Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wilson Company, the lessee, and Paxton Equipment, the lessor, sign a lease agreement on January 1, 2020, that provides for Wilson to lease a

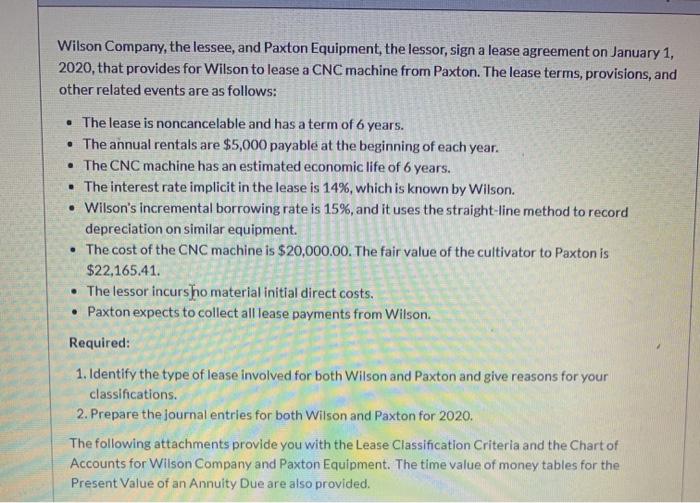

Wilson Company, the lessee, and Paxton Equipment, the lessor, sign a lease agreement on January 1, 2020, that provides for Wilson to lease a CNC machine from Paxton. The lease terms, provisions, and other related events are as follows: The lease is noncancelable and has a term of 6 years. The annual rentals are $5,000 payable at the beginning of each year. The CNC machine has an estimated economic life of 6 years. The interest rate implicit in the lease is 14%, which is known by Wilson. Wilson's incremental borrowing rate is 15%, and it uses the straight-line method to record depreciation on similar equipment. The cost of the CNC machine is $20,000.00. The fair value of the cultivator to Paxton is $22,165.41. The lessor incursho material initial direct costs. Paxton expects to collect all lease payments from Wilson. Required: 1. Identify the type of lease involved for both Wilson and Paxton and give reasons for your classifications. 2. Prepare the journal entries for both Wilson and Paxton for 2020. The following attachments provide you with the Lease Classification Criteria and the Chart of Accounts for Wilson Company and Paxton Equipment. The time value of money tables for the Present Value of an Annuity Due are also provided.

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Present Value of lease payments The lease involved f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started