Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will Upvote! please solve this step by step. Take your time and make sure it is accurate PLEASE!I'm not sure what tables are relevant. The

Will Upvote! please solve this step by step. Take your time and make sure it is accurate PLEASE!I'm not sure what tables are relevant. The first picture is the question, the rest are tables included in the problem

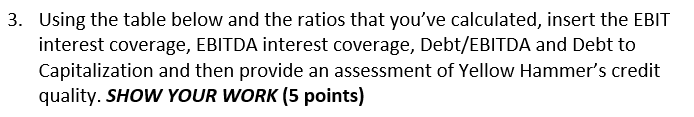

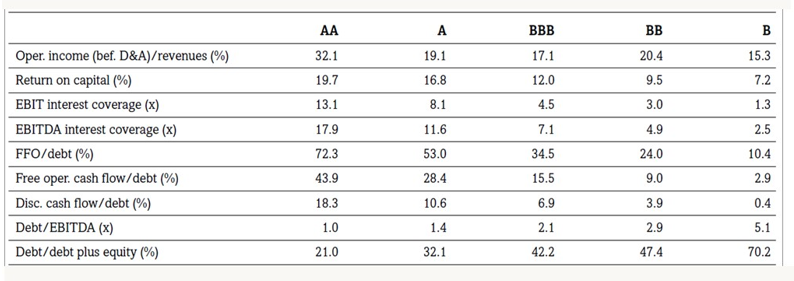

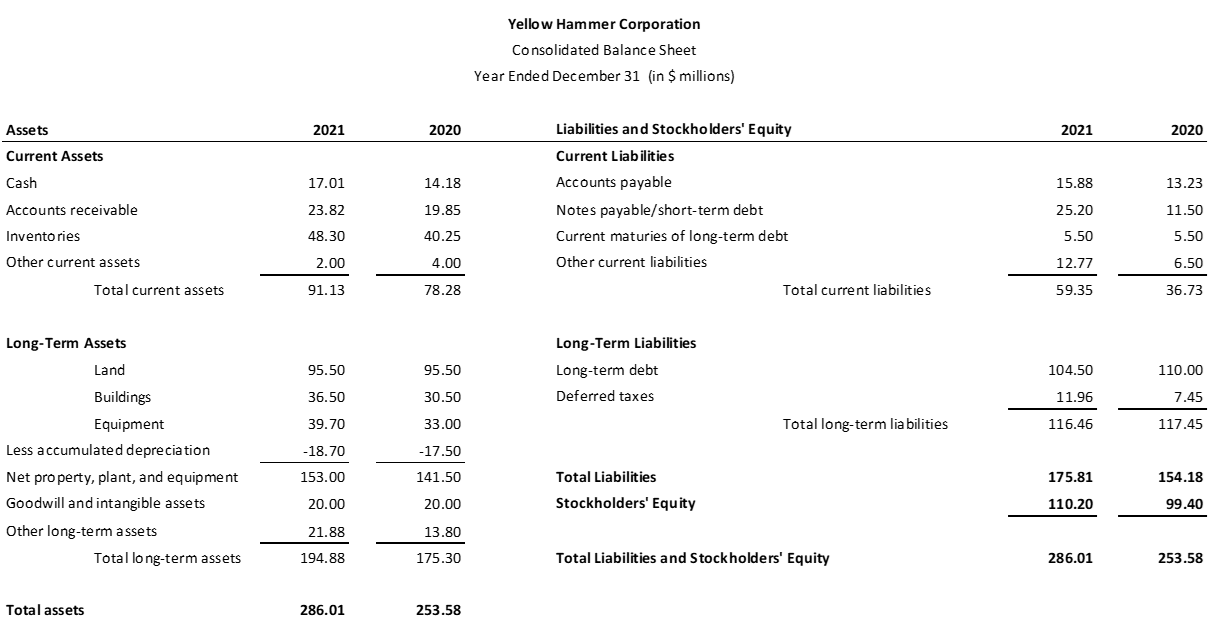

Using the table below and the ratios that you've calculated, insert the EBIT interest coverage, EBITDA interest coverage, Debt/EBITDA and Debt to Capitalization and then provide an assessment of Yellow Hammer's credit quality. SHOW YOUR WORK (5 points) \begin{tabular}{lrrrrr|} \hline & AA & A & BBB & BB & B \\ \hline Oper. income (bef. D\&A)/revenues (\%) & 32.1 & 19.1 & 17.1 & 20.4 & 15.3 \\ \hline Return on capital (\%) & 19.7 & 16.8 & 12.0 & 9.5 & 7.2 \\ \hline EBIT interest coverage (x) & 13.1 & 8.1 & 4.5 & 3.0 & 1.3 \\ \hline EBITDA interest coverage (x) & 17.9 & 11.6 & 7.1 & 4.9 & 2.5 \\ \hline FFO/debt (%) & 72.3 & 53.0 & 34.5 & 24.0 & 10.4 \\ \hline Free oper. cash flow/debt (%) & 43.9 & 28.4 & 15.5 & 9.0 & 2.9 \\ \hline Disc. cash flow/debt (%) & 18.3 & 10.6 & 6.9 & 3.9 & 0.4 \\ \hline Debt/EBITDA (x) & 1.0 & 1.4 & 2.1 & 2.9 & 5.1 \\ \hline Debt/debt plus equity (%) & 21.0 & 32.1 & 42.2 & 47.4 & 70.2 \\ \hline \end{tabular} Yellow Hammer Corporation Consolidated Balance Sheet Year Ended December 31 (in \$millions) Yellow Hammer Corporation Income Statement Year Ended December 31 (in \$ millions) Using the table below and the ratios that you've calculated, insert the EBIT interest coverage, EBITDA interest coverage, Debt/EBITDA and Debt to Capitalization and then provide an assessment of Yellow Hammer's credit quality. SHOW YOUR WORK (5 points) \begin{tabular}{lrrrrr|} \hline & AA & A & BBB & BB & B \\ \hline Oper. income (bef. D\&A)/revenues (\%) & 32.1 & 19.1 & 17.1 & 20.4 & 15.3 \\ \hline Return on capital (\%) & 19.7 & 16.8 & 12.0 & 9.5 & 7.2 \\ \hline EBIT interest coverage (x) & 13.1 & 8.1 & 4.5 & 3.0 & 1.3 \\ \hline EBITDA interest coverage (x) & 17.9 & 11.6 & 7.1 & 4.9 & 2.5 \\ \hline FFO/debt (%) & 72.3 & 53.0 & 34.5 & 24.0 & 10.4 \\ \hline Free oper. cash flow/debt (%) & 43.9 & 28.4 & 15.5 & 9.0 & 2.9 \\ \hline Disc. cash flow/debt (%) & 18.3 & 10.6 & 6.9 & 3.9 & 0.4 \\ \hline Debt/EBITDA (x) & 1.0 & 1.4 & 2.1 & 2.9 & 5.1 \\ \hline Debt/debt plus equity (%) & 21.0 & 32.1 & 42.2 & 47.4 & 70.2 \\ \hline \end{tabular} Yellow Hammer Corporation Consolidated Balance Sheet Year Ended December 31 (in \$millions) Yellow Hammer Corporation Income Statement Year Ended December 31 (in \$ millions)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started