Answered step by step

Verified Expert Solution

Question

1 Approved Answer

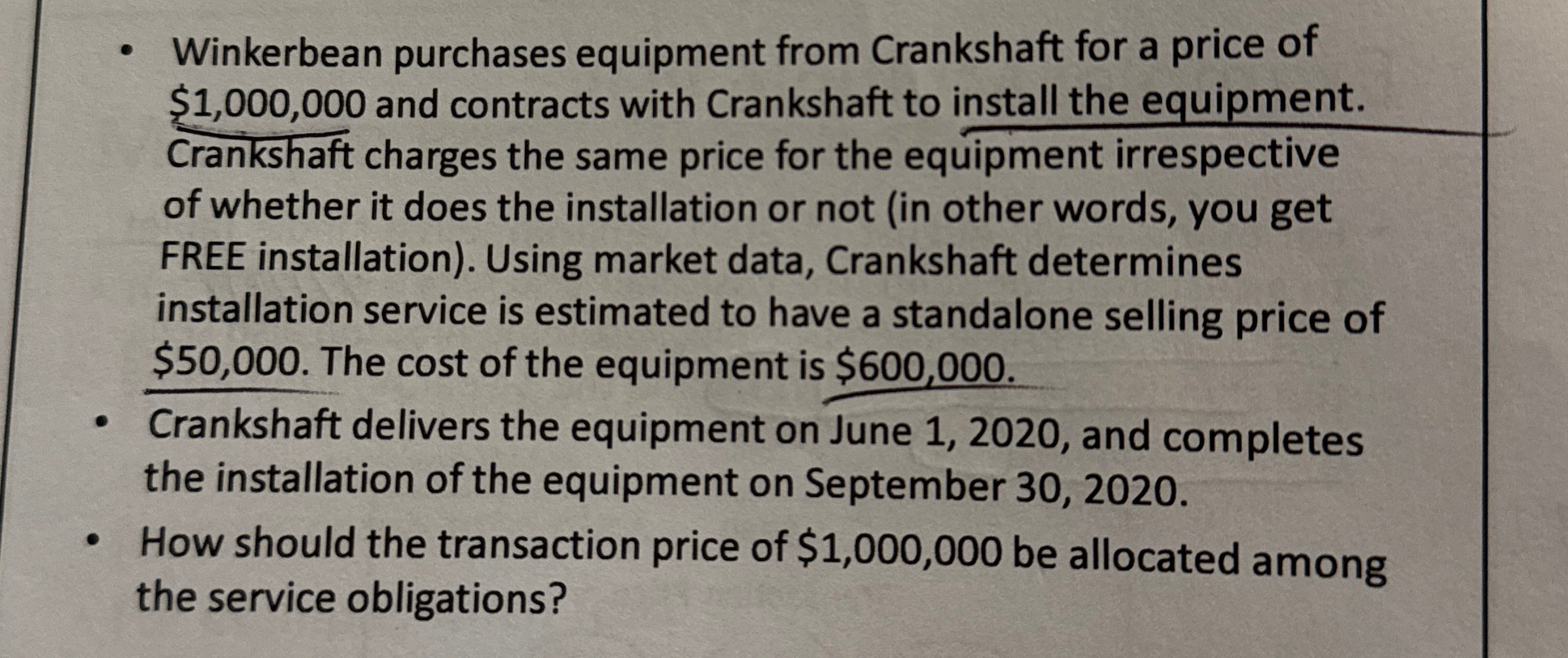

Winkerbean purchases equipment from Crankshaft for a price of $ 1 , 0 0 0 , 0 0 0 and contracts with Crankshaft to install

Winkerbean purchases equipment from Crankshaft for a price of

$ and contracts with Crankshaft to install the equipment.

Crankshaft charges the same price for the equipment irrespective

of whether it does the installation or not in other words, you get

FREE installation Using market data, Crankshaft determines

installation service is estimated to have a standalone selling price of

$ The cost of the equipment is $

Crankshaft delivers the equipment on June and completes

the installation of the equipment on September

How should the transaction price of $ be allocated among

the service obligations?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started