Answered step by step

Verified Expert Solution

Question

1 Approved Answer

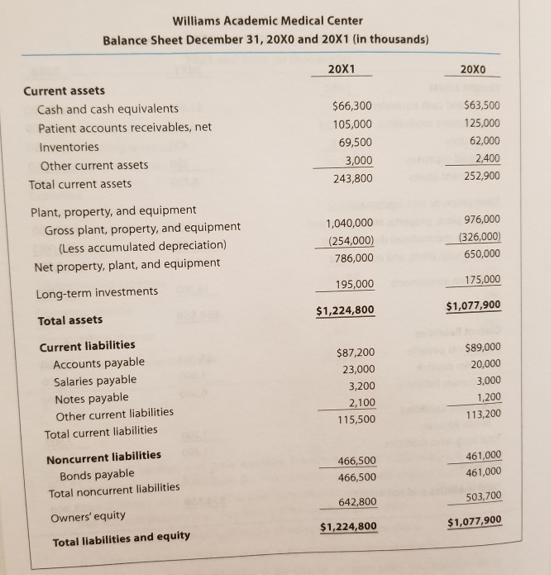

Williams Academic Medical Center Balance Sheet December 31, 20X0 and 20X1 (in thousands) 20X1 Current assets Cash and cash equivalents Patient accounts receivables, net

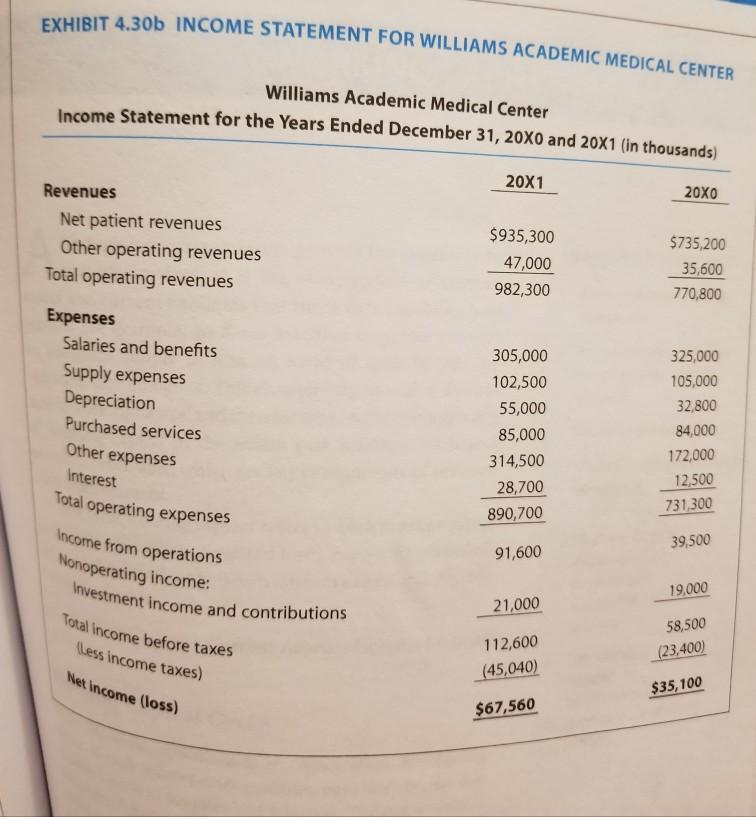

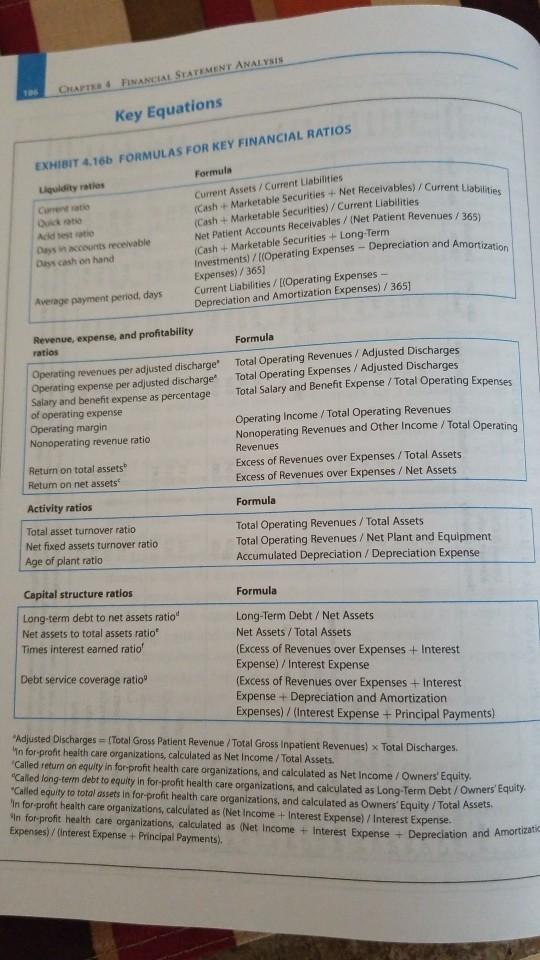

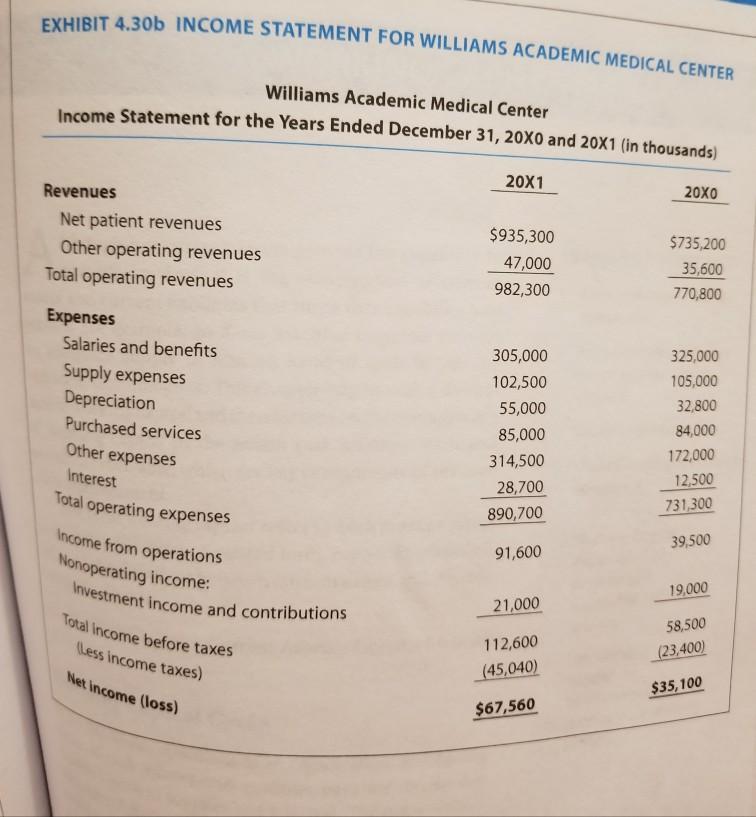

Williams Academic Medical Center Balance Sheet December 31, 20X0 and 20X1 (in thousands) 20X1 Current assets Cash and cash equivalents Patient accounts receivables, net Inventories Other current assets Total current assets Plant, property, and equipment Gross plant, property, and equipment (Less accumulated depreciation) Net property, plant, and equipment Long-term investments Total assets Current liabilities Accounts payable Salaries payable Notes payable Other current liabilities Total current liabilities Noncurrent liabilities Bonds payable Total noncurrent liabilities Owners' equity Total liabilities and equity $66,300 105,000 69,500 3,000 243,800 1,040,000 (254,000) 786,000 195,000 $1,224,800 $87,200 23,000 3,200 2,100 115,500 466,500 466,500 642,800 $1,224,800 20X0 $63,500 125,000 62,000 2,400 252,900 976,000 (326,000) 650,000 175,000 $1,077,900 $89,000 20,000 3,000 1,200 113,200 461,000 461,000 503,700 $1,077,900 EXHIBIT 4.30b INCOME STATEMENT FOR WILLIAMS ACADEMIC MEDICAL CENTER Williams Academic Medical Center Income Statement for the Years Ended December 31, 20X0 and 20X1 (in thousands) Revenues Net patient revenues Other operating revenues Total operating revenues Expenses Salaries and benefits Supply expenses Depreciation Purchased services Other expenses Interest Total operating expenses Income from operations Nonoperating income: Investment income and contributions Total Income before taxes (Less income taxes) Net income (loss) 20X1 $935,300 47,000 982,300 305,000 102,500 55,000 85,000 314,500 28,700 890,700 91,600 21,000 112,600 (45,040) $67,560 20X0 $735,200 35,600 770,800 325,000 105,000 32,800 84,000 172,000 12,500 731,300 39,500 19,000 58,500 (23,400) $35,100 CHAPTER 4 FINANCIAL STATEMENT ANALYSIS Key Equations EXHIBIT 4.16b FORMULAS FOR KEY FINANCIAL RATIOS Liquidity ratios Current ratio Quick rate Adid test ratio Days in accounts receivable Days cash on hand Average payment period, days Revenue, expense, and profitability ratios Return on total assets Return on net assets Formula Current Assets/Current Liabilities (Cash+Marketable Securities + Net Receivables)/Current Liabilities (Cash+Marketable Securities)/Current Liabilities Activity ratios Total asset turnover ratio Net fixed assets turnover ratio Age of plant ratio Net Patient Accounts Receivables/ (Net Patient Revenues/365) (Cash+Marketable Securities +Long-Term Investments) / [(Operating Expenses - Depreciation and Amortization Expenses)/365] Operating revenues per adjusted discharge" Operating expense per adjusted discharge Salary and benefit expense as percentage of operating expense Operating margin Nonoperating revenue ratio Capital structure ratios Long-term debt to net assets ratio" Net assets to total assets ratio Times interest earned ratio Debt service coverage ratio" Current Liabilities/ [(Operating Expenses- Depreciation and Amortization Expenses) / 365] Formula Total Operating Revenues / Adjusted Discharges Total Operating Expenses / Adjusted Discharges Total Salary and Benefit Expense / Total Operating Expenses Operating Income / Total Operating Revenues Nonoperating Revenues and Other Income / Total Operating Revenues Excess of Revenues over Expenses/Total Assets. Excess of Revenues over Expenses / Net Assets Formula Total Operating Revenues/Total Assets Total Operating Revenues / Net Plant and Equipment Accumulated Depreciation / Depreciation Expense Formula Long-Term Debt / Net Assets Net Assets/Total Assets (Excess of Revenues over Expenses + Interest Expense) / Interest Expense (Excess of Revenues over Expenses + Interest Expense + Depreciation and Amortization Expenses)/ (Interest Expense + Principal Payments) "Adjusted Discharges= (Total Gross Patient Revenue / Total Gross Inpatient Revenues) x Total Discharges. in for-profit health care organizations, calculated as Net Income / Total Assets. 'Called return on equity in for-profit health care organizations, and calculated as Net Income / Owners' Equity. "Called long-term debt to equity in for-profit health care organizations, and calculated as Long-Term Debt/Owners' Equity. "Called equity to total assets in for-profit health care organizations, and calculated as Owners' Equity / Total Assets. In for-profit health care organizations, calculated as (Net Income + Interest Expense) / Interest Expense. In for-profit health care organizations, calculated as (Net Income + Interest Expense + Depreciation and Amortizati Expenses)/(Interest Expense + Principal Payments). EXHIBIT 4.30b INCOME STATEMENT FOR WILLIAMS ACADEMIC MEDICAL CENTER Williams Academic Medical Center Income Statement for the Years Ended December 31, 20X0 and 20X1 (in thousands) Revenues Net patient revenues Other operating revenues Total operating revenues Expenses Salaries and benefits Supply expenses Depreciation Purchased services Other expenses Interest Total operating expenses Income from operations Nonoperating income: Investment income and contributions Total Income before taxes (Less income taxes) Net income (loss) 20X1 $935,300 47,000 982,300 305,000 102,500 55,000 85,000 314,500 28,700 890,700 91,600 21,000 112,600 (45,040) $67,560 20X0 $735,200 35,600 770,800 325,000 105,000 32,800 84,000 172,000 12,500 731,300 39,500 19,000 58,500 (23,400) $35,100 24. Horizontal, vertical, and ratio analyses. Exhibits 4.30a and 4.30b show the balance sheet and income statement for the 660-bed Williams Academic Medical Center for the years 20X0 and 20X1. Assume that principal payments each year come to $5,500,000 and that adjusted discharges are 120,000 for 20X0 and 125,000 for 20X1. a. Perform full horizontal and vertical analyses on the balance sheet. b. Perform full horizontal and vertical analyses on the income statement. c. Calculate every ratio described in the chapter for both years, and compare these ratios with the benchmarks (Exhibit 4.16a). Discuss Williams's current financial position and future outlook based on these results. Make the basis for the vertical analysis the year 20X0.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Income statement analysis 20x1 20x0 YOY Basis YOY Remarks Revenue Net Patient Revenues 935300 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started