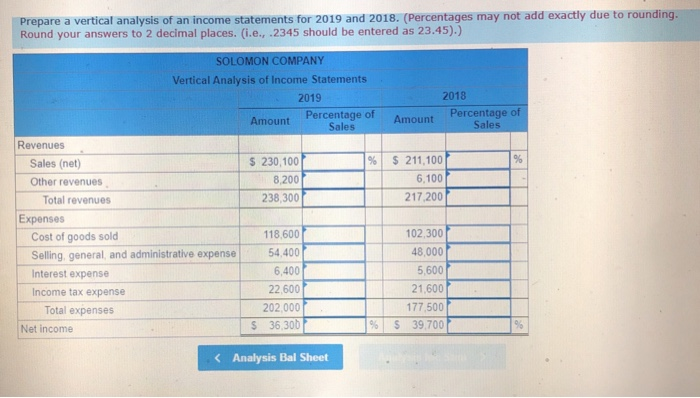

a Required Prepare a vertical analysis of both the balance sheets and income statements for 2019 and 2018 Complete this question by entering your answers in the tabs below Analysis Inc Stmt Analysis Bal Sheet Prepare a vertical analysis of the balance sheets for 2019 and 2018. (Percentages may not add exactly due to rounding. Round your answers to 2 should be entered as 23.45).) decimal p Vertical Analysis of Balance Sheets 2018 Perc 2019 Percentage of Amount Amount Assets Current assets S 12 400 17 500 Cash Marketable securities 7 900 21700 Vertical Analysis of Balance Sheets 2018 2019 Amount Percentage of Amount Percentage of Assets Current assets %| S 12,400 7.900 46900 144 300 11.100 222.600 20 900 256,900 24 500 S 17.500 21,700 55 700 137,000 26.500 258 400 Cash Marketable securities Accounts receivable (net) Inventories Prepaid nems Total current assets Investments Plant (net Land 271,00 30 400 329 600 Total long-term assets Total assets Liabilities and stockholders equty Labiles s 588.0 l t l S 524,900 5 588,000 Total assets Liabilities and stockholders' equity Liabilities Current liablities s 5,900 99 400 13,500 118.800 5 16.200 113 500 19,100 148.800 Notes payable Accounts payable Salaries payable Total curtent iabilities Noncurrent liabilities 99,300 26 200 125,500 244 300 99 300 31.800 131 100 279 900 Bonds payablie Other Total noncurrent liabilities Total liabilities Stockholders equity 77.000 77 000 126 600 280 600 77.000 77.000 154 100 08 100 s 588 000 nonpanopating 7 T00 shares authorized and issued) Preferred stock (par value S 10 4% cumulative Common stock (no par, 50.000 shares authorized 10 000 shares issued) Retained earnings Total stockholders equity Total lablities & stockholders equity %) S 52490 Prepare a vertical analysis of an income statements for 2019 and 2018. (Percentages may not add exactly due to rounding Round your answers to 2 decimal places. (i.e., 2345 should be entered as 23.45)) SOLOMON COMPANY Vertical Analysis of Income Statements 2019 2018 Amount Percentage of Amount Percentage of Revenues Sales (net) Other revenues 230,100 8,200 238,300 % 211,100 6,100 217.200 Total revenues Expenses 118,600 Selling, general, and administrative expense54,400 6,400 22,600 202,000 Cost of goods sold 102,300 48,000 5,600 21,600 177,500 %| S 39,700 Interest expense Income tax expense Total expenses S 36 Net income K Analysis Bal Sheet show good work plz

balance sheet

income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started