Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wireless Tools, Inc., Inc is a calendar year, accrual basis corporation (book and tax). The company has total assets of $5,000,125. The company reported

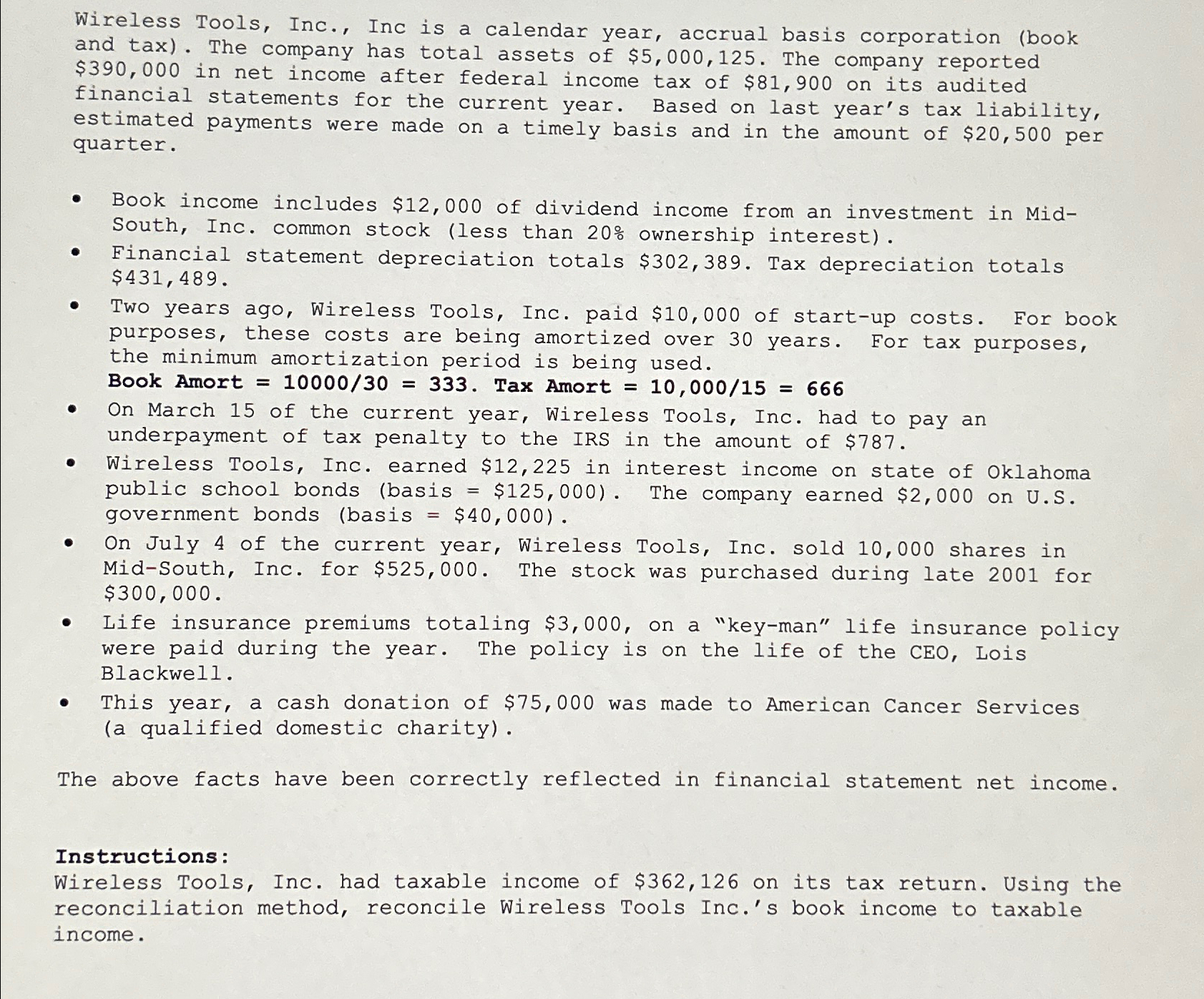

Wireless Tools, Inc., Inc is a calendar year, accrual basis corporation (book and tax). The company has total assets of $5,000,125. The company reported $390,000 in net income after federal income tax of $81,900 on its audited financial statements for the current year. Based on last year's tax liability, estimated payments were made on a timely basis and in the amount of $20,500 per quarter. Book income includes $12,000 of dividend income from an investment in Mid- South, Inc. common stock (less than 20% ownership interest). Financial statement depreciation totals $302,389. Tax depreciation totals $431,489. Two years ago, Wireless Tools, Inc. paid $10,000 of start-up costs. For book purposes, these costs are being amortized over 30 years. For tax purposes, the minimum amortization period is being used. Book Amort = 10000/30 = 333. Tax Amort = 10,000/15 = 666 On March 15 of the current year, Wireless Tools, Inc. had to pay an underpayment of tax penalty to the IRS in the amount of $787. Wireless Tools, Inc. earned $12,225 in interest income on state of Oklahoma public school bonds (basis = $125,000). The company earned $2,000 on U.S. government bonds (basis = $40,000). On July 4 of the current year, Wireless Tools, Inc. sold 10,000 shares in Mid-South, Inc. for $525,000. The stock was purchased during late 2001 for $300,000. Life insurance premiums totaling $3,000, on a "key-man" life insurance policy were paid during the year. The policy is on the life of the CEO, Lois Blackwell. This year, a cash donation of $75,000 was made to American Cancer Services (a qualified domestic charity). The above facts have been correctly reflected in financial statement net income. Instructions: Wireless Tools, Inc. had taxable income of $362,126 on its tax return. Using the reconciliation method, reconcile Wireless Tools Inc.'s book income to taxable income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To reconcile Wireless Tools Incs book income to taxable income we need to adjust for the differences ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started