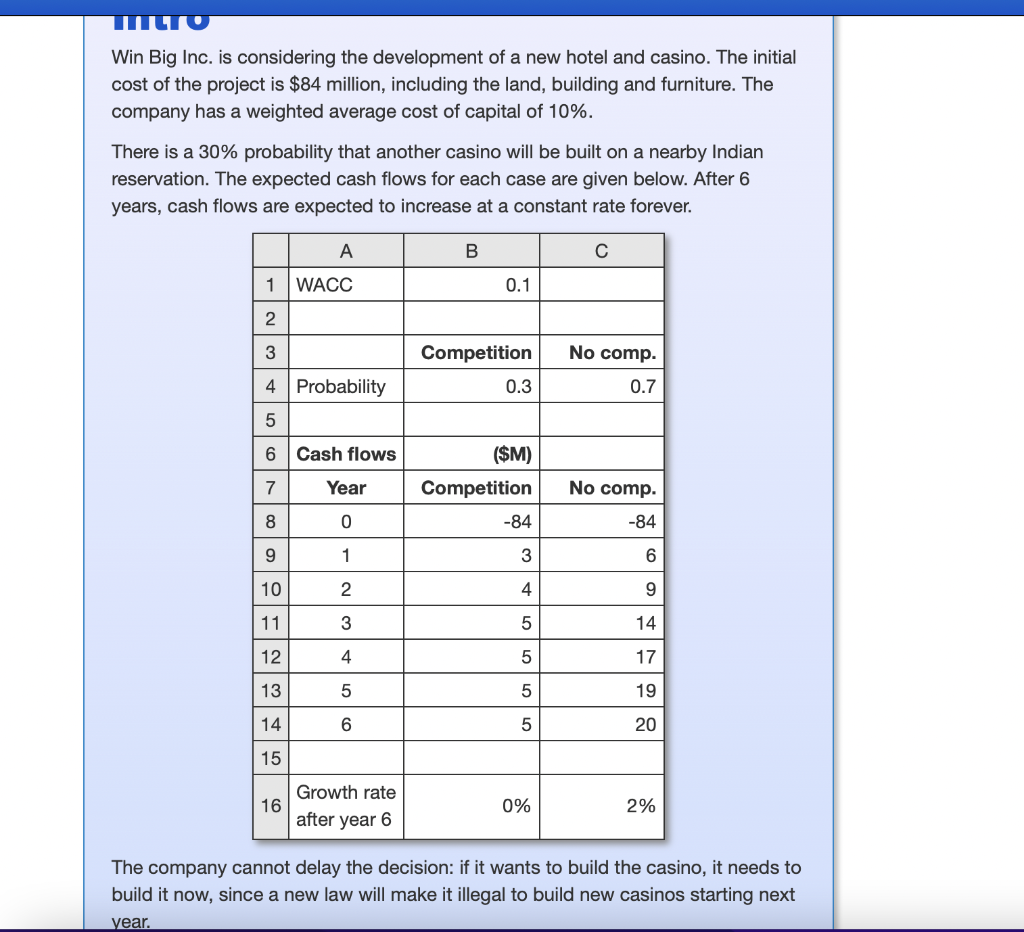

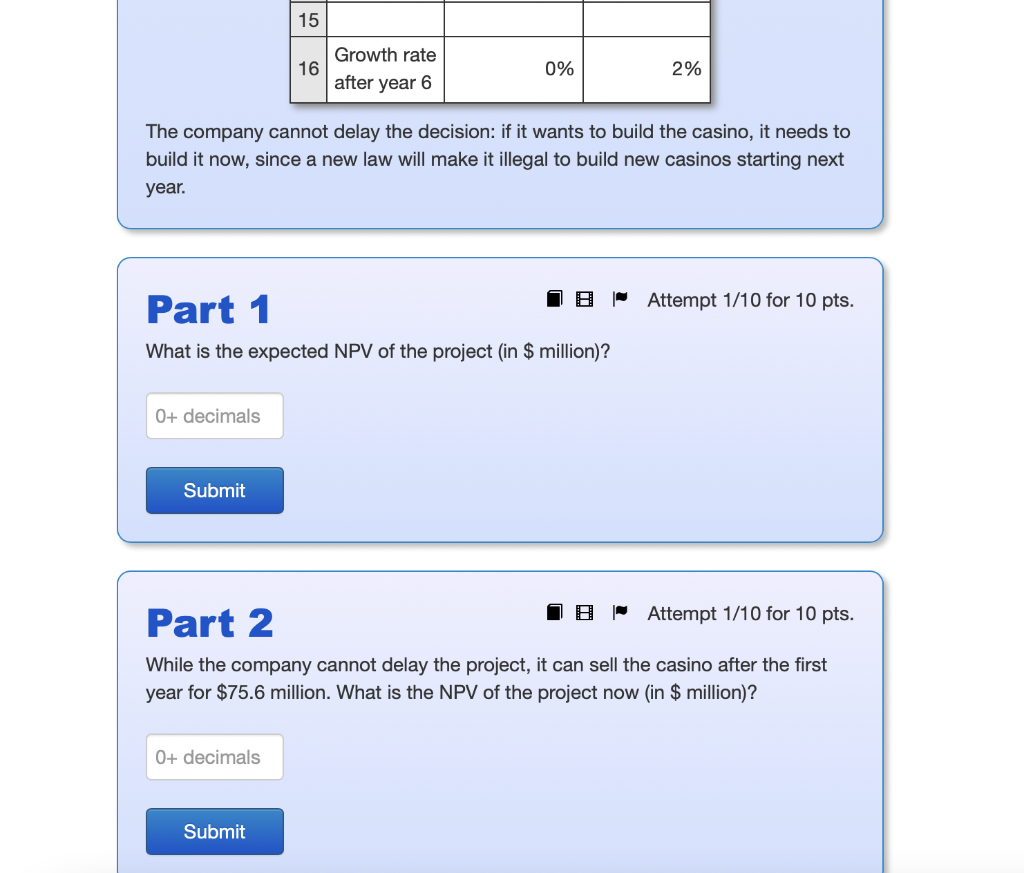

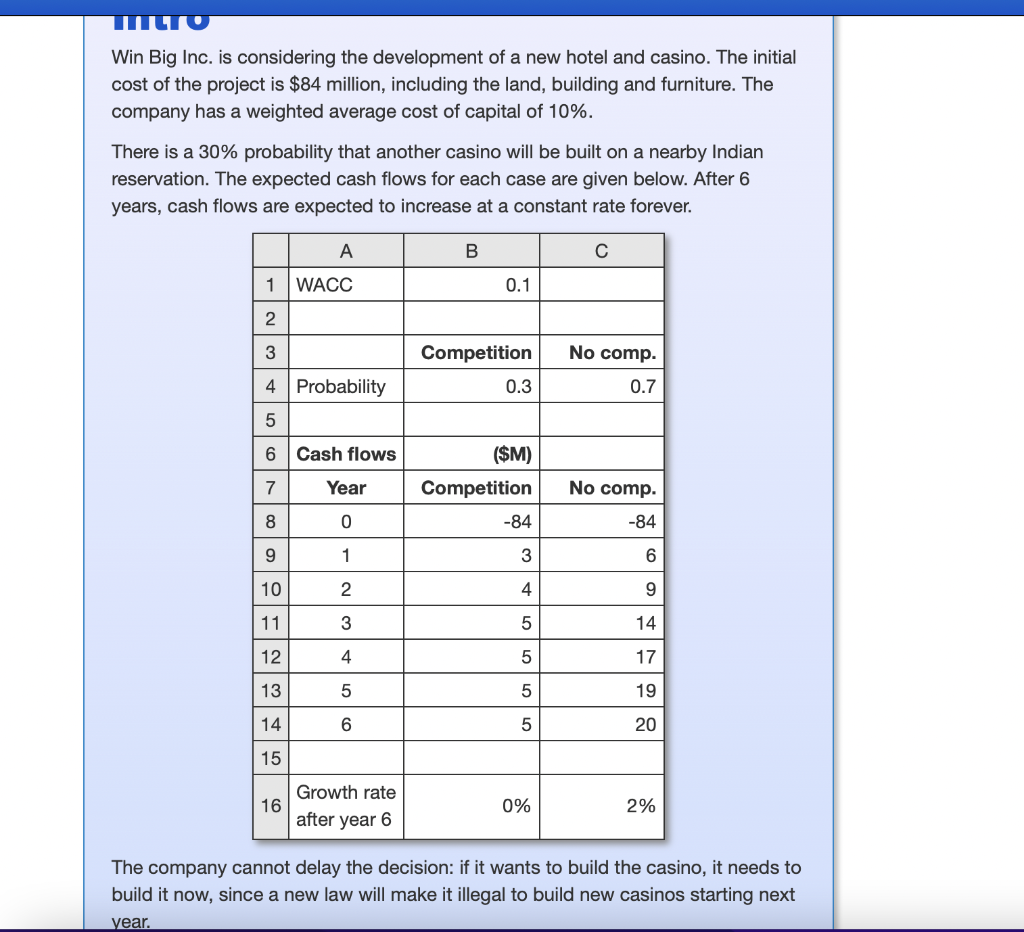

Win Big Inc. is considering the development of a new hotel and casino. The initial cost of the project is $84 million, including the land, building and furniture. The company has a weighted average cost of capital of 10%. There is a 30% probability that another casino will be built on a nearby Indian reservation. The expected cash flows for each case are given below. After 6 years, cash flows are expected to increase at a constant rate forever. A B 1 WACC 0.1 2 3 Competition No comp. 4 Probability 0.3 0.7 5 6 Cash flows ($M) Competition 7 Year No comp. 8 0 -84 -84 9 1 3 6 10 2 4 9 11 3 5 14 12 4 5 17 13 5 5 19 14 6 5 20 15 16 Growth rate after year 6 0% 2% The company cannot delay the decision: if it wants to build the casino, it needs to build it now, since a new law will make it illegal to build new casinos starting next year. 15 16 Growth rate after year 6 0% 2% The company cannot delay the decision: if it wants to build the casino, it needs to build it now, since a new law will make it illegal to build new casinos starting next year. Part 1 1B "Attempt 1/10 for 10 pts. What is the expected NPV of the project (in $ million)? 0+ decimals Submit IB Attempt 1/10 for 10 pts. Part 2 While the company cannot delay the project, it can sell the casino after the first year for $75.6 million. What is the NPV of the project now (in $ million)? 0+ decimals Submit | Attempt 1/10 for 10 pts. Part 3 What is the value of the option (in $ million)? 1+ decimals Submit Win Big Inc. is considering the development of a new hotel and casino. The initial cost of the project is $84 million, including the land, building and furniture. The company has a weighted average cost of capital of 10%. There is a 30% probability that another casino will be built on a nearby Indian reservation. The expected cash flows for each case are given below. After 6 years, cash flows are expected to increase at a constant rate forever. A B 1 WACC 0.1 2 3 Competition No comp. 4 Probability 0.3 0.7 5 6 Cash flows ($M) Competition 7 Year No comp. 8 0 -84 -84 9 1 3 6 10 2 4 9 11 3 5 14 12 4 5 17 13 5 5 19 14 6 5 20 15 16 Growth rate after year 6 0% 2% The company cannot delay the decision: if it wants to build the casino, it needs to build it now, since a new law will make it illegal to build new casinos starting next year. 15 16 Growth rate after year 6 0% 2% The company cannot delay the decision: if it wants to build the casino, it needs to build it now, since a new law will make it illegal to build new casinos starting next year. Part 1 1B "Attempt 1/10 for 10 pts. What is the expected NPV of the project (in $ million)? 0+ decimals Submit IB Attempt 1/10 for 10 pts. Part 2 While the company cannot delay the project, it can sell the casino after the first year for $75.6 million. What is the NPV of the project now (in $ million)? 0+ decimals Submit | Attempt 1/10 for 10 pts. Part 3 What is the value of the option (in $ million)? 1+ decimals Submit