Answered step by step

Verified Expert Solution

Question

1 Approved Answer

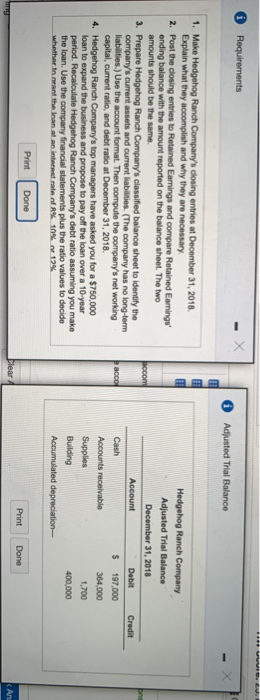

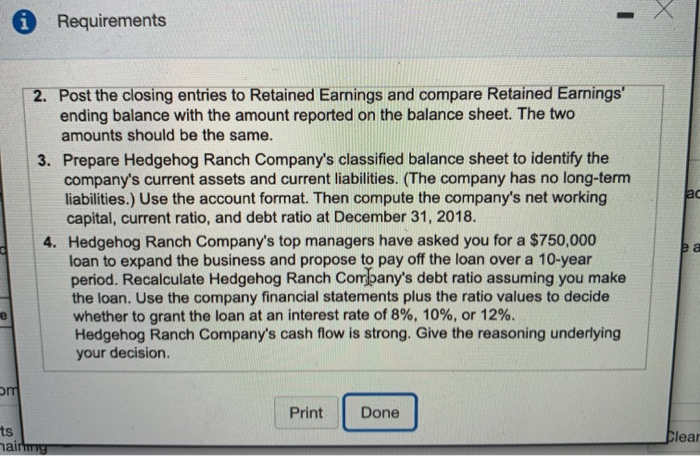

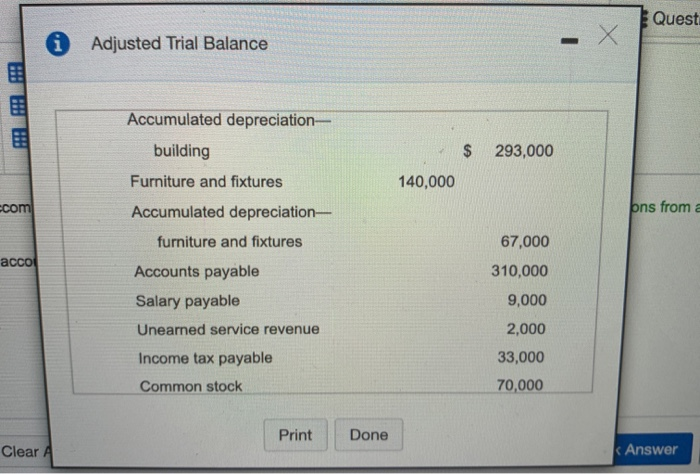

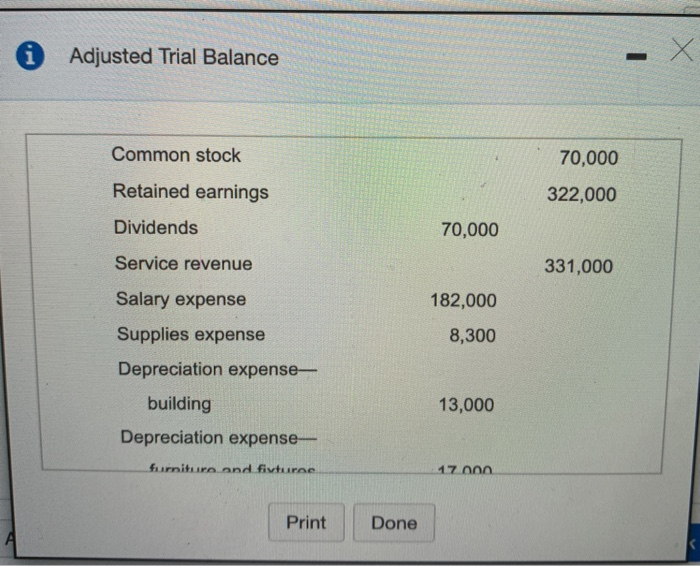

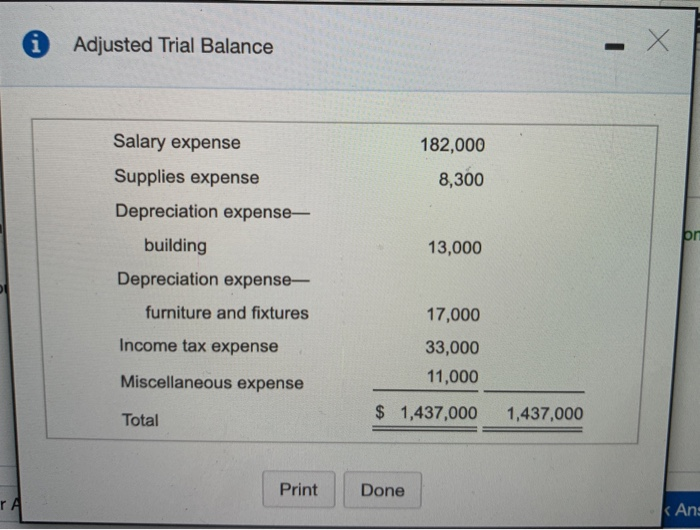

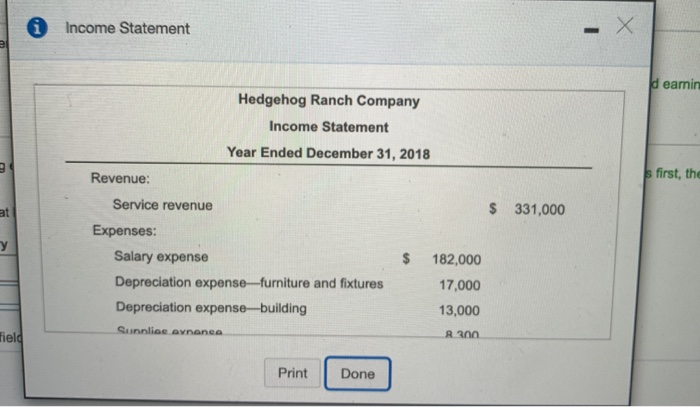

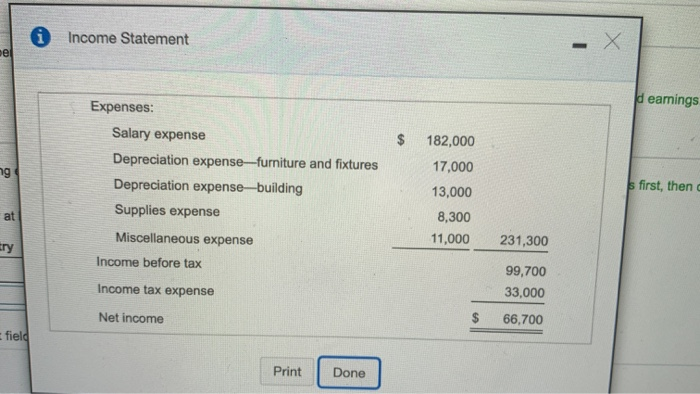

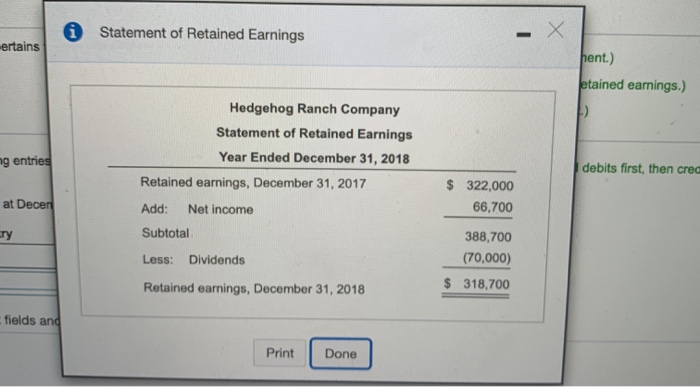

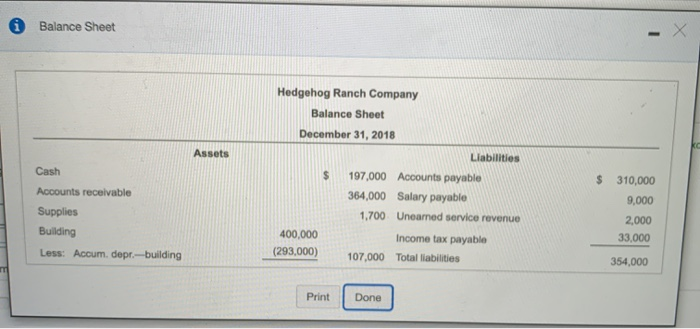

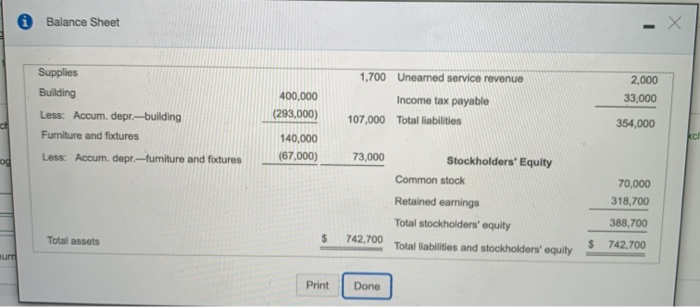

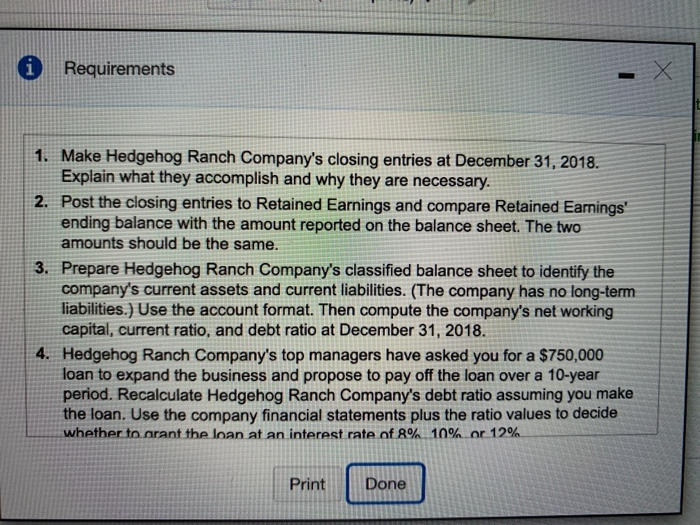

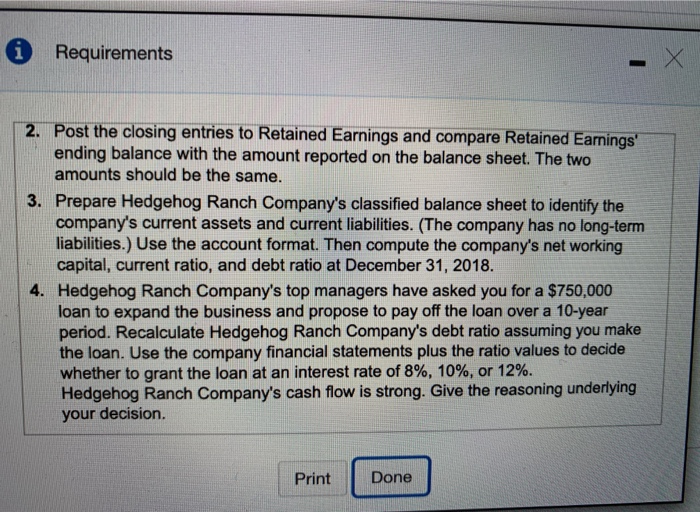

will rate!! The following trial balance for Hedgehog Ranch Company pertains to December 31, 2018, which the end of the firm's your long accounting period.

will rate!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started