Answered step by step

Verified Expert Solution

Question

1 Approved Answer

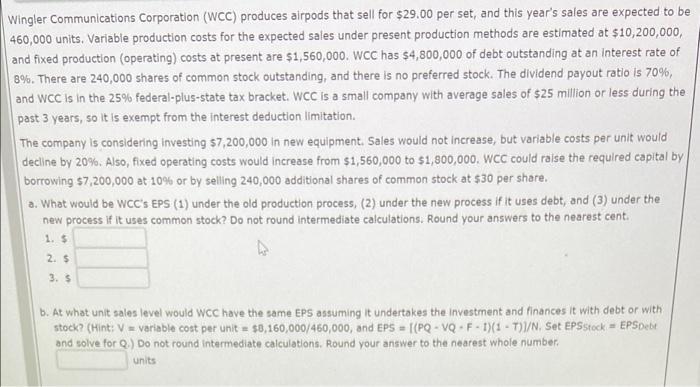

Wingler Communications Corporation (wCC) produces airpods that sell for $29.00 per set, and this year's sales are expected to be 460,000 units. Variable production

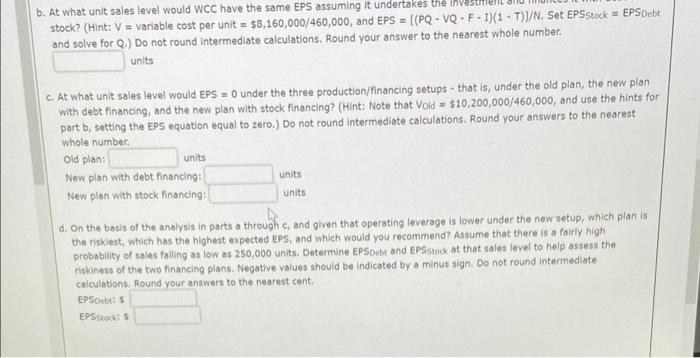

Wingler Communications Corporation (wCC) produces airpods that sell for $29.00 per set, and this year's sales are expected to be 460,000 units. Variable production costs for the expected sales under present production methods are estimated at $10,200,000, and fixed production (operating) costs at present are $1,560,000. WCC has $4,800,000 of debt outstanding at an interest rate of 8%. There are 240,000 shares of common stock outstanding, and there is no preferred stock. The dividend payout ratio is 70%, and WCC is in the 25% federal-plus-state tax bracket. WCC is a small company with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. The company is considering investing $7,200,000 in new equipment. Sales would not increase, but variable costs per unit would decline by 20%. Also, fixed operating costs would increase from $1,560,000 to $1,800,000. WCC could raise the required capital by borrowing $7,200,000 at 10% or by selling 240,000 additional shares of common stock at $30 per share. a. What would be WCC's EPS (1) under the old production process, (2) under the new process if it uses debt, and (3) under the new process if it uses common stock? Do not round intermediate calculations. Round your answers to the nearest cent. 1. $ 2. $ 3. S b. At what unit sales level would wCC have the same EPS assuming it undertakes the investment and finances it with debt or with stock? (Hint: V= variable cost per unit = $8,160,000/460,000, and EPS [(PQ - vQ - F - 1)(1 - T)1/N, Set EPSstock - EPSpebt and solve for Q.) Do not round intermediate calculations. Round your answer to the nearest whole number. units b. At what unit sales level would WCC have the same EPS assuming it undertakes th IAVE stock? (Hint: V = variable cost per unit = $8,160,000/460,000, and EPS = [(PQ - VQ - F - I)(1 - T)]/N. Set EPSStock = EPSDebt and solve for Q.) Do not round Intermediate calculations. Round your answer to the nearest whole number. units C. At what unit sales level would EPS = 0 under the three production/financing setups - that is, under the old plan, the new plan with debt financing, and the new plan with stock financing? (Hint: Note that Vold = $10,200,000/460,000, and use the hints for part b, setting the EPS equation equal to zero.) Do not round intermediate calculations. Round your answers to the nearest whole number. Old plan: New plan with debt financing: units units New plan with stock financing: units d. On the basis of the analysis in parts a through c, and given that operating leverage is lower under the new setup, which plan is the riskiest, which has the highest expected EPS, and which would you recommend? Assume that there is a fairly high probability of sales falling as low as 250,000 units. Determine EPSDebt and EPSstock at that sales level to help assess the riskiness of the two financing plans. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. EPSoebt: EPSstockS

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a EPS under the 3 scenarios is calculated below Dividend payout ratio has no role because dividend i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started