will rate

will rate

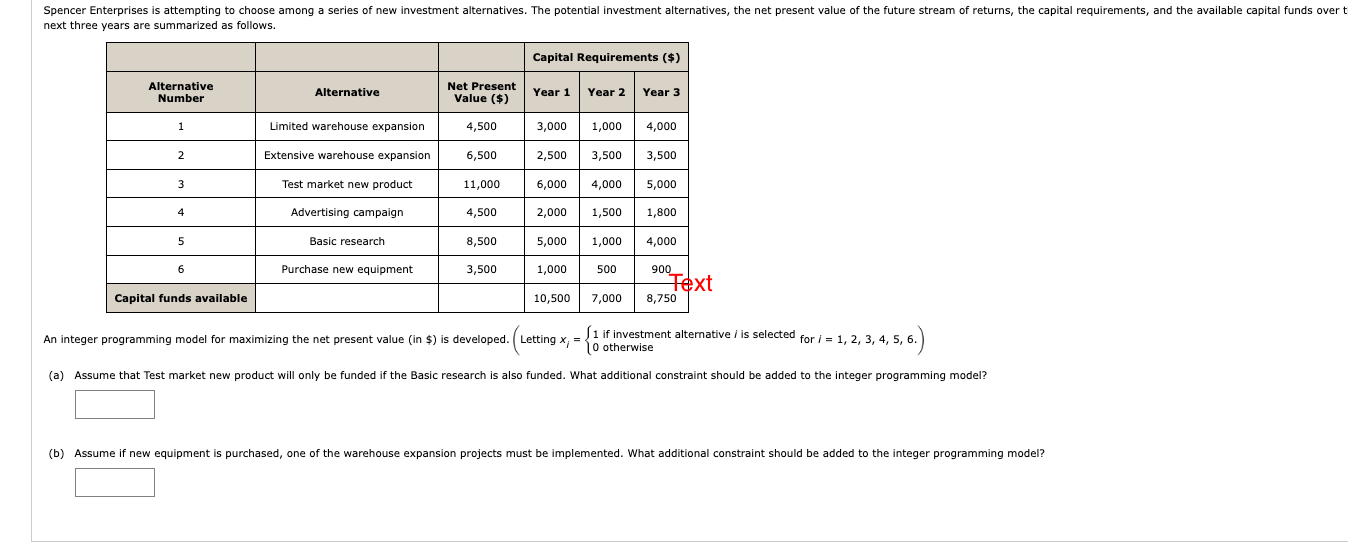

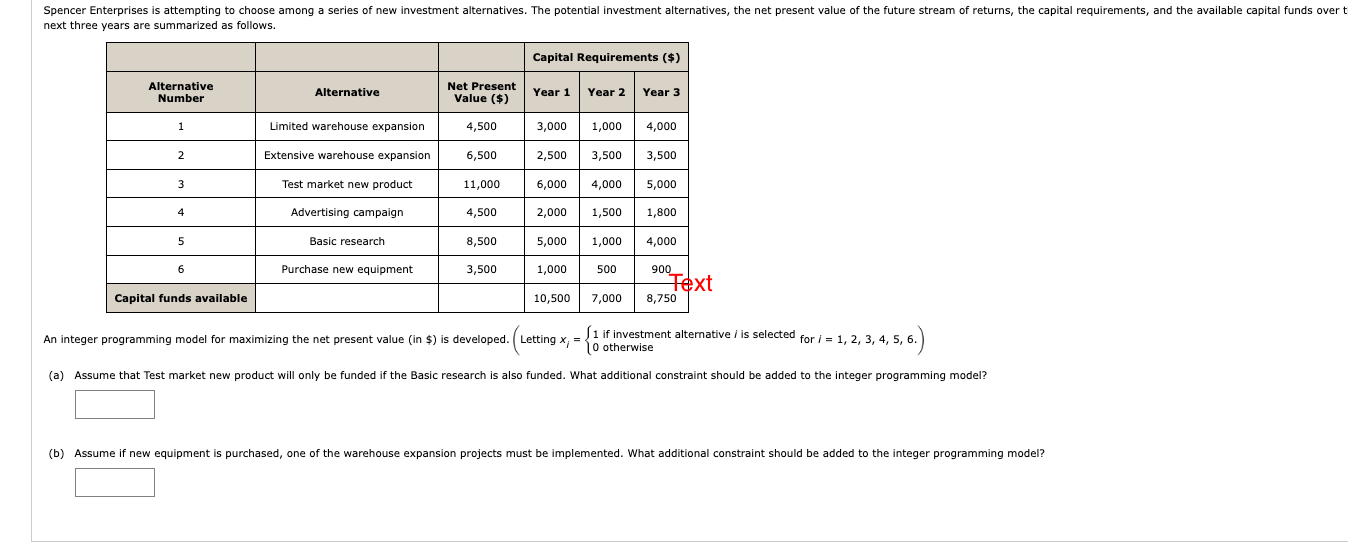

Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over t next three years are summarized as follows. Capital Requirements ($) Alternative Number Alternative Net Present Value ($) Year 1 Year 2 Year 3 1 Limited warehouse expansion 4,500 3,000 1,000 4,000 2 6,500 2,500 3,500 3,500 Extensive warehouse expansion Test market new product 3 11,000 6,000 4,000 5,000 4 Advertising campaign 4,500 2,000 1,500 1,800 5 Basic research 8,500 5,000 1,000 4,000 6 Purchase new equipment 3,500 1,000 500 900 Text Capital funds available 10,500 7,000 8,750 An integer programming model for maximizing the net present value (in $) is developed. Letting x, = {, , , 5, 6. 1 if investment alternative i is selected for i = 1, 2, 3, 4, 5, 6. O otherwise (a) Assume that test market new product will only be funded if the Basic research is also funded. What additional constraint should be added to the integer programming model? (b) Assume if new equipment is purchased, one of the warehouse expansion projects must be implemented. What additional constraint should be added to the integer programming model? Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over t next three years are summarized as follows. Capital Requirements ($) Alternative Number Alternative Net Present Value ($) Year 1 Year 2 Year 3 1 Limited warehouse expansion 4,500 3,000 1,000 4,000 2 6,500 2,500 3,500 3,500 Extensive warehouse expansion Test market new product 3 11,000 6,000 4,000 5,000 4 Advertising campaign 4,500 2,000 1,500 1,800 5 Basic research 8,500 5,000 1,000 4,000 6 Purchase new equipment 3,500 1,000 500 900 Text Capital funds available 10,500 7,000 8,750 An integer programming model for maximizing the net present value (in $) is developed. Letting x, = {, , , 5, 6. 1 if investment alternative i is selected for i = 1, 2, 3, 4, 5, 6. O otherwise (a) Assume that test market new product will only be funded if the Basic research is also funded. What additional constraint should be added to the integer programming model? (b) Assume if new equipment is purchased, one of the warehouse expansion projects must be implemented. What additional constraint should be added to the integer programming model

will rate

will rate