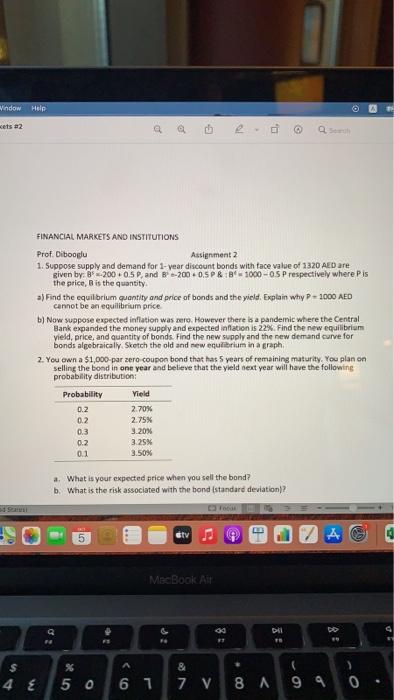

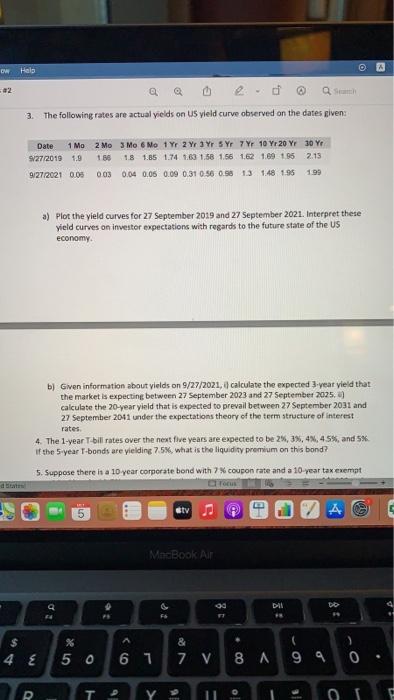

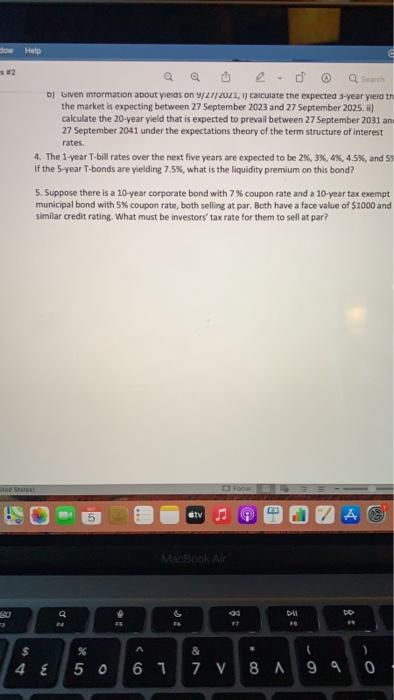

Window Help cets 2 0 FINANCIAL MARKETS AND INSTITUTIONS Prof. Dibooglu Assignment 2 1. Suppose supply and demand for 1-year discount bonds with tace value of 1320 AED are given by 8-2000.5 P. and B-2000. P& B-1000-05 P respectively where Pis the price is the quantity a) Find the equilibrium quantity and price of bonds and the yield. Explain why P = 1000 AED cannot be an equilibrium price b) Now suppose expected inflation was zero. However there is a pandemic where the Central Bank expanded the money supply and expected inflation is 22%. Find the new equilibrium yield, price, and quantity of bonds. Find the new supply and the new demand curve for bonds algebraically Sketch the old and new equilibrium in a graph 2. You own a $1,000 par zero coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year and believe that the yield next year will have the following probability distribution: Probability Yield D.2 2.70% 0.2 2.75% 03 9.20% 0.2 3.25% 0.1 3.50% a. What is your expected price when you sell the bond? b. What is the risk associated with the bond standard deviation? 5 otv / MacBook Air Di TE A $ 4 E % 50 & 7 V 6 1 8 A 99 0 OM Hals -02 a 3. The following rates are actual yields on US yield curve observed on the dates given Date 1 Mo 2 Mo 3 Mo 6 No 1 Y 2 Y 3Y SY 7 Y 10 Yr 20 Y 30 Y 9/27/2010 1.0 13 1.8 1.85 1.74 1.63 1.58 1.56 1.62 1.69 195 2.13 9:272021 0.0003 0.04 0.06 0.09 0.31 0.56 0.58 13 148 1.96 199 a) Plot the yield curves for 27 September 2019 and 27 September 2021. Interpret these yield curves on investor expectations with regards to the future state of the US economy b) Given information about yields on 9/27/2021, calculate the expected 3-year yield that the market is expecting between 27 September 2023 and 27 September 2025. calculate the 20-year yield that is expected to prevall between 27 September 2031 and 27 September 2011 under the expectations theory of the term structure of interest rates 4. The 1-year T-bill rates over the next five years are expected to be 2%,3%, 4, 45% and 5% if the 5-year T-bonds are yielding 75%, what is the liquidity premium on this bond? 5. Suppose there is a 10 year corporate bond with 7 coupon rate and a 10-year tax exempt gtv MacBook Air od DAN Die 03 % $ 4 E 50 6 1 & 7 V 8 A 99 0 0 T. YOU dow Help 2 Q Dj Given information about yields on 9/21/2021, calculate the expected 3-year yietoth the market is expecting between 27 September 2023 and 27 September 2025.) calculate the 20-year yield that is expected to prevail between 27 September 2031 an 27 September 2041 under the expectations theory of the term structure of interest rates. 4. The 1-year T-bill rates over the next five years are expected to be 2%, 3%, 4%, 4.5%, and If the 5-year T-bonds are yielding 7.5%, what is the liquidity premium on this bond? 5. Suppose there is a 10 year corporate bond with 7% coupon rate and a 10-year tax exempt municipal bond with 5% coupon rate, both selling at par, Both have a face value of $1000 and similar credit rating. What must be investors' tax rate for them to sell at par? 5 stv 1 A BAN 20 90 02 DI FE $ 4 E % 50 6 1 & 7 V 8 A 9 9 0