Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will you please help me with these problems. Will you please help me with these problems? 1. Assign Overhead Costs to Activity Cost Pools ?

Will you please help me with these problems.

Will you please help me with these problems?

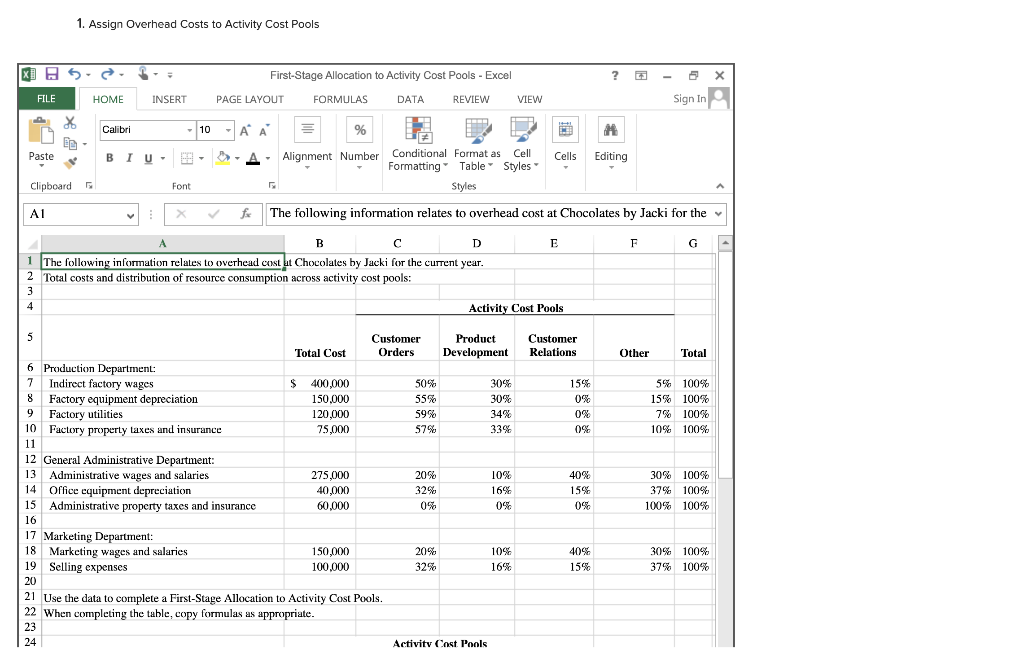

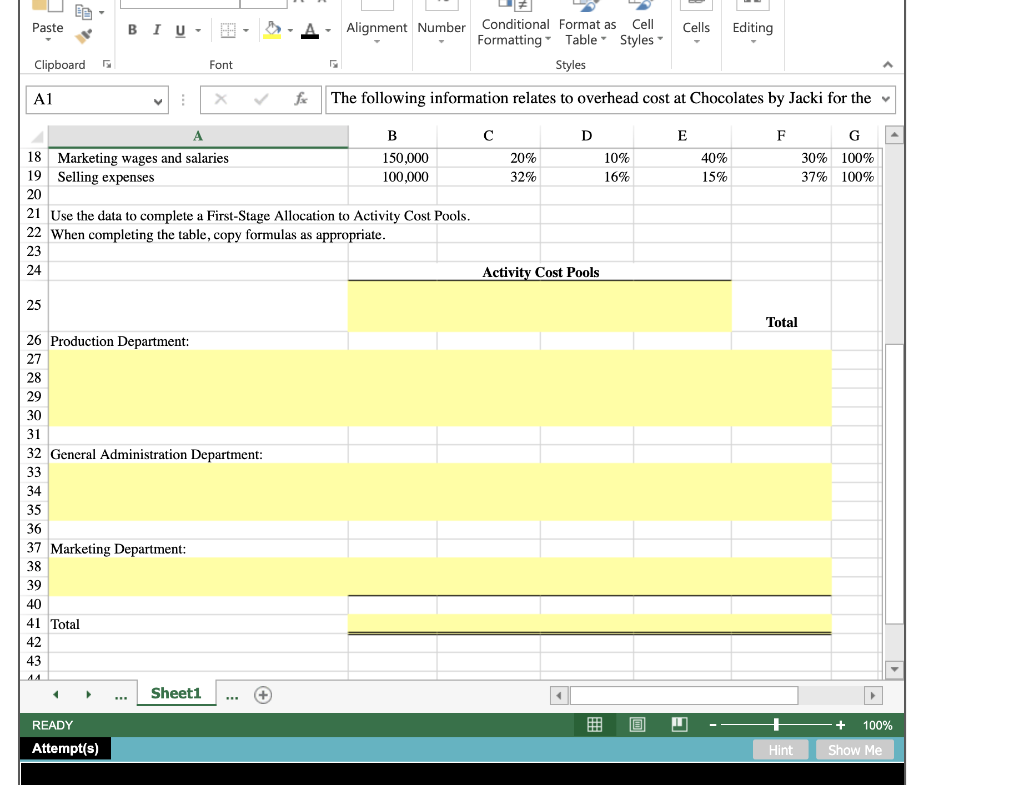

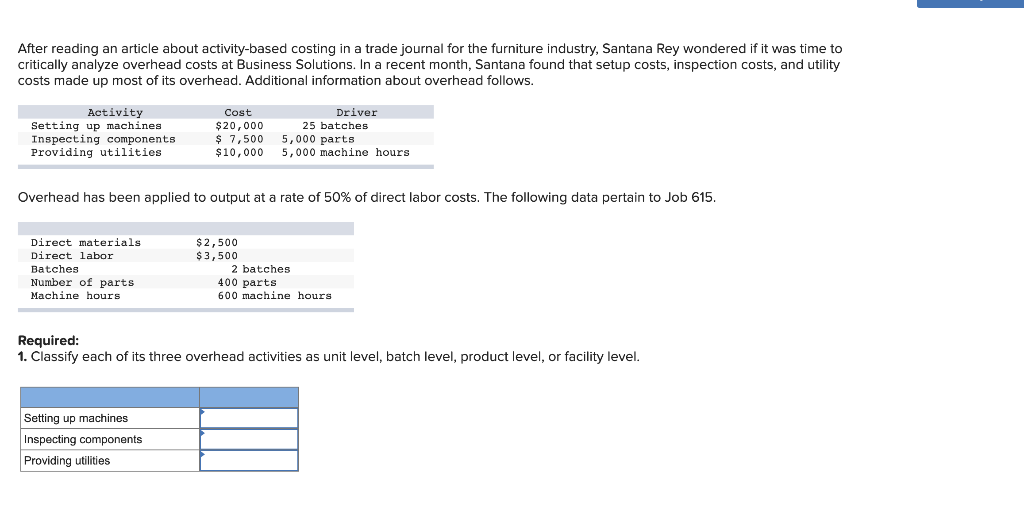

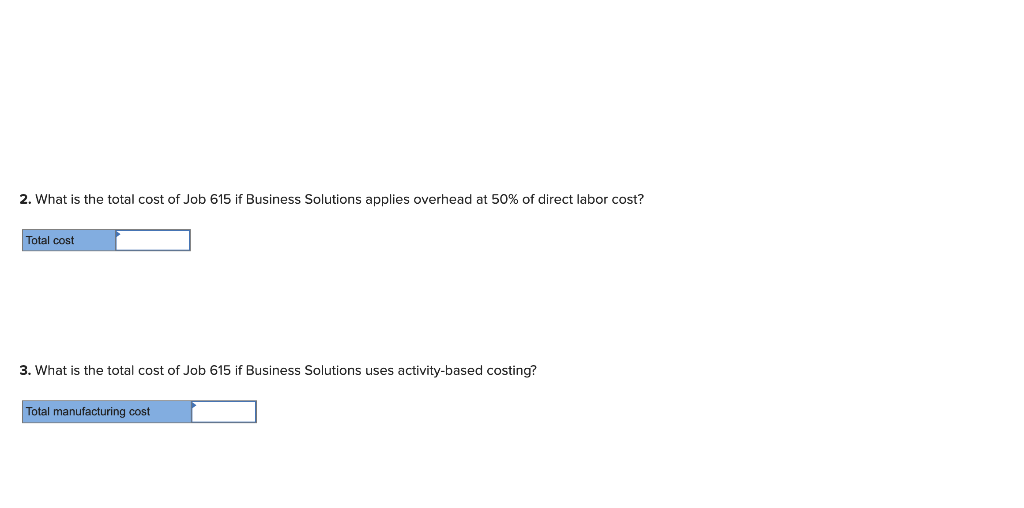

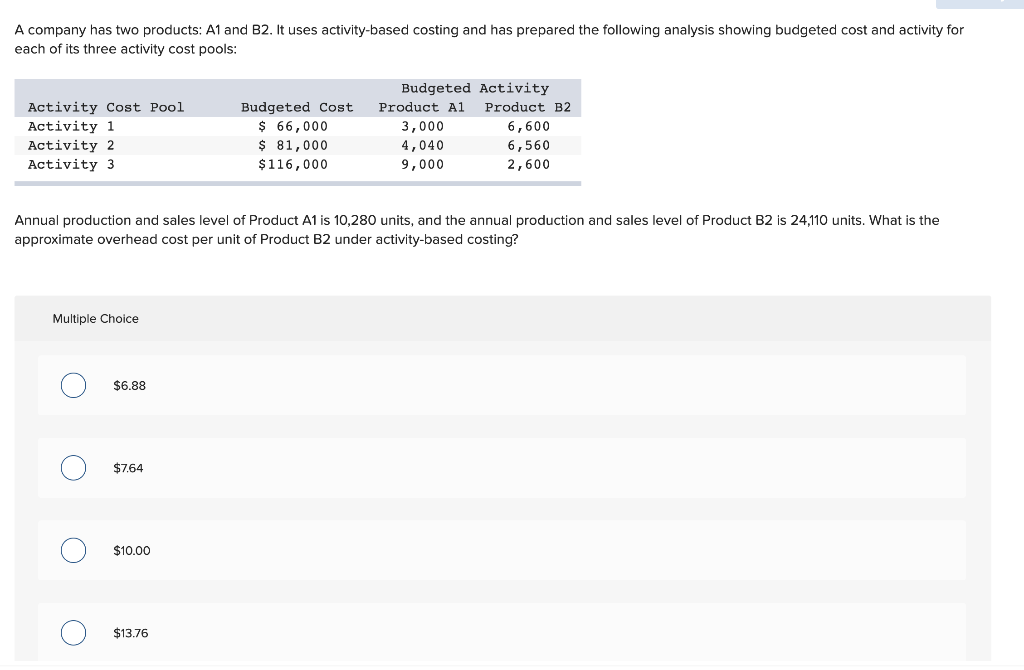

1. Assign Overhead Costs to Activity Cost Pools ? x First-Stage Allocation to Activity Cost Pools - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW - 6 Sign In FILE HOME INSERT Paste B I -10 AA U- - - A - Alignment Number - Font Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard A1 X x The following information relates to overhead cost at Chocolates by Jacki for the EF A 1 The following information relates to overhead cost at Chocolates by Jacki for the current year. 2 Total costs and distribution of resource consumption across activity cost pools: Activity Cost Pools Customer Orders Product Development Customer Relations Total Cost Other Total $ 6 7 8 9 10 Production Department: Indirect factory wages Factory equipment depreciation Factory utilities Factory property taxes and insurance 400,000 150,000 120.000 75,000 50% 55% 59% 57% 30% 30% 34% 33% 15% 0% 0% 5% 15% 7% 10% 100% 100% 100% 100% 12 General Administrative Department: 13 Administrative wages and salaries 14 Office equipment depreciation 15 Administrative property taxes and insurance 275,000 40.000 60,000 20% 32% 0% 10% 16% 0% 40% 15% 0% 30% 37% 100% 100% 100% 100% 17 Marketing Department: 18 Marketing wages and salaries 19 Selling expenses 150,000 100,000 20% 32% 10% 16% 40% 15% 30% 37% 100% 100% 21 Use the data to complete a First-Stage Allocation to Activity Cost Pools. 22 When completing the table, copy formulas as appropriate. Activity Cost Pools Paste B I U , I. - A - Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 x fc The following information relates to overhead cost at Chocolates by Jacki for the C D E 18 Marketing wages and salaries 19 Selling expenses 150,000 100,000 20% 32% 10% 16% 40% 15% 30% 37% 100% 100% 21 Use the data to complete a First-Stage Allocation to Activity Cost Pools. 22 When completing the table, copy formulas as appropriate. Activity Cost Pools Total 26 Production Department: 32 General Administration Department: 37 Marketing Department: 41 Total 44 ... Sheet1 ... + @ -- READY Attempt(s) + 100% Show Me Hint After reading an article about activity-based costing in a trade journal for the furniture industry, Santana Rey wondered if it was time to critically analyze overhead costs at Business Solutions. In a recent month, Santana found that setup costs, inspection costs, and utility costs made up most of its overhead. Additional information about overhead follows. Activity Setting up machines Inspecting components Providing utilities Cost $20,000 $ 7,500 $10,000 Driver 25 batches 5,000 parts 5,000 machine hours Overhead has been applied to output at a rate of 50% of direct labor costs. The following data pertain to Job 615. Direct materials Direct labor Batches Number of parts Machine hours $2,500 $3,500 2 batches 400 parts 600 machine hours Required: 1. Classify each of its three overhead activities as unit level, batch level, product level, or facility level. Setting up machines Inspecting components Providing utilities 2. What is the total cost of Job 615 if Business Solutions applies overhead at 50% of direct labor cost? Total cost 3. What is the total cost of Job 615 if Business Solutions uses activity-based costing? Total manufacturing cost A company has two products: A1 and B2. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools: Activity Cost Pool Activity 1 Activity 2 Activity 3 Budgeted Cost $ 66,000 $ 81,000 $116,000 Budgeted Activity Product A1 Product B2 3,000 6,600 4,040 6,560 9,000 2,600 Annual production and sales level of Product A1 is 10,280 units, and the annual production and sales level of Product B2 is 24,110 units. What is the approximate overhead cost per unit of Product B2 under activity-based costing? 0 $6.88 0 $7.64 0 $10.00 0 $13.76 Annual production and sales level of Product A1 is 10,280 units, and the annual production and sales level of Product B2 is 24,110 units. What is the approximate overhead cost per unit of Product B2 under activity-based costingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started