Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WindFarm Reno is considering the purchase of wind turbines at a cost of $100 million as of 1/1/ 2013. The company expects the wind

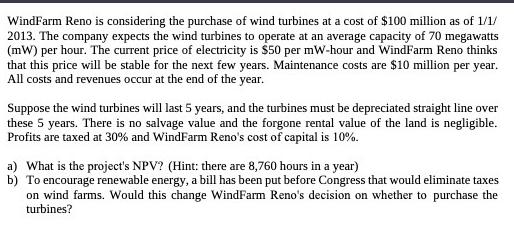

WindFarm Reno is considering the purchase of wind turbines at a cost of $100 million as of 1/1/ 2013. The company expects the wind turbines to operate at an average capacity of 70 megawatts (mW) per hour. The current price of electricity is $50 per mW-hour and WindFarm Reno thinks that this price will be stable for the next few years. Maintenance costs are $10 million per year. All costs and revenues occur at the end of the year. Suppose the wind turbines will last 5 years, and the turbines must be depreciated straight line over these 5 years. There is no salvage value and the forgone rental value of the land is negligible. Profits are taxed at 30% and WindFarm Reno's cost of capital is 10%. a) What is the project's NPV? (Hint: there are 8,760 hours in a year) b) To encourage renewable energy, a bill has been put before Congress that would eliminate taxes on wind farms. Would this change WindFarm Reno's decision on whether to purchase the turbines?

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the projects NPV we need to first calculate the annual cash flows Revenue 70 mW x 876...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started