Answered step by step

Verified Expert Solution

Question

1 Approved Answer

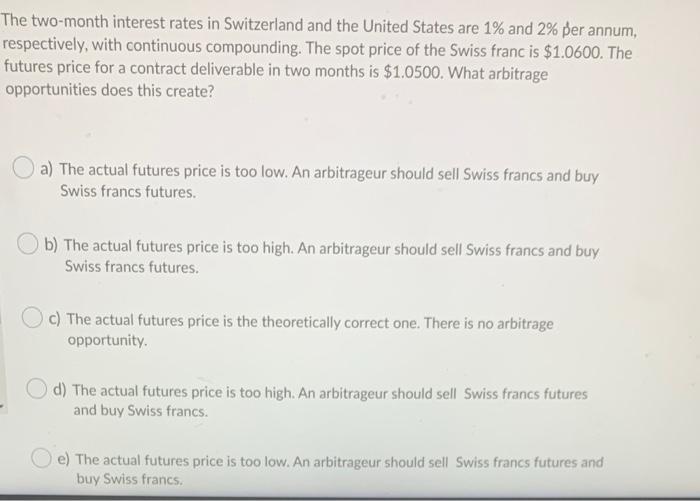

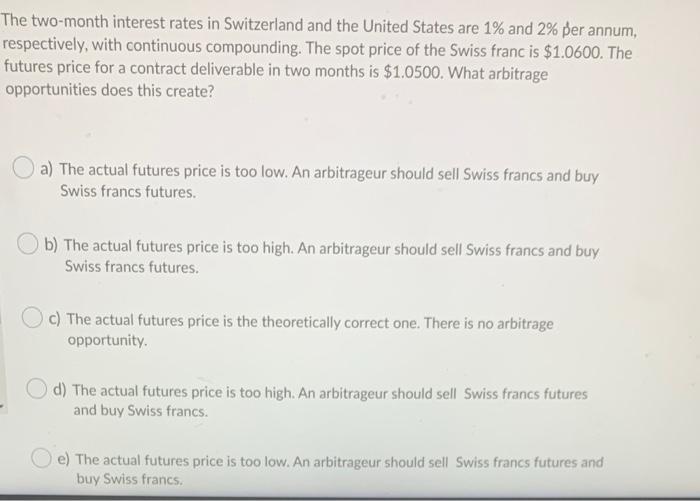

will thumbs up! The two-month interest rates in Switzerland and the United States are 1% and 2% per annum, respectively, with continuous compounding. The spot

will thumbs up!

The two-month interest rates in Switzerland and the United States are 1% and 2% per annum, respectively, with continuous compounding. The spot price of the Swiss franc is $1.0600. The futures price for a contract deliverable in two months is $1.0500. What arbitrage opportunities does this create? a) The actual futures price is too low. An arbitrageur should sell Swiss francs and buy Swiss francs futures. b) The actual futures price is too high. An arbitrageur should sell Swiss francs and buy Swiss francs futures. c) The actual futures price is the theoretically correct one. There is no arbitrage opportunity d) The actual futures price is too high. An arbitrageur should sell Swiss francs futures and buy Swiss francs. e) The actual futures price is too low. An arbitrageur should sell Swiss francs futures and buy Swiss francs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started