Question

Will the bonds be issued at par, a premium, or a discount (3 points)? Par Discount Premium b. Provide the journal entry (accounts and amounts)

Will the bonds be issued at par, a premium, or a discount (3 points)?

Par

Discount

Premium

b. Provide the journal entry (accounts and amounts) Red Inc. would record at the issuance of the bonds (2 points for J/E accounts and 4 points for correct amounts).

c. Provide the journal entry to account for interest expense that will be incurred from January 1, 20X1 to June 30, 20X1 (6 points, 3 points for J/E accounts and 3 points for correct amounts).

d. Suppose that on July 1, 20X1, the market rate of interest decreased by 1%. Given this change in the market rate, would the interest expense incurred between July 1 and December 31 be higher, lower, or the same as the interest expense had the market rate remained the same (2 points)?

Group of answer choices

Lower

No change in interest expense

Higher

e. Suppose Red Inc. is being sued by a group of customers. On December 31, 20X1 (the fiscal year end), Red Inc. determines that it is reasonably possible that they will lose the lawsuit and have to pay an estimated sum of $2,500,000 to the customers. Provide the journal entry, if any, that Red Inc. will record on December 31, 20X1 to account for this contingency (2 points).

f. Based on the information in question (e) above, what is the effect of this contingency on the net income of Red Inc. (2 points)?

Group of answer choices

Increase net income

Decrease net income

No effect on net income

g. What, if any, should Red Inc. report in its footnote disclosure and why. (2 points)?

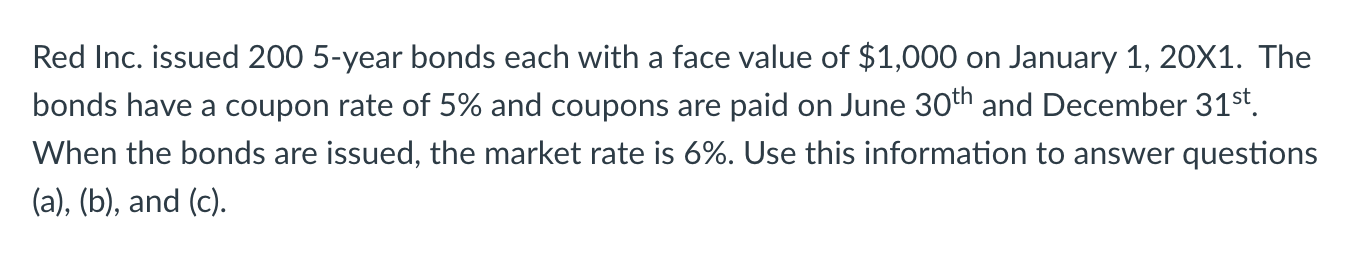

Red Inc. issued 200 5-year bonds each with a face value of $1,000 on January 1, 20X1. The bonds have a coupon rate of 5% and coupons are paid on June 30th and December 31st When the bonds are issued, the market rate is 6%. Use this information to answer questions (a), (b), and (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started