wird 7. One month after the completion of Sybil's tax return, she calls up for some...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

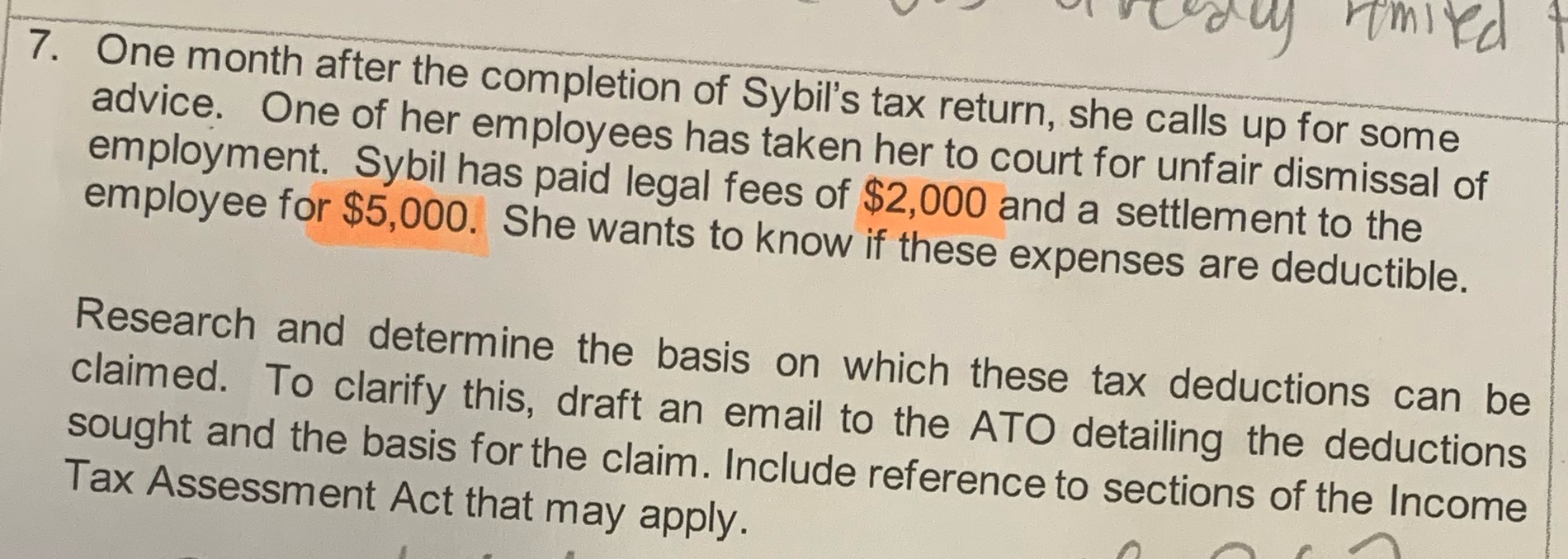

wird 7. One month after the completion of Sybil's tax return, she calls up for some advice. One of her employees has taken her to court for unfair dismissal of employment. Sybil has paid legal fees of $2,000 and a settlement to the employee for $5,000. She wants to know if these expenses are deductible. Research and determine the basis on which these tax deductions can be claimed. To clarify this, draft an email to the ATO detailing the deductions sought and the basis for the claim. Include reference to sections of the Income Tax Assessment Act that may apply. wird 7. One month after the completion of Sybil's tax return, she calls up for some advice. One of her employees has taken her to court for unfair dismissal of employment. Sybil has paid legal fees of $2,000 and a settlement to the employee for $5,000. She wants to know if these expenses are deductible. Research and determine the basis on which these tax deductions can be claimed. To clarify this, draft an email to the ATO detailing the deductions sought and the basis for the claim. Include reference to sections of the Income Tax Assessment Act that may apply.

Expert Answer:

Answer rating: 100% (QA)

Subject Clarification on Deductibility of Legal Fees and Settlement Expenses Dear ATO Representative ... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

Tools Inc. currently works with approximately 200 suppliers to source their 8,500+ SKU's. Rhonda, the Sourcing Manager, knows how important it is to manage supplier relationships properly. She knows...

-

Identify the process evaluation article that you chose and explain why you selected this example. Describe the purpose of the evaluation, the informants, the questions asked, and the results of the...

-

The information listed below refers to the employees of Lemonica Company for the year ended December 31, 2016. The wages are separated into the quarters in which they were paid to the individual...

-

When a parameter is changed, does this affect the argument that was passed into the parameter?

-

What factors should a manager consider when evaluating a region in which to locate a business? Where are such data available?

-

You are given the dollar value of a product in 2012 and the rate at which the value of the product is expected to change during the next 5 years. Write a linear equation that gives the dollar value V...

-

Why is product design important to operations costs? LO.1

-

Tidy House produces a variety of household products. The firm operates 24 hours per day with three daily work shifts. The first-shift workers receive regular pay. The second shift receives an 8...

-

4. The shareholders equity section of the statement of financial position of Baker Ltd. At July 31, 2010 is as follows: 2010 2009 General reserve 55,000 45,000 Revaluation reserve 85,000 70,000 Share...

-

DQ QUESTION 4.1 - Treatment Interventions and Insights After reading the articles regarding the different treatment approaches and the APA guidelines for practice, what do you think the treatment...

-

A LIFO liquidation means which of the following: A) The firm uses the LIFO cost flow assumption, and it is insolvent. It must liquidate all of its inventory. B) The firm did not purchase enough...

-

What is the length of the partial wavelength for electromagnetic energy with a frequency of 15 MHz and a phase shift of 263 degrees (in meters)?

-

Let y = f(x) be a function that is differentiable at all real numbers. Suppose f has the form f(x) = {; [cx +6 4+2c for x 1 for x > 1. where b and c are some constants. What is the value of the...

-

Consider the sequence (n) defined by xn = (a) Show that 0In - n! nn (b) Use the result of part (a) and the Squeeze theorem to show that In 0 and n o.

-

Officials of Gwinnett County, one of the fastest growing counties in the country, are looking for ways to expand their sewer system. They are considering two alternative sewer designs. All annual...

-

On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: Rafael Masey transferred cash from a personal bank account to an account to be...

-

15) The following data are available for Crane Repair Shop for 2022: Repair technician's wages $230000 Fringe benefits 60000 Overhead 85000 Total $375000 The desired profit margin is $19 per labour...

-

Ball bearings are widely used in industrial applications. You work for an industrial food machinery manufacturer and your role is to design the driveshaft assembly on a new type of equipment that...

-

Volpe Corporation has only five employees who are all paid $850 per week. Compute the total FICA taxes that the employer would withhold from the five employees each week and the amount the company...

-

For social security purposes, what conditions must an individual meet to be classified as a "covered" employer?

-

Ernesto Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee. Payroll Period W=Weekly...

-

2. If you were the top manager at Hormel, name two organizational systems you would establish to encourage organization member creativity.

-

would ensure Hormels future success. Be sure to explain how each idea would contribute to that success.

-

3. List three creative ideas based on your TQM expertise that, if implemented,

Study smarter with the SolutionInn App