Answered step by step

Verified Expert Solution

Question

1 Approved Answer

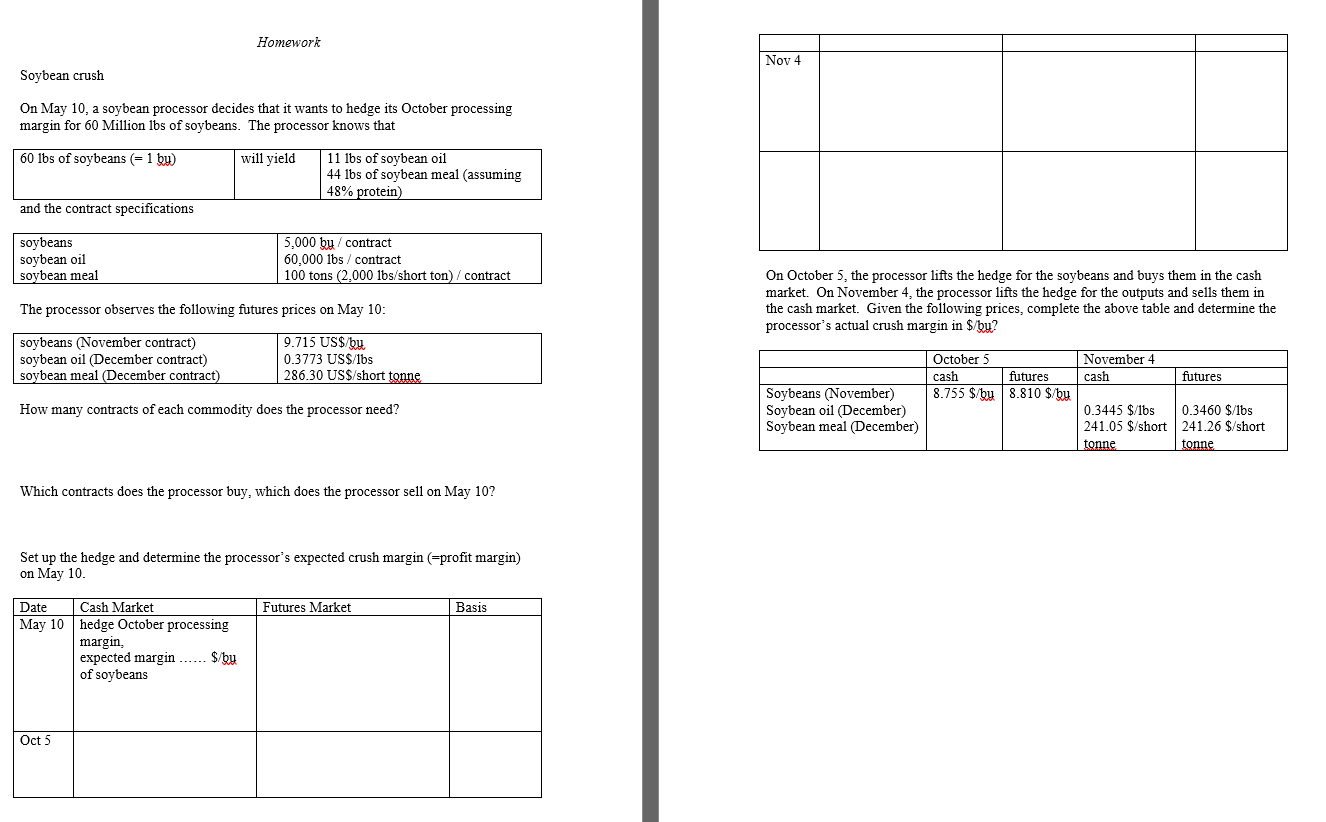

Will you please help me with this assignment? Thank you very much. Ho mework Soybean crush On May 10, a soybean processor decides that it

Will you please help me with this assignment? Thank you very much.

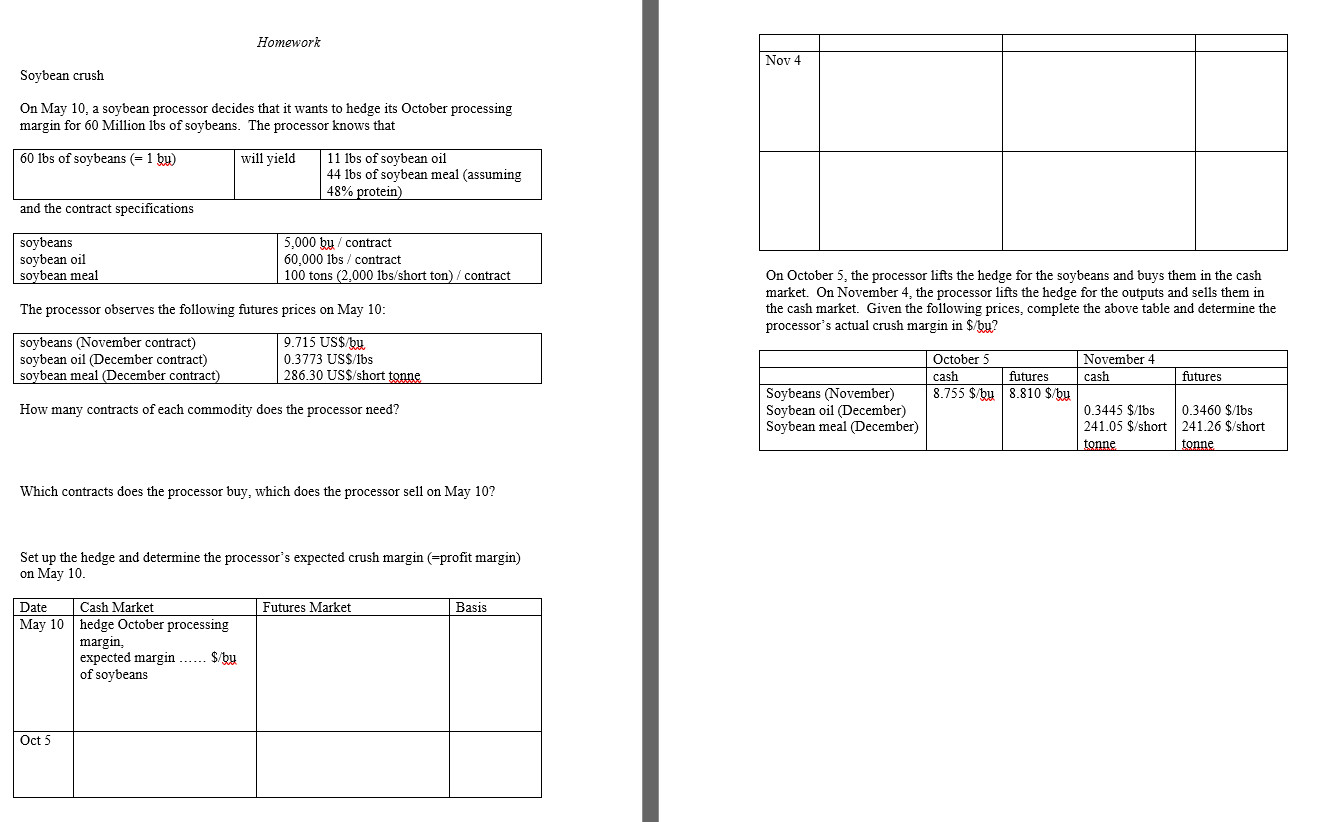

Ho mework Soybean crush On May 10, a soybean processor decides that it wants to hedge its October processing margin for 60 Million lbs of soybeans. The processor knows that 60 lbs of soybeans 1 Qu) and the contract specifications soybeans soybean oil s bean meal will yield 11 lbs of soybean oil 44 lbs of soybean meal (assuming 48% tem 5,000 / contract 602000 lbs / contract 100 tons 2,000 lbs:'sh01t ton contract The processor observes the following futures prices on May 10 Nov 4 On October 5: the processor lifts the hedge for the soybeans and buys them in the cash market. On November 4: the processor lifts the hedge for the outputs and sells them m the cash market. Given the fol owing prices, complete the above table and determine the processor's actual crush margin in soybeans (November contract) soybean oil (December conffact) s beanmeal cember contract 9.715 uss,uu 0.3773 286.30 October cash Soybeans Olovember) Soybean oil (December) Soybean meal (December) November 4 futures cash 0.3445 S/lbs 241.05 S/short How many contracts of each commodity does the processor need? Which contracts does the processor buy, which does the processor sell on May 10? Set up the hedge and determine the processor's expected crush margin (=profit margin) futures 0.3460 S/lbs 241.26 S/short on May 10. Date Cash Market May 10 hedge October processing margm: expected margin _ of soybeans Oct 5 Futures Market Basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started