-

With a lower revenue growth target, would HH be able to avoid a cash deficiency? Discuss what other measures the Browns might take in order to approach the cash level that Maggie considers ideal, where the available cash is equal to 8% of revenue.

With a lower revenue growth target, would HH be able to avoid a cash deficiency? Discuss what other measures the Browns might take in order to approach the cash level that Maggie considers ideal, where the available cash is equal to 8% of revenue.

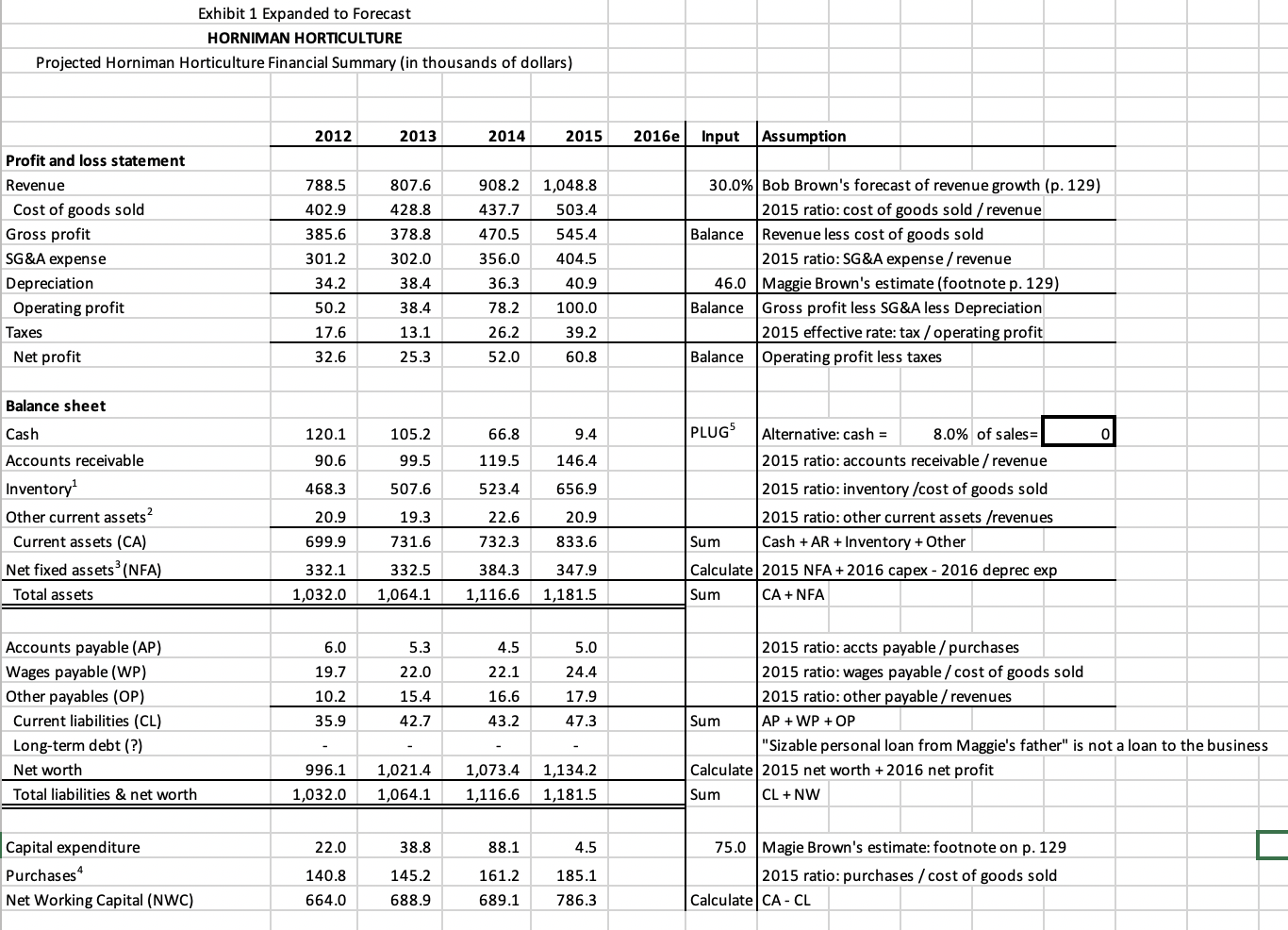

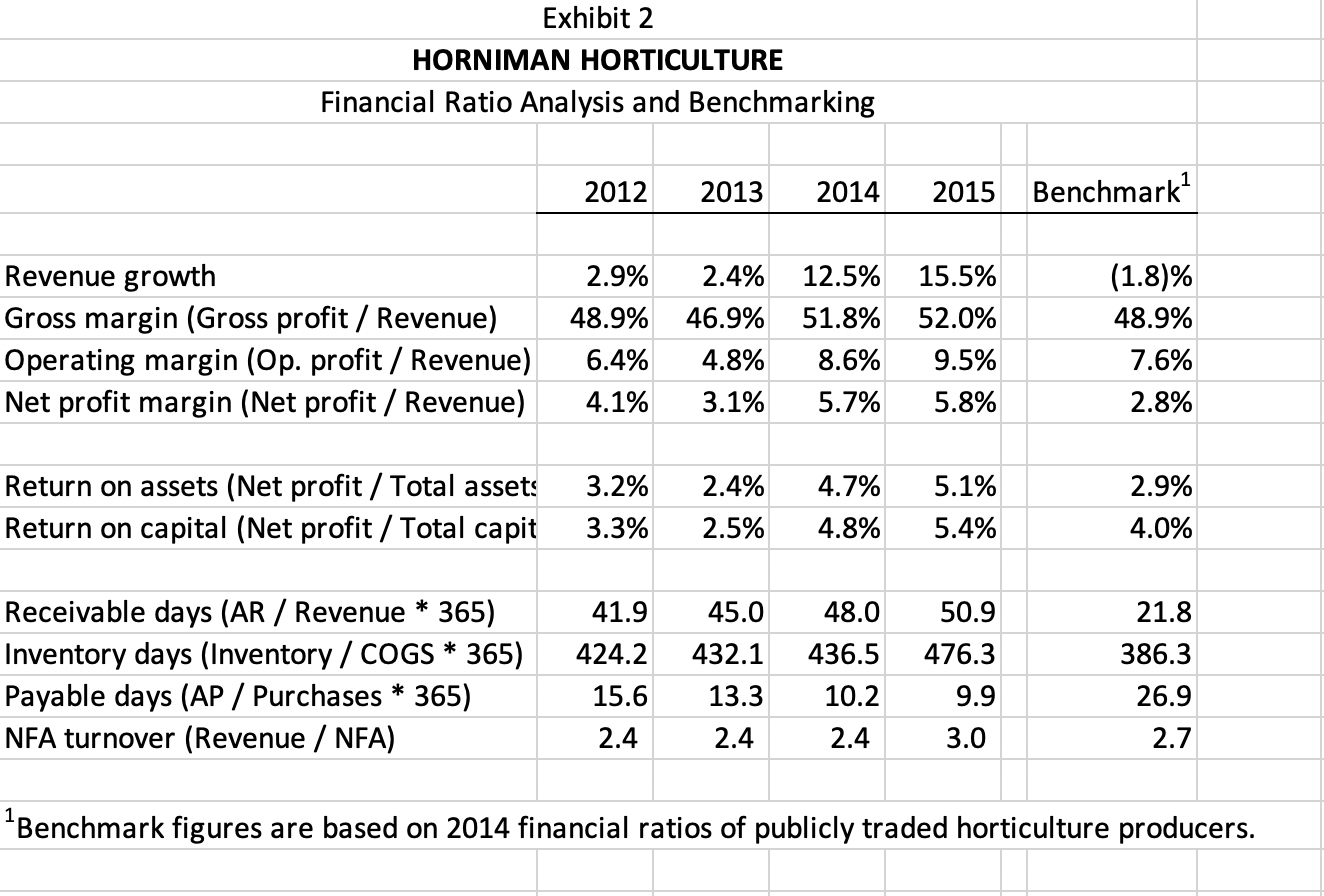

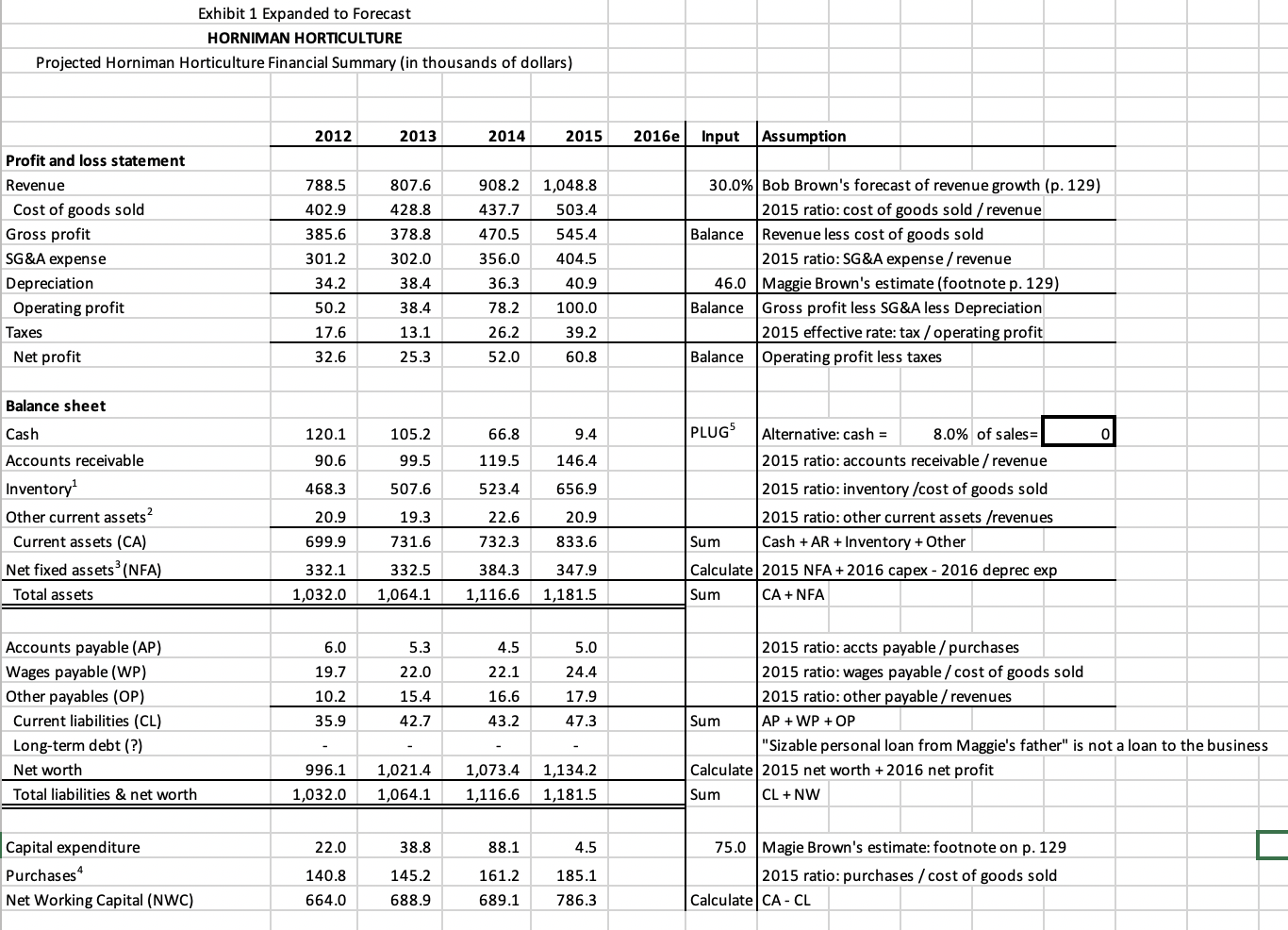

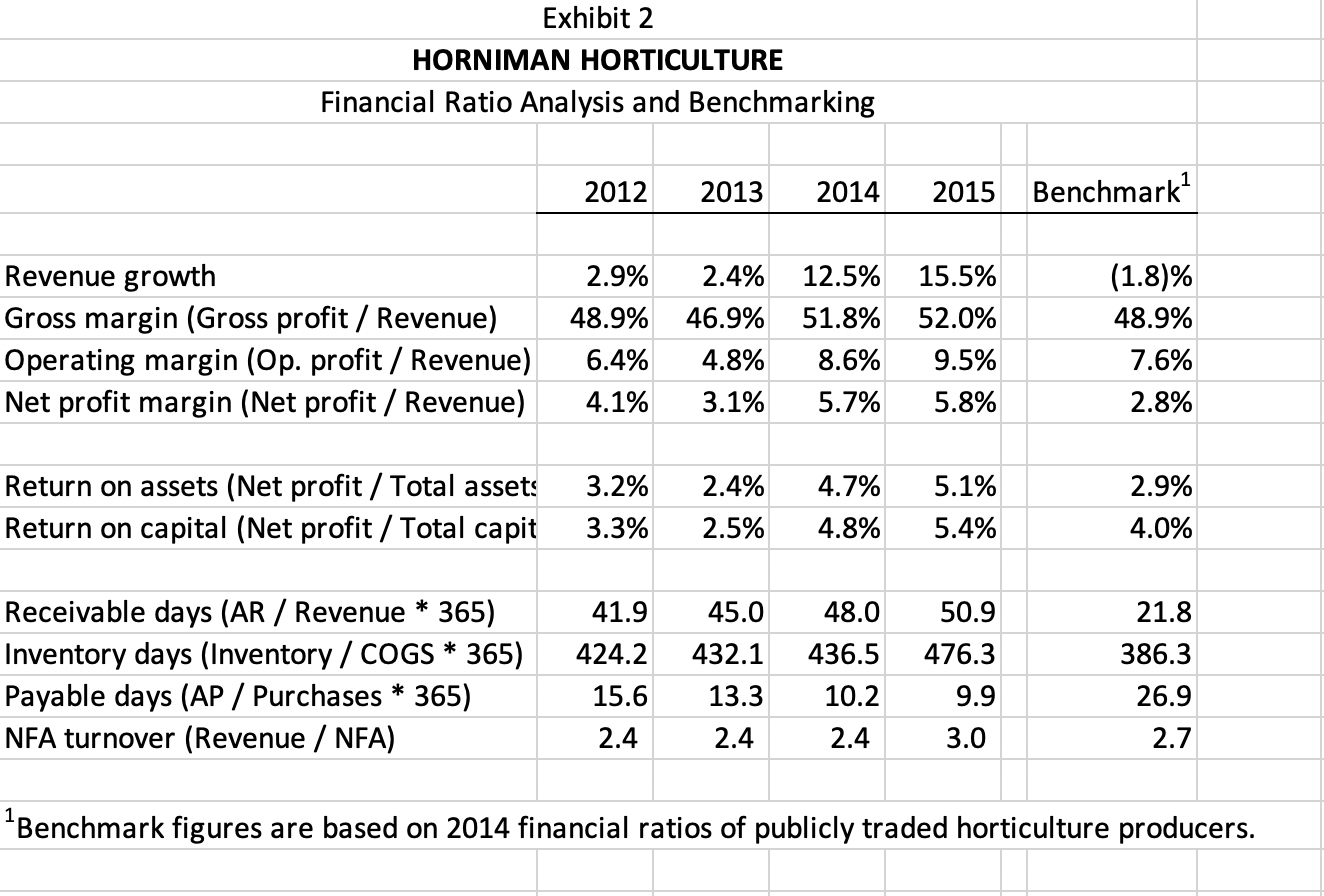

Exhibit 1 Expanded to Forecast HORNIMAN HORTICULTURE Projected Horniman Horticulture Financial Summary (in thousands of dollars) 2012 2013 2014 2015 2016e Input Assumption Profit and loss statement 788.5 807.6 1,048.8 503.4 402.9 908.2 437.7 470.5 356.0 385.6 301.2 428.8 378.8 302.0 38.4 Revenue Cost of goods sold Gross profit SG&A expense Depreciation Operating profit Taxes Net profit 545.4 404.5 30.0% Bob Brown's forecast of revenue growth (p. 129) 2015 ratio: cost of goods sold / revenue Balance Revenue less cost of goods sold 2015 ratio: SG&A expense / revenue 46.0 Maggie Brown's estimate (footnote p. 129) Balance Gross profit less SG&A less Depreciation 2015 effective rate: tax / operating profit Balance Operating profit less taxes 34.2 36.3 40.9 50.2 38.4 100.0 17.6 32.6 39.2 78.2 26.2 52.0 13.1 25.3 60.8 Balance sheet Cash 120.1 66.8 9.4 0 105.2 99.5 90.6 119.5 146.4 468.3 507.6 523.4 656.9 20.9 19.3 22.6 Accounts receivable Inventory Other current assets Current assets (CA) Net fixed assets (NFA) Total assets 20.9 833.6 PLUGS Alternative: cash = 8.0% of sales 2015 ratio: accounts receivable / revenue 2015 ratio: inventory/cost of goods sold 2015 ratio: other current assets /revenues Sum Cash + AR + Inventory + Other Calculate 2015 NFA+2016 capex - 2016 deprec exp Sum CA + NFA 699.9 731.6 732.3 332.1 1,032.0 332.5 1,064.1 384.3 1,116.6 347.9 1,181.5 6.0 5.3 4.5 5.0 19.7 24.4 22.0 15.4 22.1 16.6 10.2 17.9 Accounts payable (AP) Wages payable (WP) Other payables (OP) Current liabilities (CL) Long-term debt (?) Net worth Total liabilities & net worth 35.9 42.7 43.2 47.3 2015 ratio: accts payable / purchases 2015 ratio: wages payable / cost of goods sold 2015 ratio: other payable / revenues Sum AP + WP + OP "Sizable personal loan from Maggie's father" is not a loan to the business Calculate 2015 net worth + 2016 net profit Sum CL + NW 996.1 1,073.4 1,021.4 1,064.1 1,134.2 1,181.5 1,032.0 1,116.6 22.0 38.8 88.1 4.5 Capital expenditure Purchases Net Working Capital (NWC) 140.8 664.0 145.2 688.9 161.2 689.1 185.1 786.3 75.0 Magie Brown's estimate: footnote on p. 129 2015 ratio: purchases / cost of goods sold Calculate CA-CL Exhibit 2 HORNIMAN HORTICULTURE Financial Ratio Analysis and Benchmarking 2012 2013 2014 2015 Benchmark? Revenue growth Gross margin (Gross profit / Revenue) Operating margin (Op. profit / Revenue) Net profit margin (Net profit / Revenue) 2.9% 48.9% 6.4% 4.1% 2.4% 46.9% 4.8% 3.1% 12.5% 51.8% 8.6% 5.7% 15.5% 52.0% 9.5% 5.8% (1.8)% 48.9% 7.6% 2.8% Return on assets (Net profit / Total assets Return on capital (Net profit / Total capit 3.2% 3.3% 2.4% 2.5% 4.7% 4.8% 5.1% 5.4% 2.9% 4.0% Receivable days (AR / Revenue * 365) Inventory days (Inventory / COGS * 365) Payable days (AP/ Purchases * 365) NFA turnover (Revenue / NFA) 41.9 424.2 15.6 2.4 45.0 432.1 13.3 2.4 48.0 436.5 10.2 2.4 50.9 476.3 9.9 3.0 21.8 386.3 26.9 2.7 Benchmark figures are based on 2014 financial ratios of publicly traded horticulture producers. Exhibit 1 Expanded to Forecast HORNIMAN HORTICULTURE Projected Horniman Horticulture Financial Summary (in thousands of dollars) 2012 2013 2014 2015 2016e Input Assumption Profit and loss statement 788.5 807.6 1,048.8 503.4 402.9 908.2 437.7 470.5 356.0 385.6 301.2 428.8 378.8 302.0 38.4 Revenue Cost of goods sold Gross profit SG&A expense Depreciation Operating profit Taxes Net profit 545.4 404.5 30.0% Bob Brown's forecast of revenue growth (p. 129) 2015 ratio: cost of goods sold / revenue Balance Revenue less cost of goods sold 2015 ratio: SG&A expense / revenue 46.0 Maggie Brown's estimate (footnote p. 129) Balance Gross profit less SG&A less Depreciation 2015 effective rate: tax / operating profit Balance Operating profit less taxes 34.2 36.3 40.9 50.2 38.4 100.0 17.6 32.6 39.2 78.2 26.2 52.0 13.1 25.3 60.8 Balance sheet Cash 120.1 66.8 9.4 0 105.2 99.5 90.6 119.5 146.4 468.3 507.6 523.4 656.9 20.9 19.3 22.6 Accounts receivable Inventory Other current assets Current assets (CA) Net fixed assets (NFA) Total assets 20.9 833.6 PLUGS Alternative: cash = 8.0% of sales 2015 ratio: accounts receivable / revenue 2015 ratio: inventory/cost of goods sold 2015 ratio: other current assets /revenues Sum Cash + AR + Inventory + Other Calculate 2015 NFA+2016 capex - 2016 deprec exp Sum CA + NFA 699.9 731.6 732.3 332.1 1,032.0 332.5 1,064.1 384.3 1,116.6 347.9 1,181.5 6.0 5.3 4.5 5.0 19.7 24.4 22.0 15.4 22.1 16.6 10.2 17.9 Accounts payable (AP) Wages payable (WP) Other payables (OP) Current liabilities (CL) Long-term debt (?) Net worth Total liabilities & net worth 35.9 42.7 43.2 47.3 2015 ratio: accts payable / purchases 2015 ratio: wages payable / cost of goods sold 2015 ratio: other payable / revenues Sum AP + WP + OP "Sizable personal loan from Maggie's father" is not a loan to the business Calculate 2015 net worth + 2016 net profit Sum CL + NW 996.1 1,073.4 1,021.4 1,064.1 1,134.2 1,181.5 1,032.0 1,116.6 22.0 38.8 88.1 4.5 Capital expenditure Purchases Net Working Capital (NWC) 140.8 664.0 145.2 688.9 161.2 689.1 185.1 786.3 75.0 Magie Brown's estimate: footnote on p. 129 2015 ratio: purchases / cost of goods sold Calculate CA-CL Exhibit 2 HORNIMAN HORTICULTURE Financial Ratio Analysis and Benchmarking 2012 2013 2014 2015 Benchmark? Revenue growth Gross margin (Gross profit / Revenue) Operating margin (Op. profit / Revenue) Net profit margin (Net profit / Revenue) 2.9% 48.9% 6.4% 4.1% 2.4% 46.9% 4.8% 3.1% 12.5% 51.8% 8.6% 5.7% 15.5% 52.0% 9.5% 5.8% (1.8)% 48.9% 7.6% 2.8% Return on assets (Net profit / Total assets Return on capital (Net profit / Total capit 3.2% 3.3% 2.4% 2.5% 4.7% 4.8% 5.1% 5.4% 2.9% 4.0% Receivable days (AR / Revenue * 365) Inventory days (Inventory / COGS * 365) Payable days (AP/ Purchases * 365) NFA turnover (Revenue / NFA) 41.9 424.2 15.6 2.4 45.0 432.1 13.3 2.4 48.0 436.5 10.2 2.4 50.9 476.3 9.9 3.0 21.8 386.3 26.9 2.7 Benchmark figures are based on 2014 financial ratios of publicly traded horticulture producers

With a lower revenue growth target, would HH be able to avoid a cash deficiency? Discuss what other measures the Browns might take in order to approach the cash level that Maggie considers ideal, where the available cash is equal to 8% of revenue.

With a lower revenue growth target, would HH be able to avoid a cash deficiency? Discuss what other measures the Browns might take in order to approach the cash level that Maggie considers ideal, where the available cash is equal to 8% of revenue.