Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Winston is 66 years old and unmarried. Winston also owns shares in a foreign company. During the current year of assessment, received the

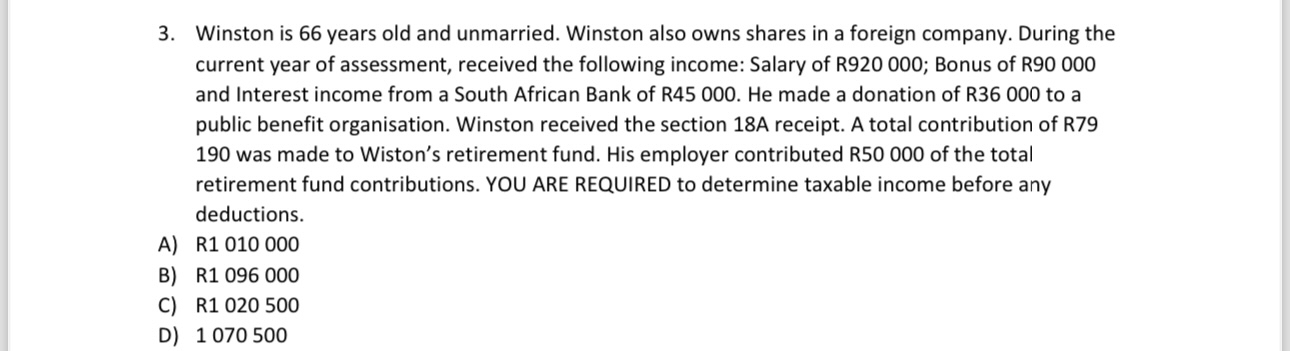

3. Winston is 66 years old and unmarried. Winston also owns shares in a foreign company. During the current year of assessment, received the following income: Salary of R920 000; Bonus of R90 000 and Interest income from a South African Bank of R45 000. He made a donation of R36 000 to a public benefit organisation. Winston received the section 18A receipt. A total contribution of R79 190 was made to Wiston's retirement fund. His employer contributed R50 000 of the total retirement fund contributions. YOU ARE REQUIRED to determine taxable income before any deductions. A) R1 010 000 B) R1 096 000 C) R1 020 500 D) 1070 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine taxable income before any deductions we need to calculate Winstons total income fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started