Answered step by step

Verified Expert Solution

Question

1 Approved Answer

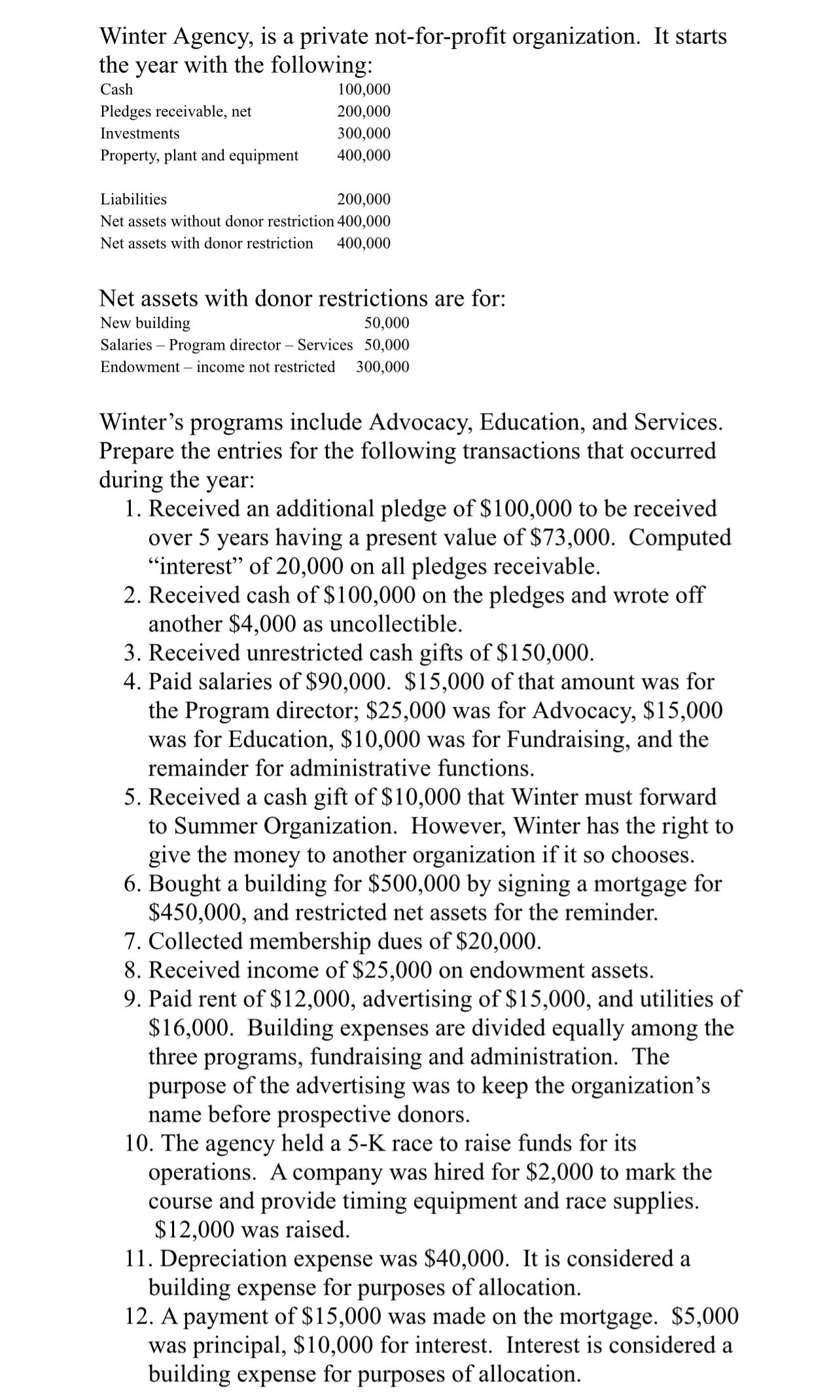

Winter Agency, is a private not-for-profit organization. It starts the year with the following: Cash 100,000 Pledges receivable, net 200,000 Investments 300,000 Property, plant

Winter Agency, is a private not-for-profit organization. It starts the year with the following: Cash 100,000 Pledges receivable, net 200,000 Investments 300,000 Property, plant and equipment 400,000 Liabilities 200,000 Net assets without donor restriction 400,000 Net assets with donor restriction 400,000 Net assets with donor restrictions are for: New building Endowment 50,000 Salaries Program director - Services 50,000 income not restricted 300,000 Winter's programs include Advocacy, Education, and Services. Prepare the entries for the following transactions that occurred during the year: 1. Received an additional pledge of $100,000 to be received over 5 years having a present value of $73,000. Computed "interest" of 20,000 on all pledges receivable. 2. Received cash of $100,000 on the pledges and wrote off another $4,000 as uncollectible. 3. Received unrestricted cash gifts of $150,000. 4. Paid salaries of $90,000. $15,000 of that amount was for the Program director; $25,000 was for Advocacy, $15,000 was for Education, $10,000 was for Fundraising, and the remainder for administrative functions. 5. Received a cash gift of $10,000 that Winter must forward to Summer Organization. However, Winter has the right to give the money to another organization if it so chooses. 6. Bought a building for $500,000 by signing a mortgage for $450,000, and restricted net assets for the reminder. 7. Collected membership dues of $20,000. 8. Received income of $25,000 on endowment assets. 9. Paid rent of $12,000, advertising of $15,000, and utilities of $16,000. Building expenses are divided equally among the three programs, fundraising and administration. The purpose of the advertising was to keep the organization's name before prospective donors. 10. The agency held a 5-K race to raise funds for its operations. A company was hired for $2,000 to mark the course and provide timing equipment and race supplies. $12,000 was raised. 11. Depreciation expense was $40,000. It is considered a building expense for purposes of allocation. 12. A payment of $15,000 was made on the mortgage. $5,000 was principal, $10,000 for interest. Interest is considered a building expense for purposes of allocation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of direct materials used during the period we can use t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started