William (Bill) Smith, CFO of Universal Technologies, Inc. (UT), has received an offer from Bigalow General Corporation (BG) to purchase the common stock of UT for the price of $20.00 per share. Based on this offer, Bill has asked you construct a valuation of UTs common stock.

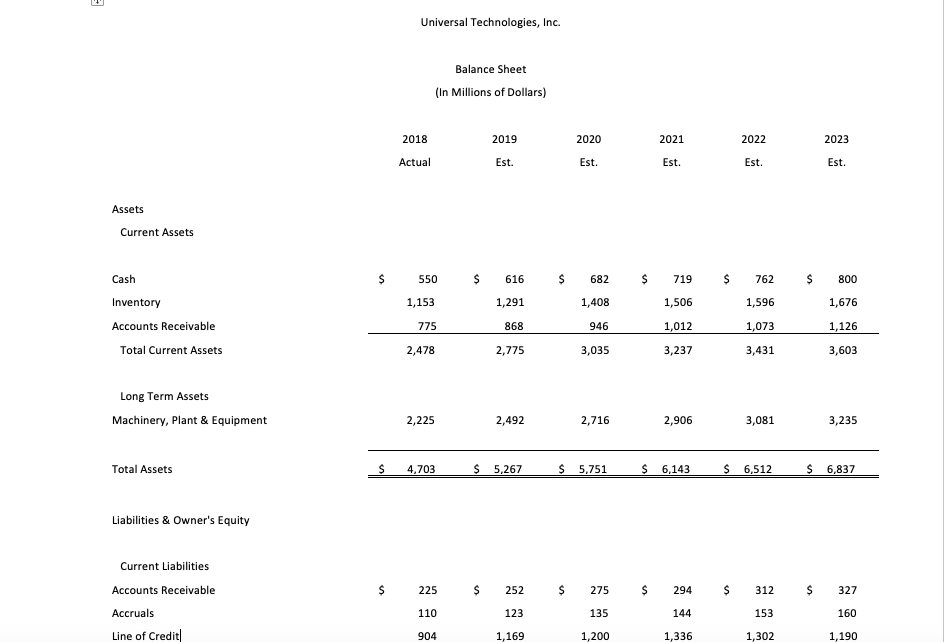

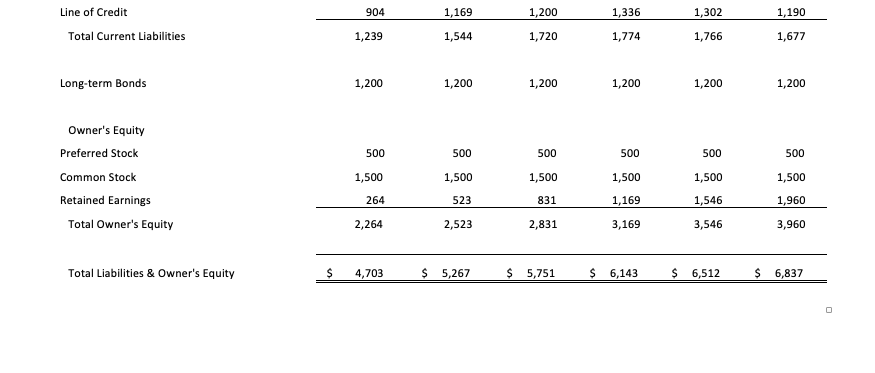

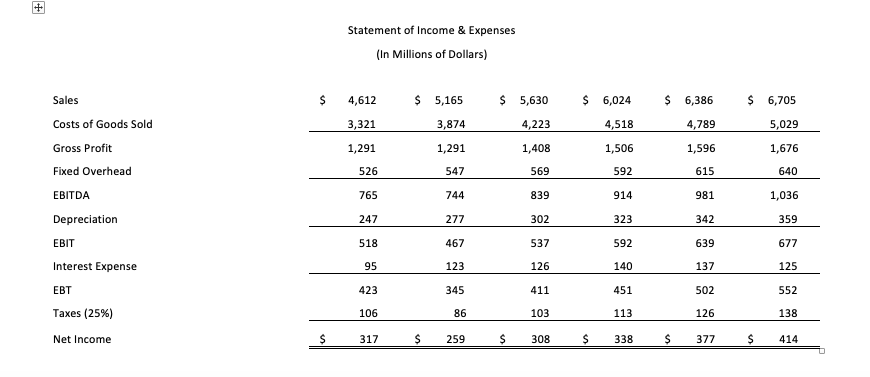

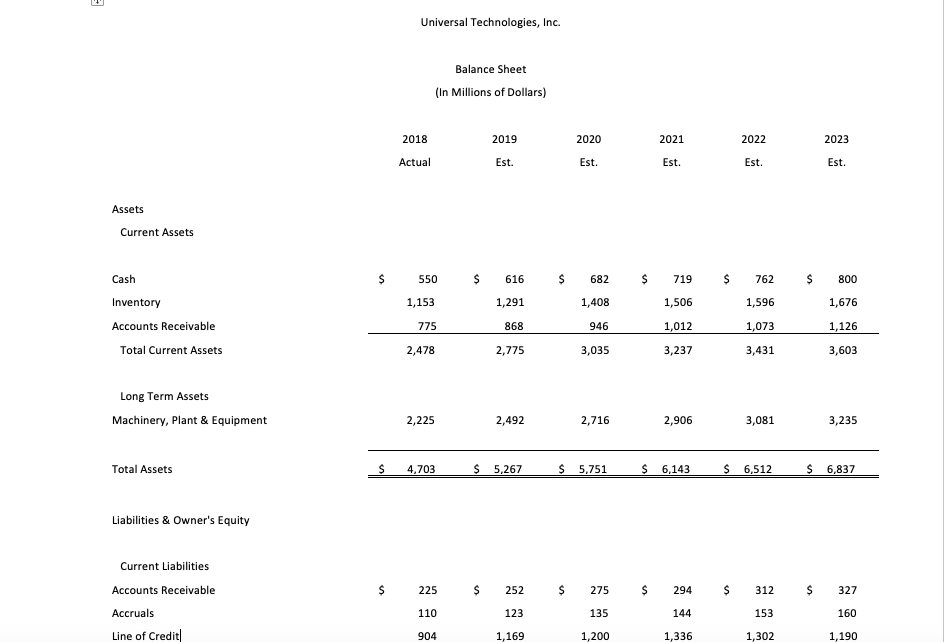

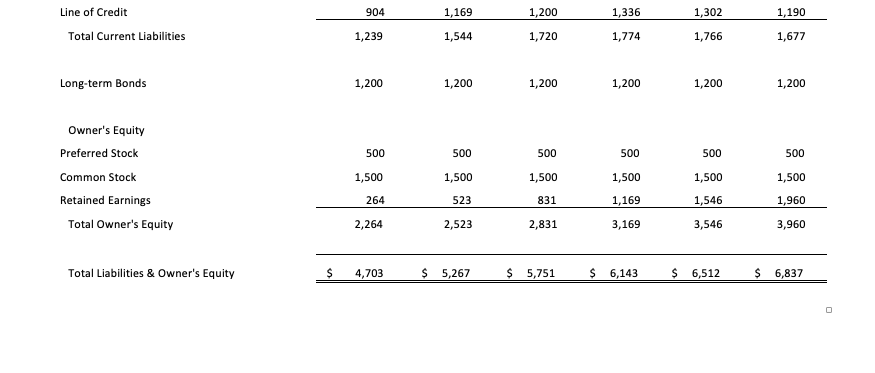

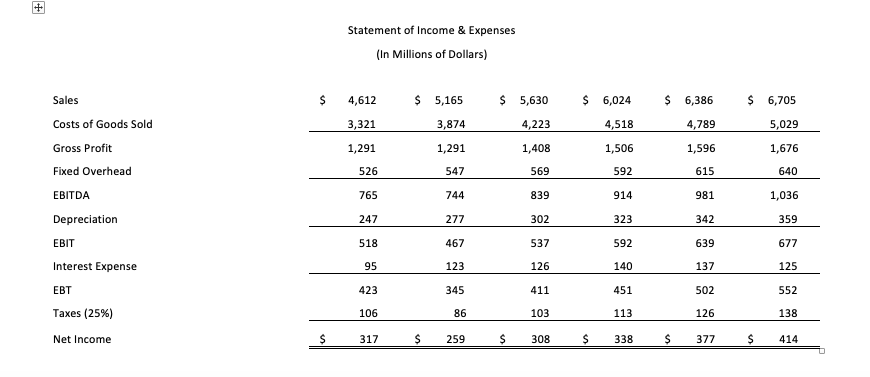

Based upon this request you have constructed a set of projections for UT for years 2019 2023 (See Attached Appendix A). After 2023, you have determined that Free Cash Flows will grow at a constant rate or 4% per year. In addition to the projections, you have the following information about UT and the financial markets.

UT has a $1.5 billion Commercial Line of Credit that carries a variable interest rate priced at the Prime Rate of interest as published from time to time by the Wall Street Journal. UT has $1.2 billion of $1,000 par value bonds that carry a coupon interest rate of 5.75%, payable annually. The bonds mature 7 years from now, and currently sell in the secondary market at $887 per bond.

UT has issued $500 million of $100 par value perpetual preferred stock that carries a preferred dividend of 6.50%. UTs preferred stock currently sells in the secondary market at $92.50 per share.

UT has 68.5 million shares of common stock outstanding.

You have noted that the yield on the short-term Treasury Bill is 1.50%. You have estimated that the beta for UTs stock is 1.2 and that the anticipated stock market return is 11.25%.

In order to estimate the value of UTs stock, you have determined that you must calculate the future Free Cash Flows for UT, estimate UTs Weighted Average Cost of Capital and then use the Corporate Valuation Model to compute the value of UTs stock. Based upon your findings, Bill has requested that you recommend whether or not UT should accept BGs offer.

Universal Technologies, Inc. Balance Sheet (In Millions of Dollars) 2019 2018 Actual 2020 Est 2021 Est 2022 Est 2023 Est. Est. Assets Current Assets Cash $ $ $ $ $ $ 550 1,153 616 1,291 868 682 1,408 Inventory Accounts Receivable Total Current Assets 719 1,506 1,012 3,237 800 1,676 1,126 775 725969946 762 1,596 1,073 3,431 946 ,02 1,073 2,478 2,775 3,035 3,603 Long Term Assets Machinery, Plant & Equipment 2,225 2,492 2,716 2,906 3,081 3,235 Total Assets 4,703 $5,267 S 5,751 $ 6,143 $6,512 6,837 Liabilities & Owner's Equity Current Liabilities Accounts Receivable $ $ $ $ $ $ Accruals 225 110 904 252 123 1,169 275 135 1,200 294 144 1,336 312 153 1,302 327 160 1,190 Line of Credit 904 1,302 1,190 Line of Credit Total Current Liabilities 1,169 1,544 1,200 1,720 1,336 1,774 1,239 1,766 1,677 Long-term Bonds 1,200 1,200 1,200 1,200 1,200 1,200 Owner's Equity Preferred Stock 500 500 500 500 500 500 1,500 1,500 1,500 1,500 1,500 Common Stock Retained Earnings 1,500 831 264 523 1,169 1,546 1,960 Total Owner's Equity 2,264 2,523 2,831 3,169 3,546 3,960 Total Liabilities & Owner's Equity $ 4,703 $ 5,267 $ 5,751 $ 6,143 $ 6,512 $ 6,837 Statement of Income & Expenses (in Millions of Dollars) Sales $ $ $ $ $ 4,612 3,321 5,165 3,874 1,291 5,630 4,223 6,024 4,518 6,705 5,029 Costs of Goods Sold 6,386 4,789 1,596 615 1,291 1,676 Gross Profit Fixed Overhead 1,408 569 1,506 592 526 547 640 EBITDA 765 744 839 914 981 1,036 Depreciation 277 302 323 342 359 EBIT 518 467 592 639 677 Interest Expense 123 537 126 411 140 125 EBT 345 Taxes (25%) 423 106 317 86 103 451 113 338 502 126 377 552 138 414 Net Income $ $ 259 $ 308 $ $ $ Universal Technologies, Inc. Balance Sheet (In Millions of Dollars) 2019 2018 Actual 2020 Est 2021 Est 2022 Est 2023 Est. Est. Assets Current Assets Cash $ $ $ $ $ $ 550 1,153 616 1,291 868 682 1,408 Inventory Accounts Receivable Total Current Assets 719 1,506 1,012 3,237 800 1,676 1,126 775 725969946 762 1,596 1,073 3,431 946 ,02 1,073 2,478 2,775 3,035 3,603 Long Term Assets Machinery, Plant & Equipment 2,225 2,492 2,716 2,906 3,081 3,235 Total Assets 4,703 $5,267 S 5,751 $ 6,143 $6,512 6,837 Liabilities & Owner's Equity Current Liabilities Accounts Receivable $ $ $ $ $ $ Accruals 225 110 904 252 123 1,169 275 135 1,200 294 144 1,336 312 153 1,302 327 160 1,190 Line of Credit 904 1,302 1,190 Line of Credit Total Current Liabilities 1,169 1,544 1,200 1,720 1,336 1,774 1,239 1,766 1,677 Long-term Bonds 1,200 1,200 1,200 1,200 1,200 1,200 Owner's Equity Preferred Stock 500 500 500 500 500 500 1,500 1,500 1,500 1,500 1,500 Common Stock Retained Earnings 1,500 831 264 523 1,169 1,546 1,960 Total Owner's Equity 2,264 2,523 2,831 3,169 3,546 3,960 Total Liabilities & Owner's Equity $ 4,703 $ 5,267 $ 5,751 $ 6,143 $ 6,512 $ 6,837 Statement of Income & Expenses (in Millions of Dollars) Sales $ $ $ $ $ 4,612 3,321 5,165 3,874 1,291 5,630 4,223 6,024 4,518 6,705 5,029 Costs of Goods Sold 6,386 4,789 1,596 615 1,291 1,676 Gross Profit Fixed Overhead 1,408 569 1,506 592 526 547 640 EBITDA 765 744 839 914 981 1,036 Depreciation 277 302 323 342 359 EBIT 518 467 592 639 677 Interest Expense 123 537 126 411 140 125 EBT 345 Taxes (25%) 423 106 317 86 103 451 113 338 502 126 377 552 138 414 Net Income $ $ 259 $ 308 $ $ $