Question

3- Suppose that a portfolio management company manages an investment fund. The fund manager observes a bond in the market and intends to add

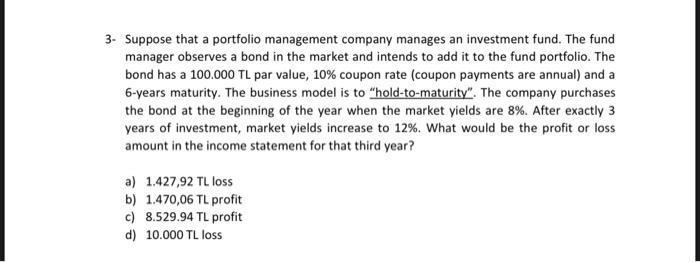

3- Suppose that a portfolio management company manages an investment fund. The fund manager observes a bond in the market and intends to add it to the fund portfolio. The bond has a 100.000 TL par value, 10% coupon rate (coupon payments are annual) and a 6-years maturity. The business model is to "hold-to-maturity". The company purchases the bond at the beginning of the year when the market yields are 8%. After exactly 3 years of investment, market yields increase to 12%. What would be the profit or loss amount in the income statement for that third year? a) 1.427,92 TL loss b) 1.470,06 TL profit c) 8.529.94 TL profit d) 10.000 TL loss

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below ANSWER To determine the profit or loss ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray Garrison, Eric Noreen, Peter Brewer

16th edition

1259307417, 978-1260153132, 1260153134, 978-1259307416

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App