Answered step by step

Verified Expert Solution

Question

1 Approved Answer

will upvote if helpful it says advise based on theory and calculation based on return of equity. Metzo Ltd is considering buying a new machine

will upvote if helpful

it says advise based on theory and calculation based on return of equity.

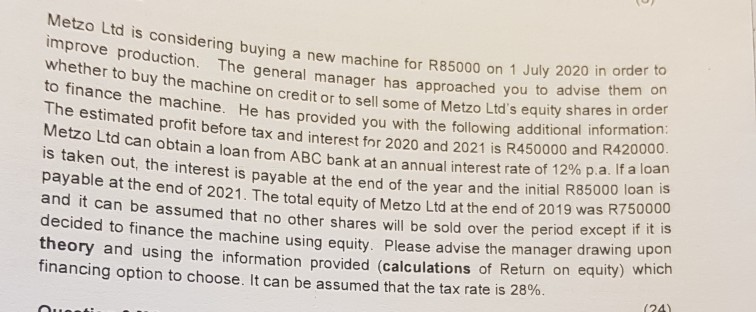

Metzo Ltd is considering buying a new machine for R85000 on 1 July 2020 in order to improve production. The general manager has approached you to advise them on whether to buy the machine on credit or to sell some of Metzo Ltd's equity shares in order to finance the machine. He has provided you with the following additional information: The estimated profit before tax and interest for 2020 and 2021 is R450000 and R420000. Metzo Ltd can obtain a loan from ABC bank at an annual interest rate of 12% p.a. If a loan is taken out, the interest is payable at the end of the year and the initial R85000 loan is payable at the end of 2021. The total equity of Metzo Ltd at the end of 2019 was R750000 and it can be assumed that no other shares will be sold over the period except if it is decided to finance the machine using equity. Please advise the manager drawing upon theory and using the information provided (calculations of Return on equity) which financing option to choose. It can be assumed that the tax rate is 28%. (24) Metzo Ltd is considering buying a new machine for R85000 on 1 July 2020 in order to improve production. The general manager has approached you to advise them on whether to buy the machine on credit or to sell some of Metzo Ltd's equity shares in order to finance the machine. He has provided you with the following additional information: The estimated profit before tax and interest for 2020 and 2021 is R450000 and R420000. Metzo Ltd can obtain a loan from ABC bank at an annual interest rate of 12% p.a. If a loan is taken out, the interest is payable at the end of the year and the initial R85000 loan is payable at the end of 2021. The total equity of Metzo Ltd at the end of 2019 was R750000 and it can be assumed that no other shares will be sold over the period except if it is decided to finance the machine using equity. Please advise the manager drawing upon theory and using the information provided (calculations of Return on equity) which financing option to choose. It can be assumed that the tax rate is 28%. (24)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started