Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wilson Johnson, a childhood, friend has asked you to assist with his personal finances. Single and 30 years old, he is employed as an

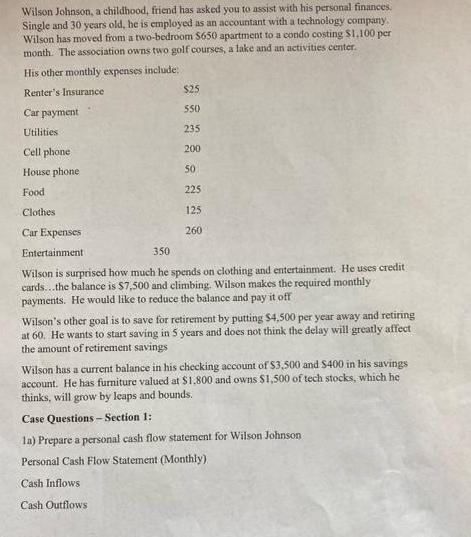

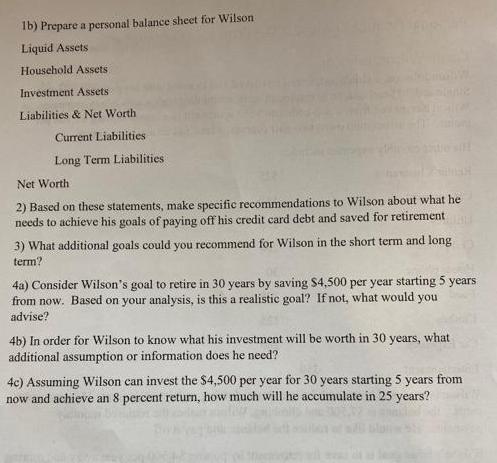

Wilson Johnson, a childhood, friend has asked you to assist with his personal finances. Single and 30 years old, he is employed as an accountant with a technology company. Wilson has moved from a two-bedroom $650 apartment to a condo costing $1.100 per month. The association owns two golf courses, a lake and an activities center. His other monthly expenses include: Renter's Insurance Car payment Utilities Cell phone House phone Food Clothes $25 550 235 200 50 225 125 260 Car Expenses Entertainment 350 Wilson is surprised how much he spends on clothing and entertainment. He uses credit cards...the balance is $7,500 and climbing. Wilson makes the required monthly payments. He would like to reduce the balance and pay it off Wilson's other goal is to save for retirement by putting $4,500 per year away and retiring at 60. He wants to start saving in 5 years and does not think the delay will greatly affect the amount of retirement savings Wilson has a current balance in his checking account of $3,500 and $400 in his savings account. He has furniture valued at $1,800 and owns $1,500 of tech stocks, which he thinks, will grow by leaps and bounds. Case Questions-Section 1: la) Prepare a personal cash flow statement for Wilson Johnson Personal Cash Flow Statement (Monthly) Cash Inflows Cash Outflows 1b) Prepare a personal balance sheet for Wilson Liquid Assets Household Assets Investment Assets Liabilities & Net Worth Current Liabilities Long Term Liabilities Net Worth 2) Based on these statements, make specific recommendations to Wilson about what he needs to achieve his goals of paying off his credit card debt and saved for retirement 3) What additional goals could you recommend for Wilson in the short term and long term? 4a) Consider Wilson's goal to retire in 30 years by saving $4,500 per year starting 5 years from now. Based on your analysis, is this a realistic goal? If not, what would you advise? 4b) In order for Wilson to know what his investment will be worth in 30 years, what additional assumption or information does he need? 4c) Assuming Wilson can invest the $4,500 per year for 30 years starting 5 years from now and achieve an 8 percent return, how much will he accumulate in 25 years?

Step by Step Solution

★★★★★

3.62 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1a Cash Inflows Salary 3000 Rent 650 Utilities 235 Cell Phone 200 House Phone 50 Food 225 Clothes 125 Car Expenses 260 Entertainment 350 Total Cash In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started