Question

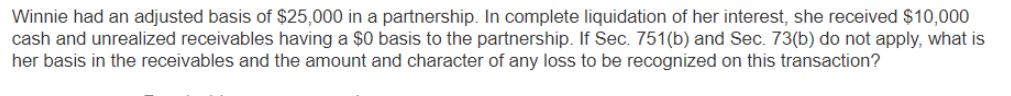

Winnie had an adjusted basis of $25,000 in a partnership. In complete liquidation of her interest, she received $10,000 cash and unrealized receivables having

Winnie had an adjusted basis of $25,000 in a partnership. In complete liquidation of her interest, she received $10,000 cash and unrealized receivables having a $0 basis to the partnership. If Sec. 751(b) and Sec. 73(b) do not apply, what is her basis in the receivables and the amount and character of any loss to be recognized on this transaction?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Winnies basis in the receivables and capital loss Basis in receivables Winnies basis in th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App