Answered step by step

Verified Expert Solution

Question

1 Approved Answer

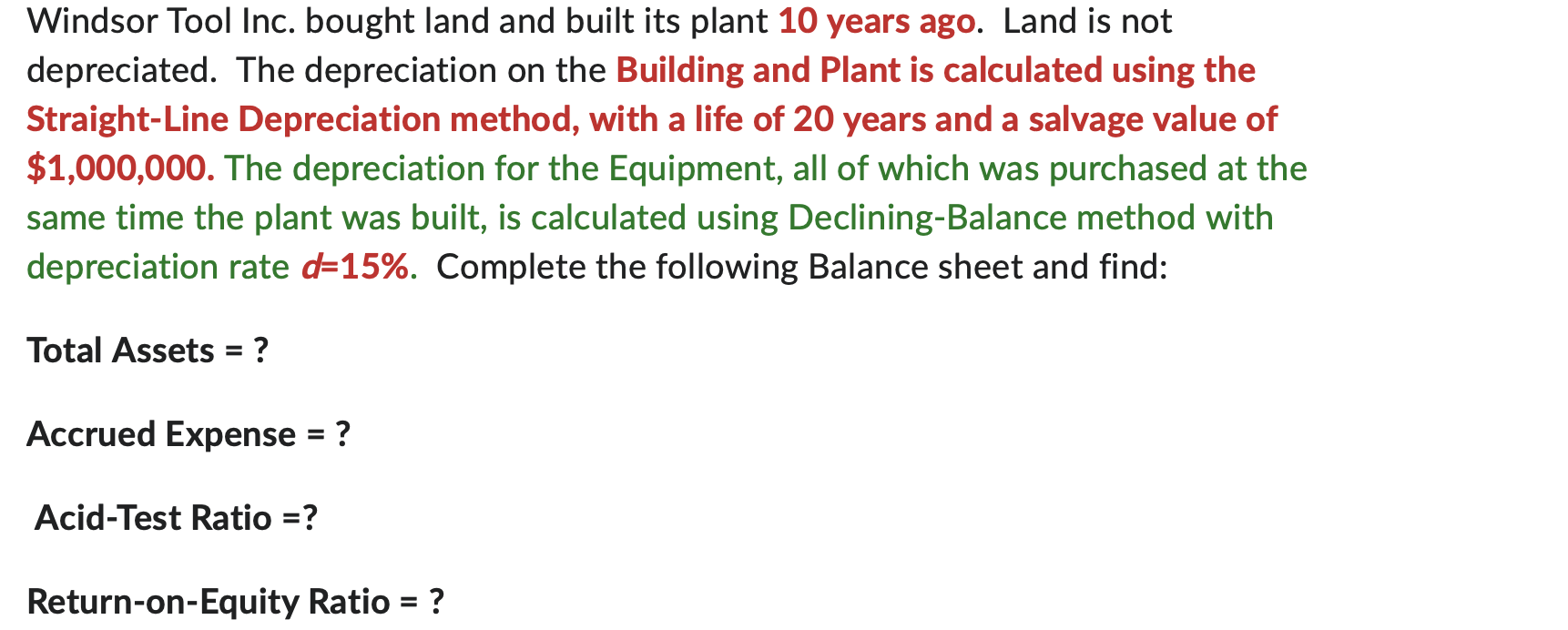

Windsor Tool Inc. bought land and built its plant 10 years ago. Land is not depreciated. The depreciation on the Building and Plant is

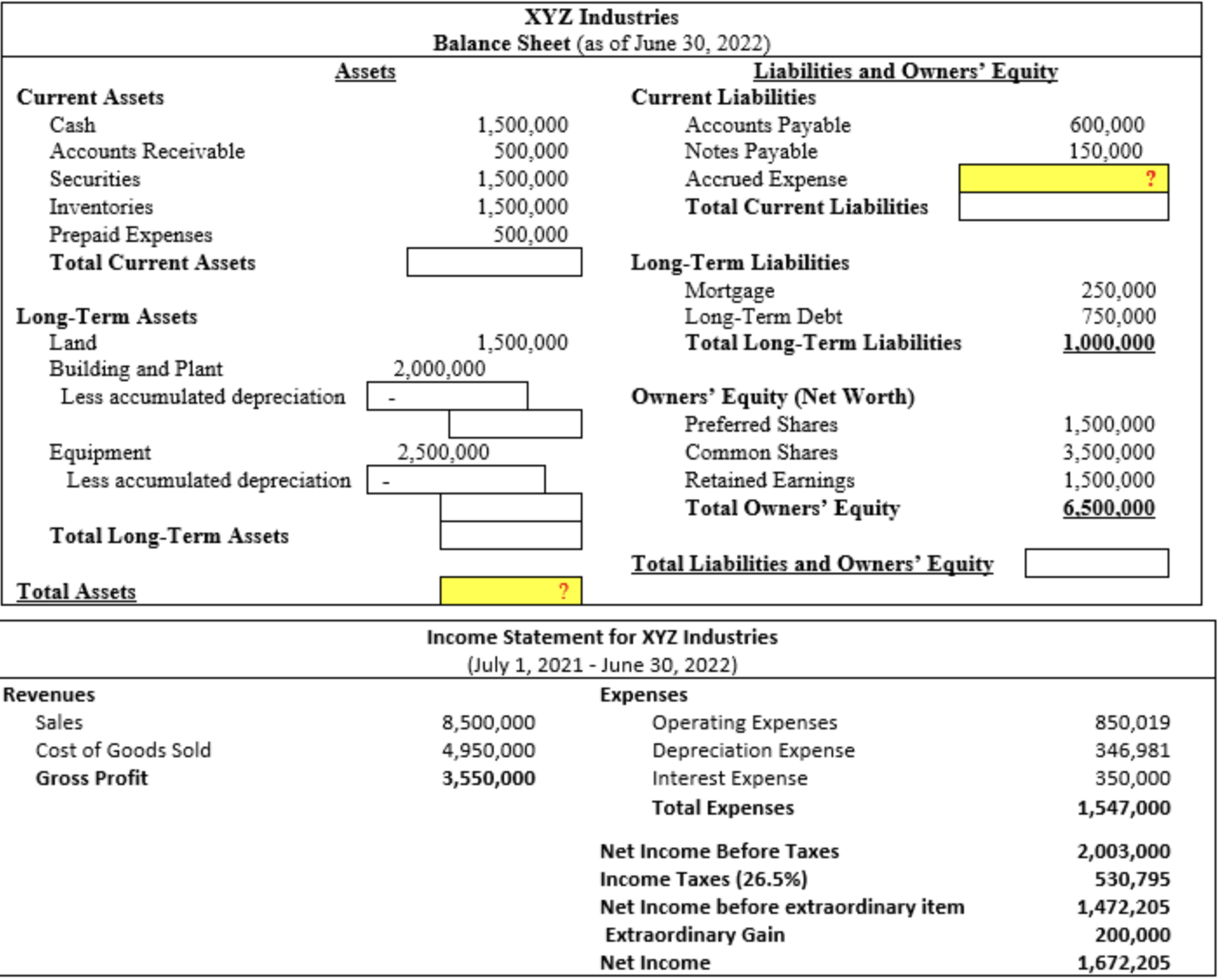

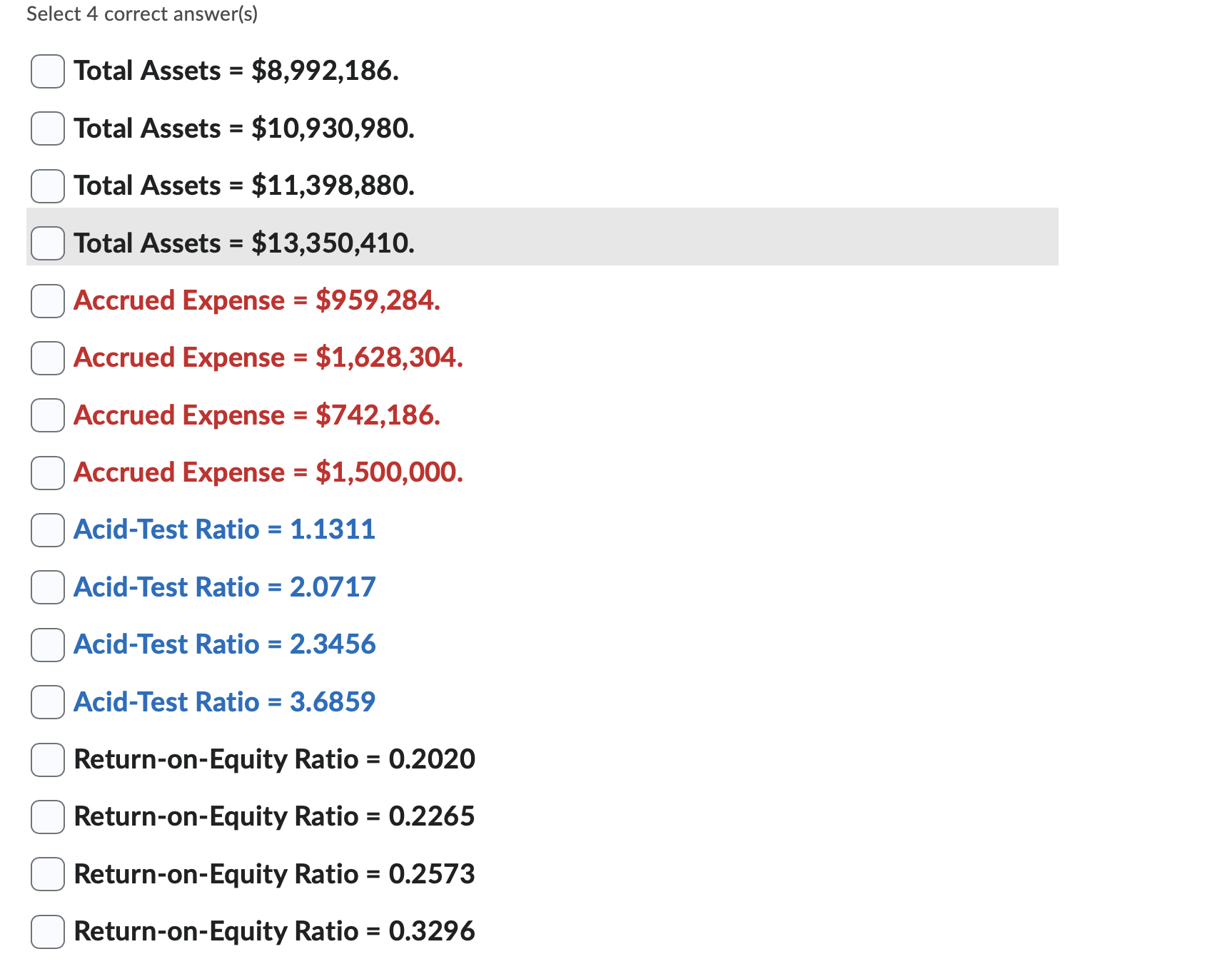

Windsor Tool Inc. bought land and built its plant 10 years ago. Land is not depreciated. The depreciation on the Building and Plant is calculated using the Straight-Line Depreciation method, with a life of 20 years and a salvage value of $1,000,000. The depreciation for the Equipment, all of which was purchased at the same time the plant was built, is calculated using Declining-Balance method with depreciation rate d=15%. Complete the following Balance sheet and find: Total Assets = ? Accrued Expense = ? Acid-Test Ratio =? Return-on-Equity Ratio = ? XYZ Industries Balance Sheet (as of June 30, 2022) Assets Liabilities and Owners' Equity Current Assets Cash Accounts Receivable Securities Inventories Prepaid Expenses Total Current Assets Long-Term Assets Current Liabilities 1,500,000 Accounts Payable 600,000 500,000 Notes Payable 150,000 1,500,000 Accrued Expense 1,500,000 Total Current Liabilities 500,000 Long-Term Liabilities Mortgage 250,000 Long-Term Debt 750,000 Land 1,500,000 Total Long-Term Liabilities 1,000,000 Building and Plant 2,000,000 Less accumulated depreciation Owners' Equity (Net Worth) Preferred Shares Equipment 2,500,000 Common Shares Less accumulated depreciation Retained Earnings Total Owners' Equity 1,500,000 3,500,000 1,500,000 6,500,000 Total Long-Term Assets Total Assets Total Liabilities and Owners' Equity Income Statement for XYZ Industries (July 1, 2021 - June 30, 2022) Revenues Expenses Sales 8,500,000 Operating Expenses 850,019 Cost of Goods Sold 4,950,000 Depreciation Expense 346,981 Gross Profit 3,550,000 Interest Expense 350,000 Total Expenses 1,547,000 Net Income Before Taxes 2,003,000 Income Taxes (26.5%) 530,795 Net Income before extraordinary item 1,472,205 Extraordinary Gain 200,000 Net Income 1,672,205 Select 4 correct answer(s) Total Assets = $8,992,186. Total Assets = $10,930,980. Total Assets = $11,398,880. Total Assets = $13,350,410. Accrued Expense = $959,284. Accrued Expense = $1,628,304. Accrued Expense = $742,186. Accrued Expense = $1,500,000. Acid-Test Ratio = 1.1311 Acid-Test Ratio = 2.0717 Acid-Test Ratio = 2.3456 Acid-Test Ratio = 3.6859 Return-on-Equity Ratio = 0.2020 Return-on-Equity Ratio = 0.2265 Return-on-Equity Ratio = 0.2573 Return-on-Equity Ratio = 0.3296

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started