Answered step by step

Verified Expert Solution

Question

1 Approved Answer

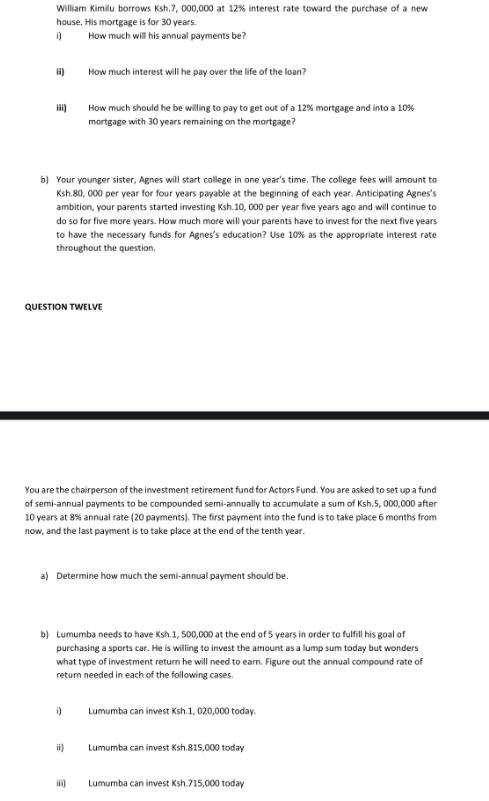

William Kimilu borrows Ksh.7, 000,000 at 12% interest rate toward the purchase of a new house. His mortgage is for 30 years. () How

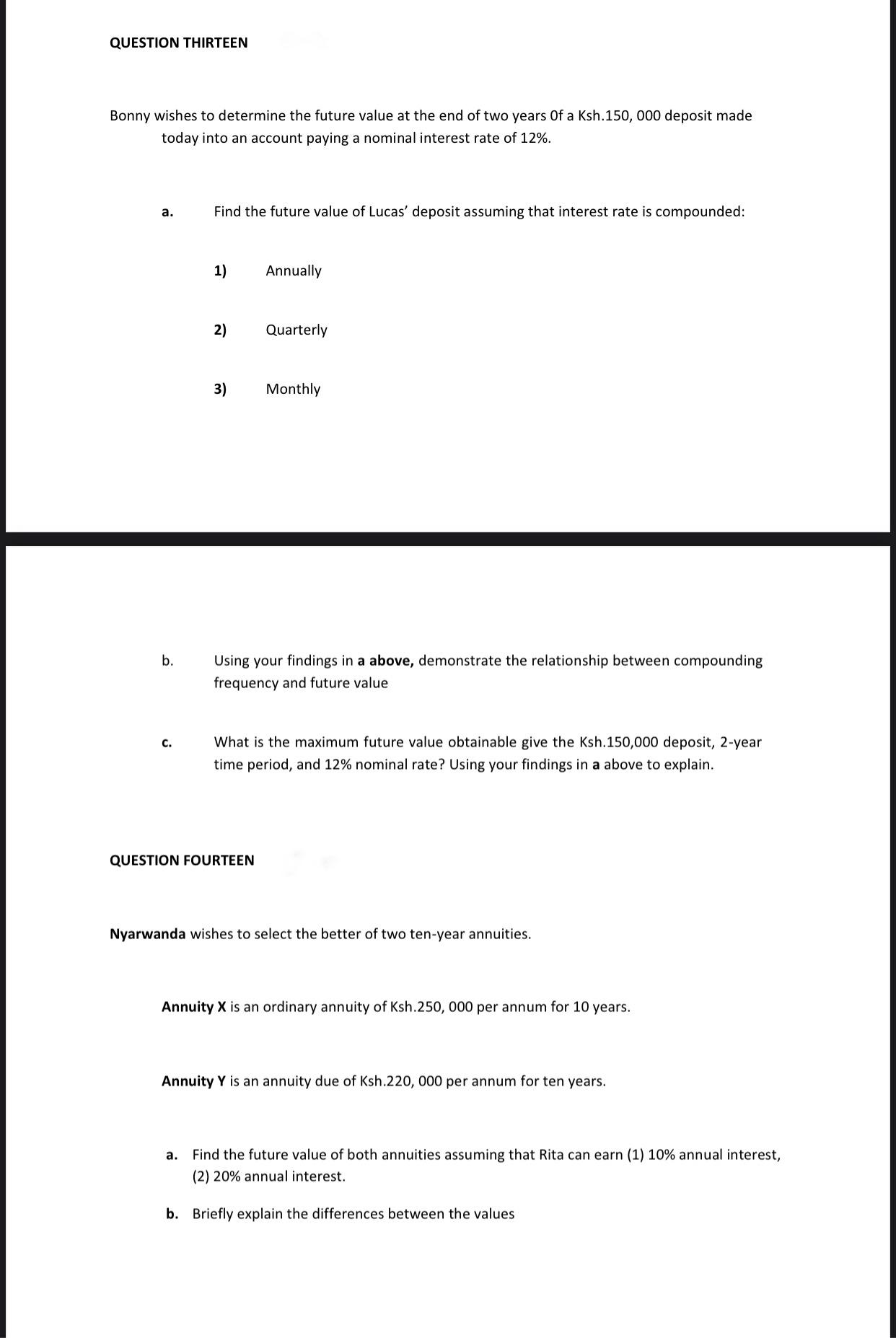

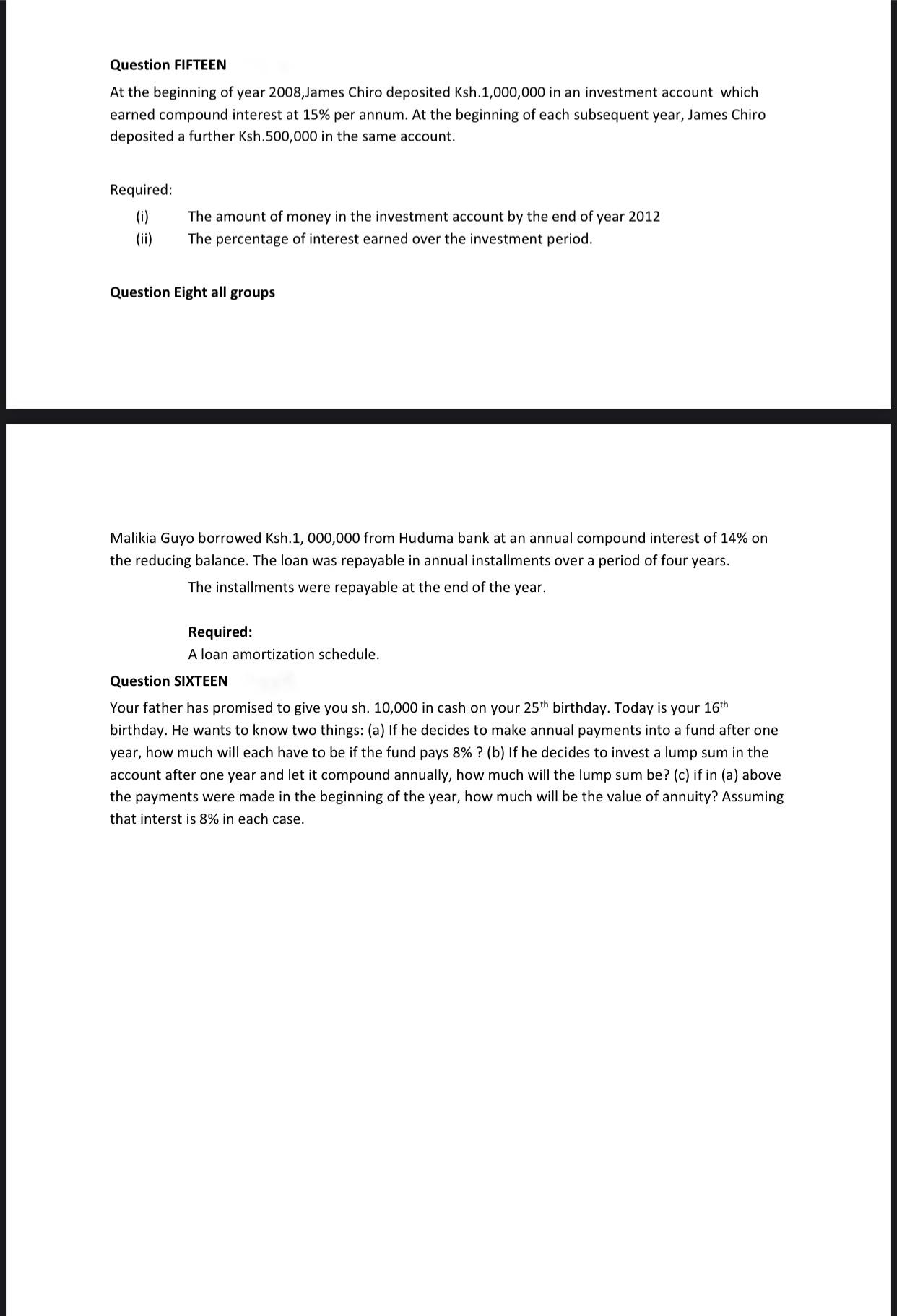

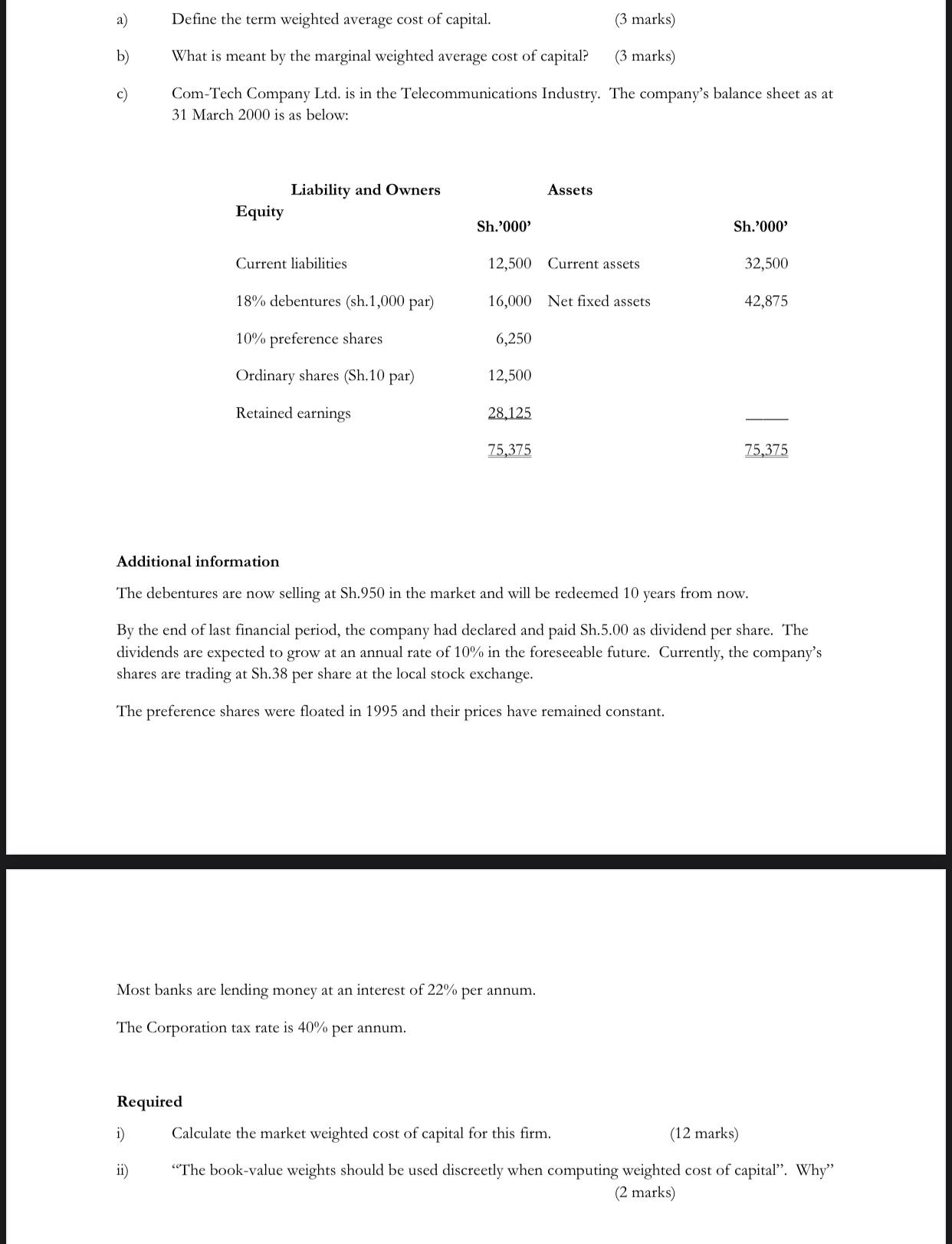

William Kimilu borrows Ksh.7, 000,000 at 12% interest rate toward the purchase of a new house. His mortgage is for 30 years. () How much will his annual payments be? H) i) b) Your younger sister, Agnes will start college in one year's time. The college fees will amount to Ksh.80, 000 per year for four years payable at the beginning of each year. Anticipating Agnes's ambition, your parents started investing Ksh. 10, 000 per year five years ago and will continue to do so for five more years. How much more will your parents have to invest for the next five years to have the necessary funds for Agnes's education? Use 10% as the appropriate interest rate throughout the question. How much interest will he pay over the life of the loan? QUESTION TWELVE How much should he be willing to pay to get out of a 12% mortgage and into a 10% mortgage with 30 years remaining on the mortgage? You are the chairperson of the investment retirement fund for Actors Fund. You are asked to set up a fund of semi-annual payments to be compounded semi-annually to accumulate a sum of Ksh. 5,000,000 after 10 years at 8% annual rate (20 payments). The first payment into the fund is to take place 6 months from now, and the last payment is to take place at the end of the tenth year. a) Determine how much the semi-annual payment should be. () b) Lumumba needs to have Ksh.1, 500,000 at the end of 5 years in order to fulfill his goal of purchasing a sports car. He is willing to invest the amount as a lump sum today but wonders what type of investment return he will need to earn. Figure out the annual compound rate of return needed in each of the following cases. ii) i) Lumumba can invest Ksh 1,020,000 today. Lumumba can invest Ksh.815,000 today Lumumba can invest Ksh.715,000 today QUESTION THIRTEEN Bonny wishes to determine the future value at the end of two years Of a Ksh.150, 000 deposit made today into an account paying a nominal interest rate of 12%. a. Find the future value of Lucas' deposit assuming that interest rate is compounded: b. C. 1) 2) 3) Annually Quarterly QUESTION FOURTEEN Monthly Using your findings in a above, demonstrate the relationship between compounding frequency and future value What is the maximum future value obtainable give the Ksh.150,000 deposit, 2-year time period, and 12% nominal rate? Using your findings in a above to explain. Nyarwanda wishes to select the better of two ten-year annuities. Annuity X is an ordinary annuity of Ksh.250, 000 per annum for 10 years. Annuity Y is an annuity due of Ksh.220, 000 per annum for ten years. a. Find the future value of both annuities assuming that Rita can earn (1) 10% annual interest, (2) 20% annual interest. b. Briefly explain the differences between the values. Question FIFTEEN At the beginning of year 2008, James Chiro deposited Ksh.1,000,000 in an investment account which earned compound interest at 15% per annum. At the beginning of each subsequent year, James Chiro deposited a further Ksh.500,000 in the same account. Required: (i) (ii) The amount of money in the investment account by the end of year 2012 The percentage of interest earned over the investment period. Question Eight all groups Malikia Guyo borrowed Ksh.1, 000,000 from Huduma bank at an annual compound interest of 14% on the reducing balance. The loan was repayable in annual installments over a period of four years. The installments were repayable at the end of the year. Required: A loan amortization schedule. Question SIXTEEN Your father has promised to give you sh. 10,000 in cash on your 25th birthday. Today is your 16th birthday. He wants to know two things: (a) If he decides to make annual payments into a fund after one year, how much will each have to be if the fund pays 8% ? (b) If he decides to invest a lump sum in the account after one year and let it compound annually, how much will the lump sum be? (c) if in (a) above the payments were made in the beginning of the year, how much will be the value of annuity? Assuming that interst is 8% in each case. a) b) c) Define the term weighted average cost of capital. (3 marks) What is meant by the marginal weighted average cost of capital? (3 marks) Com-Tech Company Ltd. is in the Telecommunications Industry. The company's balance sheet as at 31 March 2000 is as below: Equity Liability and Owners Required i) ii) Current liabilities. 18% debentures (sh.1,000 par) 10% preference shares Ordinary shares (Sh.10 par) Retained earnings Sh.'000' 12,500 Current assets 16,000 Net fixed assets 6,250 12,500 28,125 75,375 Assets Most banks are lending money at an interest of 22% per annum. The Corporation tax rate is 40% per annum. Sh.'000' Additional information The debentures are now selling at Sh.950 in the market and will be redeemed 10 years from now. 32,500 42,875 By the end of last financial period, the company had declared and paid Sh.5.00 as dividend per share. The dividends are expected to grow at an annual rate of 10% in the foreseeable future. Currently, the company's shares are trading at Sh.38 per share at the local stock exchange. The preference shares were floated in 1995 and their prices have remained constant. 75,375 Calculate the market weighted cost of capital for this firm. (12 marks) "The book-value weights should be used discreetly when computing weighted cost of capital". Why" (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started