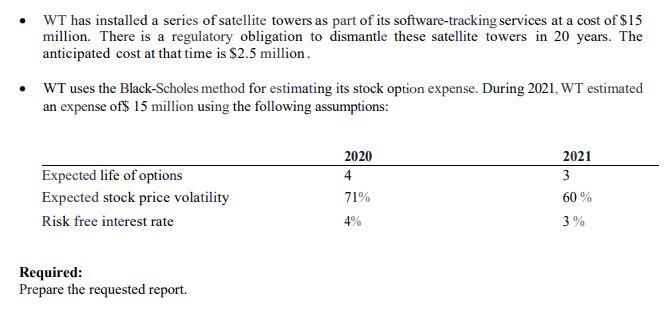

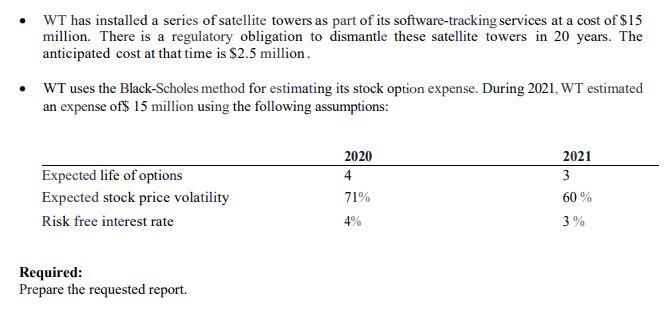

Williams Technology (WT) is a private corporation formed in 2006. WT develops and sells software for many purposes: theft recovery, geo-mapping, data and device security and IT asset management. To help motivate management, WT has a stock option plan. To help fund continued software development, WT has a bank loan with a major bank. The bank requires annual audited financial statements and has a financial covenant that stipulates a current ratio of 2 to 1. WT has an expected taxable loss of $ 10,000,000 in 2021. For the last three years the company has had taxable profits of $2,000,000 in 2018; $5,000,000 in 2019, and $1,000,000 in 2020. WT's taxable loss this year was due to intensive development of new software for security over personal data. WT anticipates sales of this product to be significant due to concerns over identity theft. You have recently been hired to develop new accounting policies for WT's December 31 year-end. You have been asked by the owners to discuss alternatives and provide recommendations on the appropriate accounting policies for events below that have occurred during 2021. Where possible, you have been asked to quantify the impact of the accounting policies. WT is seriously considering going public next year and would like to know how your recommendations would be different if it was a public company. The incremental borrowing rate for WT is 10%. The tax rates for the last few years were 2018 (38%), 2019 (39%), and both 2020 and 2021 (40%). WT offers a warranty with its theft recovery software. If a computer equipped with the software is stolen and WT is unable to recover the stolen software using its software or delete data on the stolen computer, then the customer is eligible for a warranty of up to $1,000. To qualify, customers must file a police report. The amount of the warranty depends on the value of the stolen computer. Estimated warranty liabilities on the balance sheet at the end of 2020 were $8 million. During 2021, the estimated warranty costs based on a percentage of sales will be an additional $5 million. Actual warranty costs during 2021 were$ 1 million. WT currently uses the taxes payable method of accounting for income taxes. In 2020, WT changes its method of accounting for software development from expensing to capitalizing as an intangible asset. WT has installed a series of satellite towers as part of its software-tracking services at a cost of $15 million. There is a regulatory obligation to dismantle these satellite towers in 20 years. The anticipated cost at that time is $2.5 million. WT uses the Black-Scholes method for estimating its stock option expense. During 2021, WT estimated an expense of$ 15 million using the following assumptions: Expected life of options Expected stock price volatility Risk free interest rate 2020 4 71% 4% 2021 3 60% 3% Required: Prepare the requested report. Williams Technology (WT) is a private corporation formed in 2006. WT develops and sells software for many purposes: theft recovery, geo-mapping, data and device security and IT asset management. To help motivate management, WT has a stock option plan. To help fund continued software development, WT has a bank loan with a major bank. The bank requires annual audited financial statements and has a financial covenant that stipulates a current ratio of 2 to 1. WT has an expected taxable loss of $ 10,000,000 in 2021. For the last three years the company has had taxable profits of $2,000,000 in 2018; $5,000,000 in 2019, and $1,000,000 in 2020. WT's taxable loss this year was due to intensive development of new software for security over personal data. WT anticipates sales of this product to be significant due to concerns over identity theft. You have recently been hired to develop new accounting policies for WT's December 31 year-end. You have been asked by the owners to discuss alternatives and provide recommendations on the appropriate accounting policies for events below that have occurred during 2021. Where possible, you have been asked to quantify the impact of the accounting policies. WT is seriously considering going public next year and would like to know how your recommendations would be different if it was a public company. The incremental borrowing rate for WT is 10%. The tax rates for the last few years were 2018 (38%), 2019 (39%), and both 2020 and 2021 (40%). WT offers a warranty with its theft recovery software. If a computer equipped with the software is stolen and WT is unable to recover the stolen software using its software or delete data on the stolen computer, then the customer is eligible for a warranty of up to $1,000. To qualify, customers must file a police report. The amount of the warranty depends on the value of the stolen computer. Estimated warranty liabilities on the balance sheet at the end of 2020 were $8 million. During 2021, the estimated warranty costs based on a percentage of sales will be an additional $5 million. Actual warranty costs during 2021 were$ 1 million. WT currently uses the taxes payable method of accounting for income taxes. In 2020, WT changes its method of accounting for software development from expensing to capitalizing as an intangible asset. WT has installed a series of satellite towers as part of its software-tracking services at a cost of $15 million. There is a regulatory obligation to dismantle these satellite towers in 20 years. The anticipated cost at that time is $2.5 million. WT uses the Black-Scholes method for estimating its stock option expense. During 2021, WT estimated an expense of$ 15 million using the following assumptions: Expected life of options Expected stock price volatility Risk free interest rate 2020 4 71% 4% 2021 3 60% 3% Required: Prepare the requested report