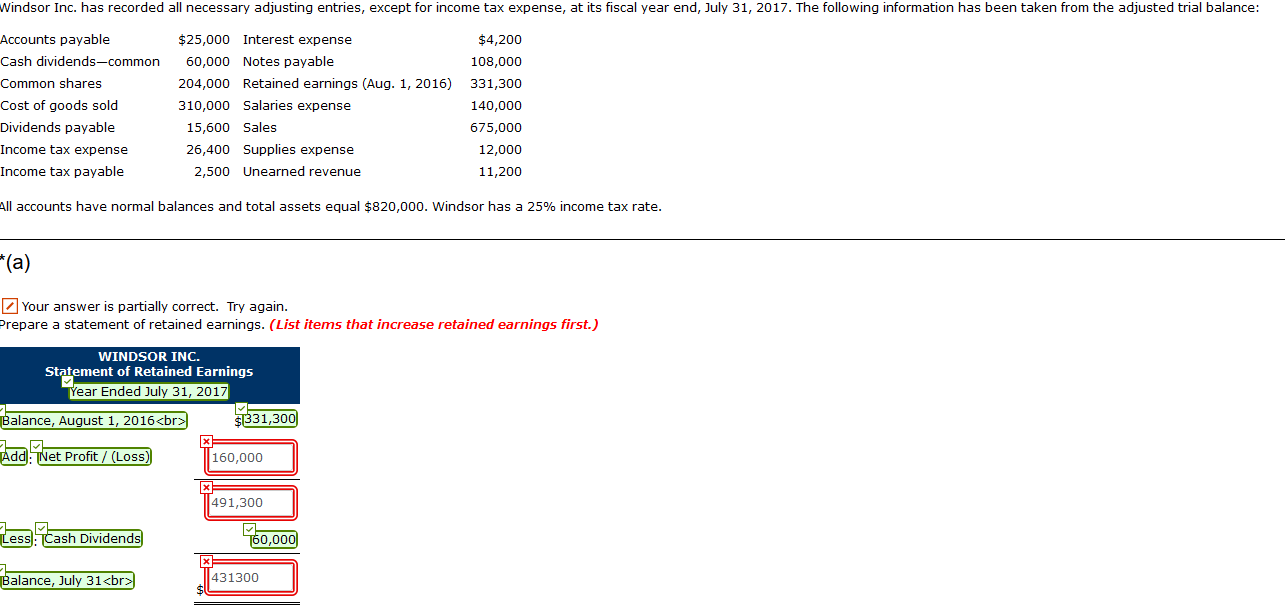

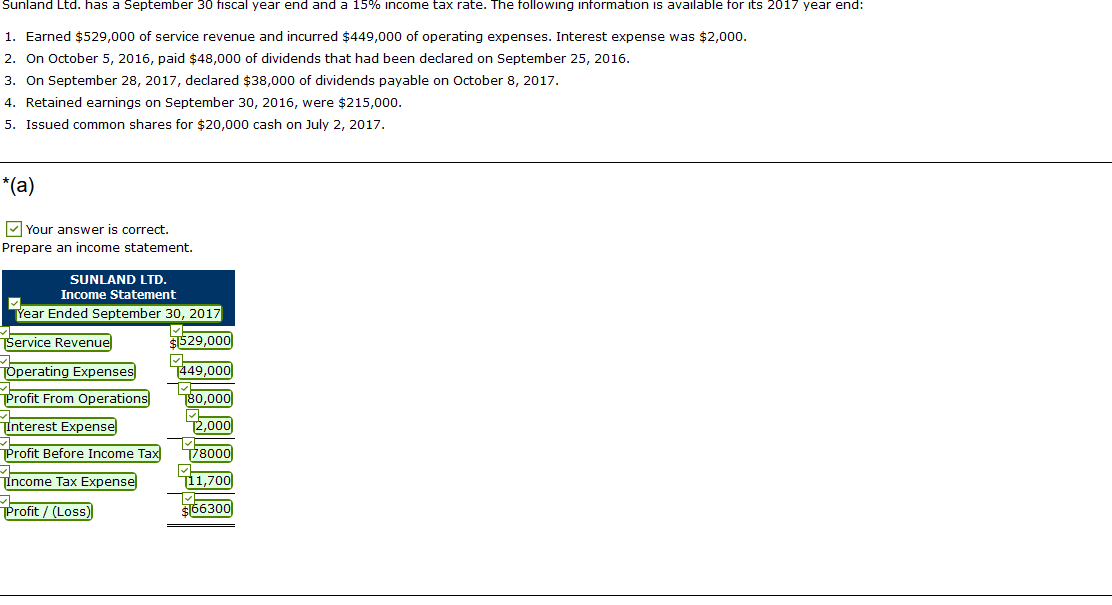

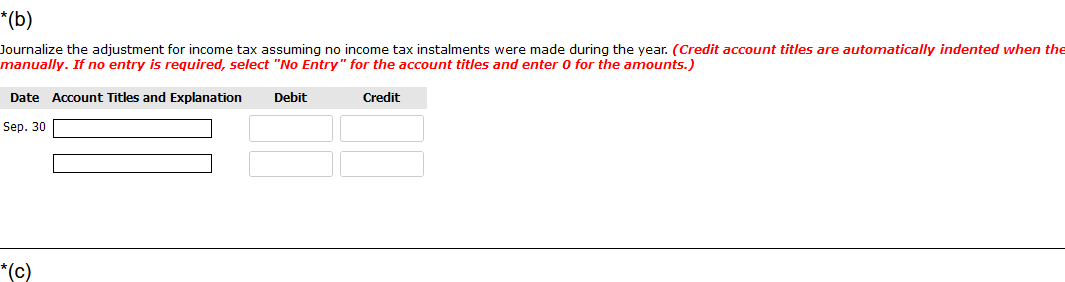

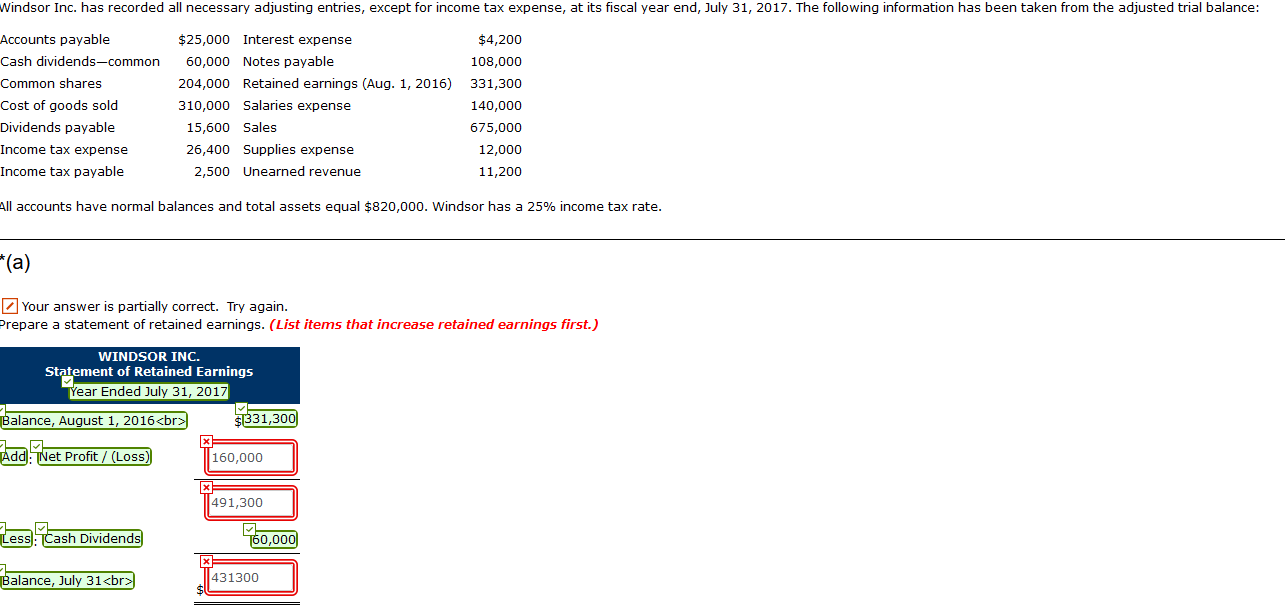

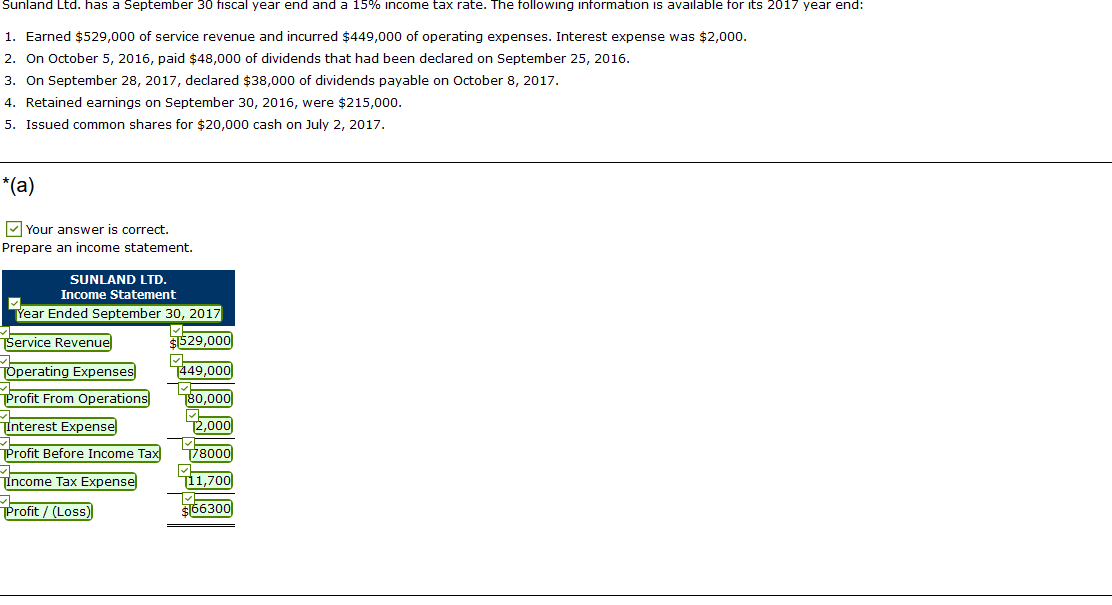

Windsor Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end, July 31, 2017. The following information has been taken from the adjusted trial balance: Accounts payable Cash dividends-common Common shares Cost of goods sold Dividends payable Income tax expense Income tax payable $25,000 Interest expense 60,000 Notes payable 204,000 Retained earnings (Aug. 1, 2016) 310,000 Salaries expense 15,600 Sales 26,400 Supplies expense 2,500 Unearned revenue $4,200 108,000 331,300 140,000 675,000 12,000 11,200 All accounts have normal balances and total assets equal $820,000. Windsor has a 25% income tax rate. *(a) Your answer is partially correct. Try again. Prepare a statement of retained earnings. (List items that increase retained earnings first.) WINDSOR INC. Statement of Retained Earnings Year Ended July 31, 2017 Balance, August 1, 2016 $1331,300) Add. Net Profit /(Loss) 160,000 491,300 Less Cash Dividends 760,000 Balance, July 31 431300 Sunland Ltd. has a September 30 fiscal year end and a 15% income tax rate. The following information is available for its 2017 year end: 1. Earned $529,000 of service revenue and incurred $449,000 of operating expenses. Interest expense was $2,000. 2. On October 5, 2016, paid $48,000 of dividends that had been declared on September 25, 2016. 3. On September 28, 2017, declared $38,000 of dividends payable on October 8, 2017. 4. Retained earnings on September 30, 2016, were $215,000. 5. Issued common shares for $20,000 cash on July 2, 2017. *(a) Your answer is correct. Prepare an income statement. SUNLAND LTD. Income Statement TYear Ended September 30, 2017 Service Revenue $1529,000 > TOperating Expenses 7449,000 Profit From Operations T80,000) Interest Expense 72,000 Profit Before Income Tax 178000 Income Tax Expense 111,700 Profit / (Loss) $166300 *(b) Journalize the adjustment for income tax assuming no income tax instalments were made during the year. (Credit account titles are automatically indented when the manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Sep. 30 *(c)