Answered step by step

Verified Expert Solution

Question

1 Approved Answer

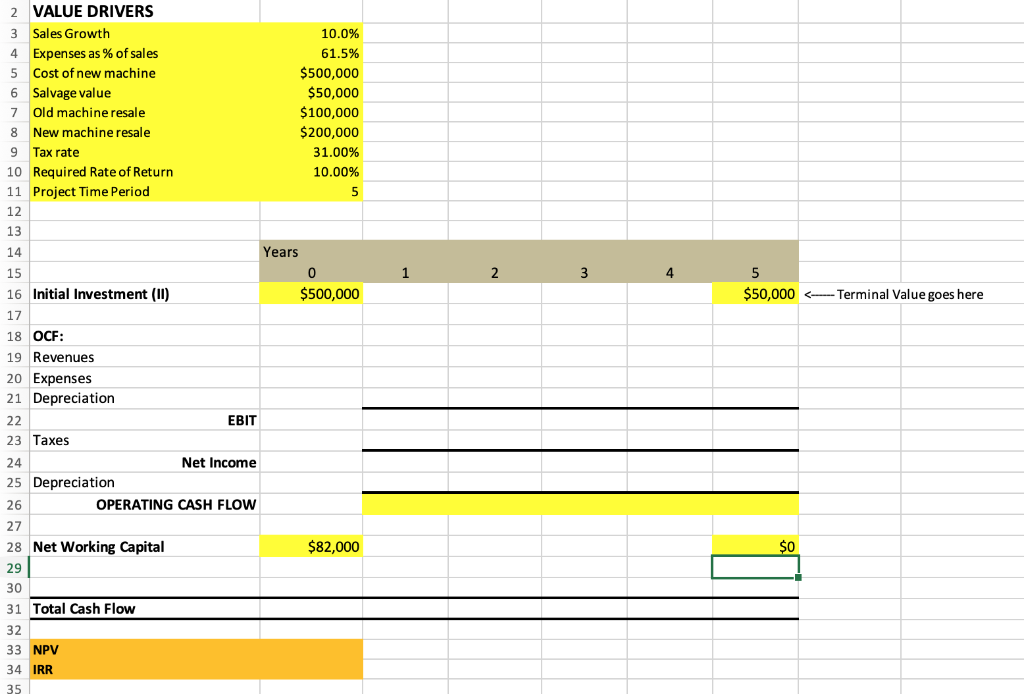

Williamston Widgets Inc. wishes to determine whether it would be advisable to replace an existing, fully depreciated machine with a new piece of equipment. Assume

Williamston Widgets Inc. wishes to determine whether it would be advisable to replace an existing, fully depreciated machine with a new piece of equipment. Assume a project time frame of 5 years.

- The new machine will cost $500,000. It will be depreciated (straight line) over a five-year period, assuming a salvage value of $50,000.

- The old machine, which has been fully depreciated, could be sold today at $100,000.

- Sales in Year 1 are projected to be $260,000. The new machine will produce superior products, causing sales to grow by 10% per year.

- Total expenses have been estimated at 61.5% of Sales.

- The firm is in the 31% marginal tax bracket and requires a minimum return on the replacement decision of 10%.

- Even though they will be depreciating the new machine to $50,000 over the course of the project, a representative from Stockbridge Sprockets has told WWI that they will likely buy the machine from them at the end of the project for $200,000. WWI has decided to include this in the terminal value of the project.

- The project will require $82,000 in Net Working Capital, none of which will be recovered at the end of the project.

Part A: Base case project decision (40 points)

- On the Assignment spreadsheet, on the part A tab, add the value drivers.

- Build the DCF Model, and calculate NPV and IRR

- Somewhere on this tab, state whether or not the company should purchase the new machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started