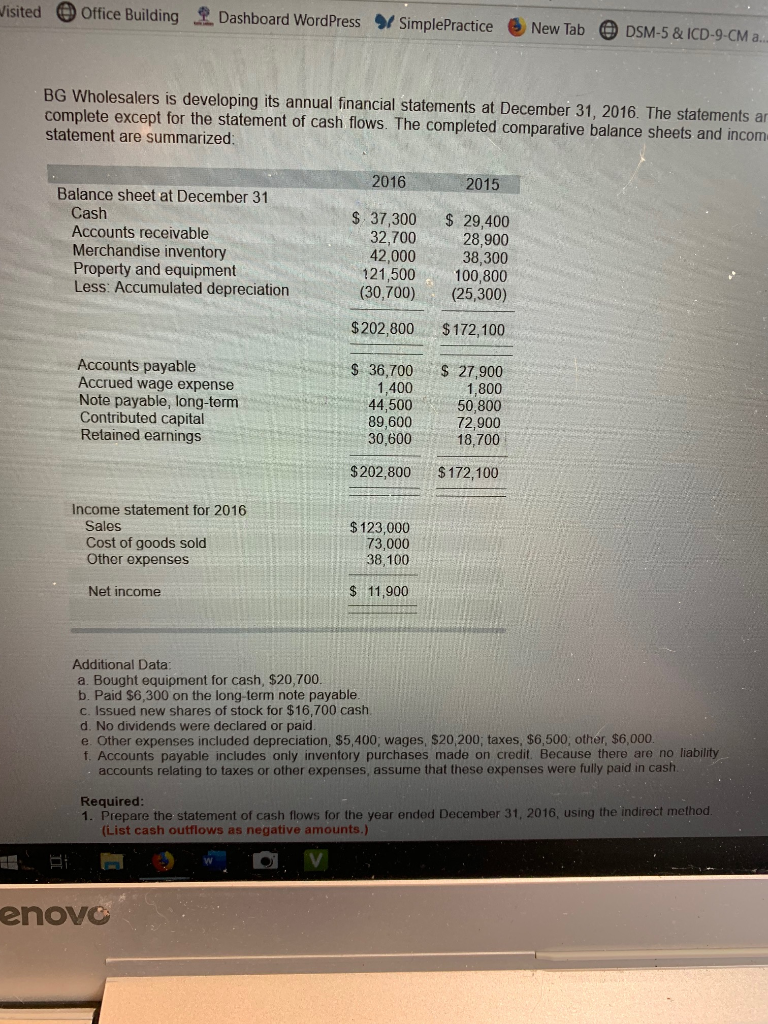

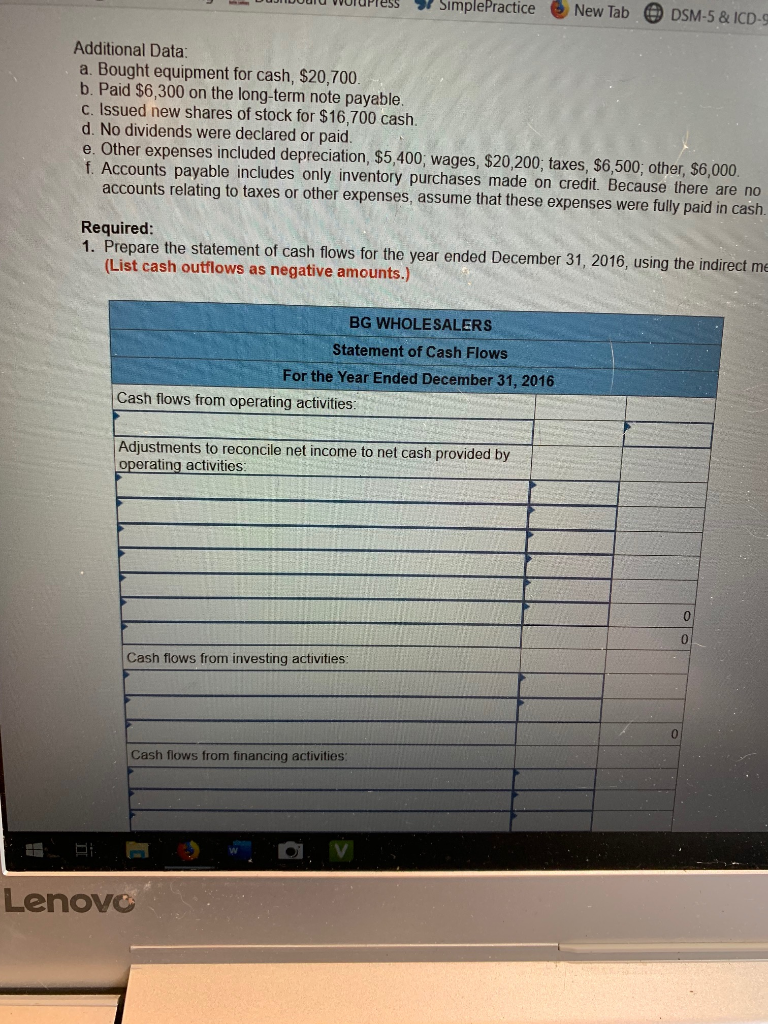

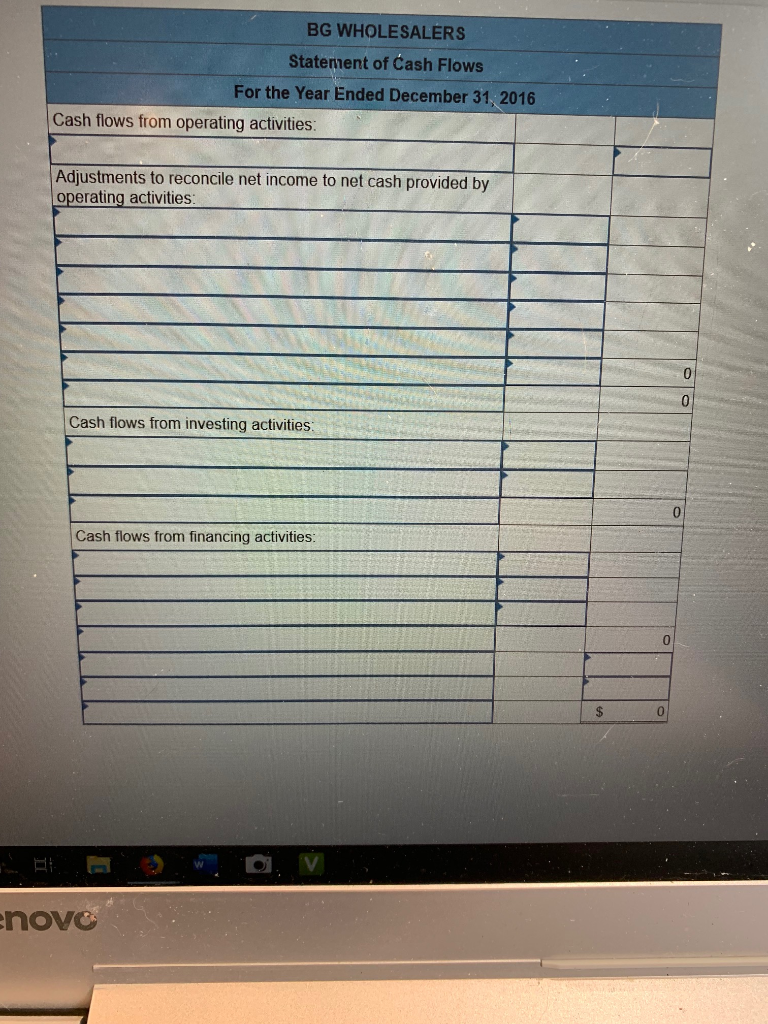

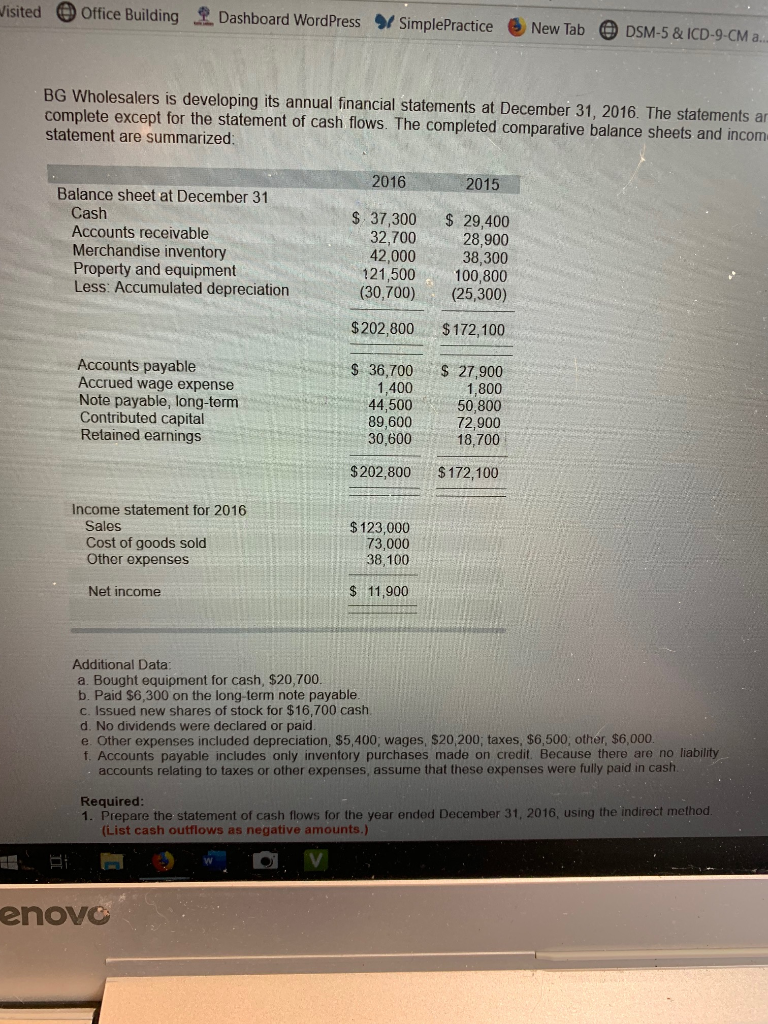

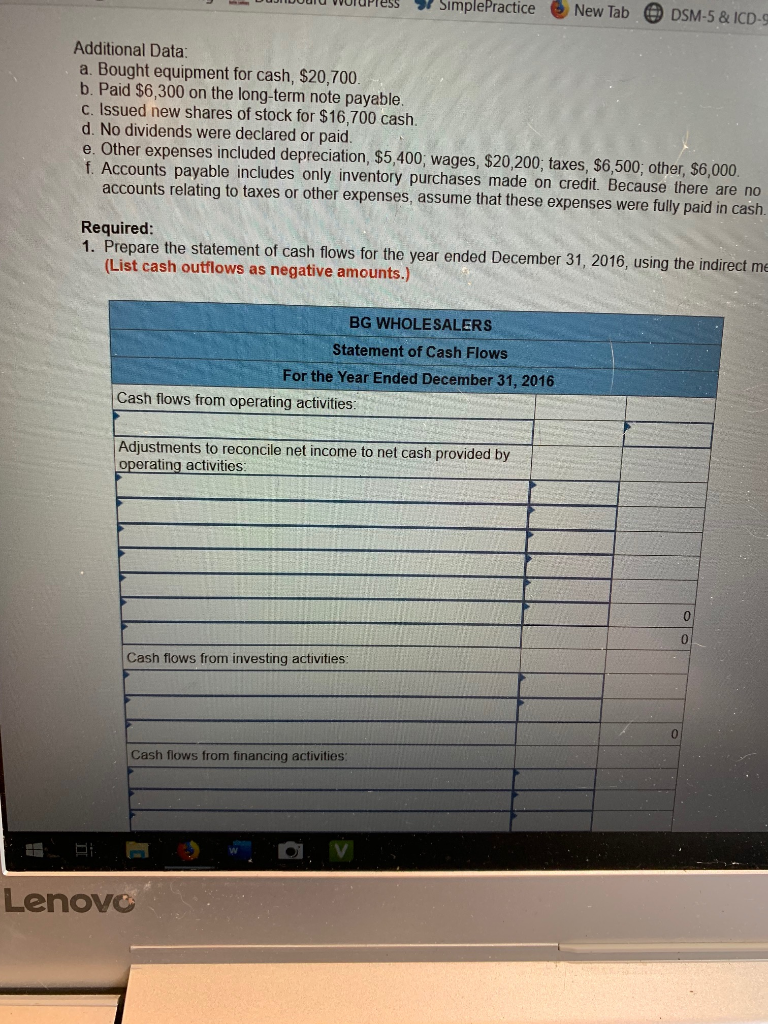

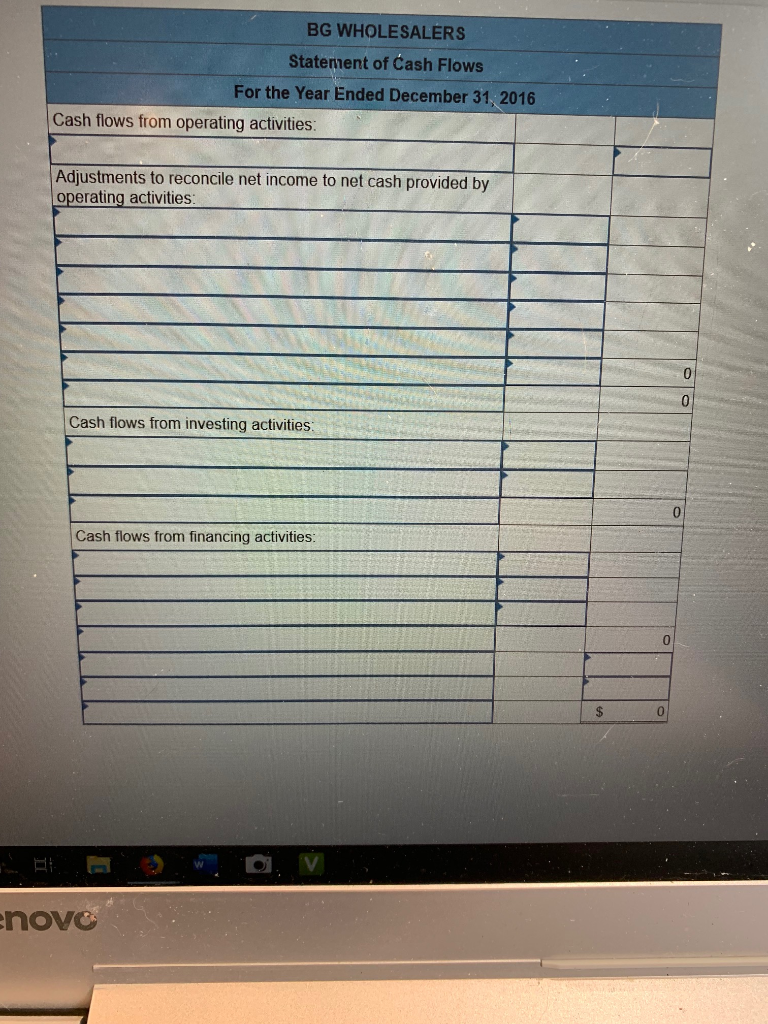

Wisited Office Building Dashboard WordPress / SimplePractice New Tab DSM-5 & ICD-9-CM a... BG Wholesalers is developing its annual financial statements at December 31, 2016. The statements ar complete except for the statement of cash flows. The completed comparative balance sheets and incom statement are summarized: 2016 2015 Balance sheet at December 31 Cash Accounts receivable Merchandise inventory Property and equipment Less: Accumulated depreciation $ 37,300 32,700 42,000 121,500 (30,700) $ 29,400 28,900 38,300 100,800 (25,300) $ 202,800 $172, 100 Accounts payable Accrued wage expense Note payable, long-term Contributed capital Retained earnings $ 36,700 1,400 44,500 89,600 30,600 $ 27,900 1,800 50,800 72,900 18,700 $ 202,800 $172,100 Income statement for 2016 Sales Cost of goods sold Other expenses $123,000 73,000 38,100 Net income $ 11,900 Additional Data: a. Bought equipment for cash, $20,700. b. Paid $6,300 on the long-term note payable. c. Issued new shares of stock for $16,700 cash d. No dividends were declared or paid. e. Other expenses included depreciation, $5,400, wages, $20,200, taxes, $6,500, other, $6,000 f. Accounts payable includes only inventory purchases made on credit. Because there are no liability - accounts relating to taxes or other expenses, assume that these expenses were fully paid in cash. Required: 1. Prepare the statement of cash flows for the year ended December 31, 2016, using the indirect method. (List cash outflows as negative amounts.) enovo DUJIIDUUIU WUIUPress Simple Practice New Tab O DSM-5 & ICD- Additional Data: a. Bought equipment for cash, $20,700. b. Paid $6,300 on the long-term note payable. c. Issued new shares of stock for $16,700 cash. d. No dividends were declared or paid. e. Other expenses included depreciation, $5,400, wages, $20,200, taxes, $6,500; other, $6,000. f. Accounts payable includes only inventory purchases made on credit. Because there are no accounts relating to taxes or other expenses, assume that these expenses were fully paid in cash. Required: 1. Prepare the statement of cash flows for the year ended December 31, 2016, using the indirect me (List cash outflows as negative amounts.) BG WHOLESALERS Statement of Cash Flows For the Year Ended December 31, 2016 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities: Cash flows from investing activities: Cash flows from financing activities: Lenove BG WHOLESALERS Statement of Cash Flows For the Year Ended December 31, 2016 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities: Cash flows from investing activities Cash flows from financing activities: . nove