Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With a view to minimizing total Tax Payable for the GRE and the beneficiaries, determine the amounts and type of income that should be

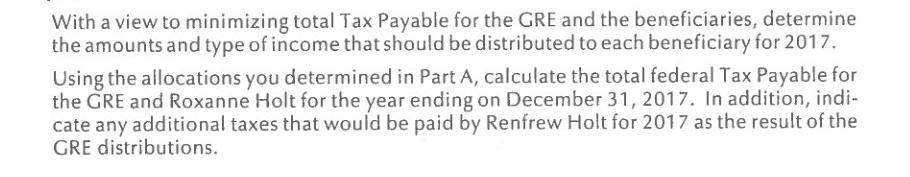

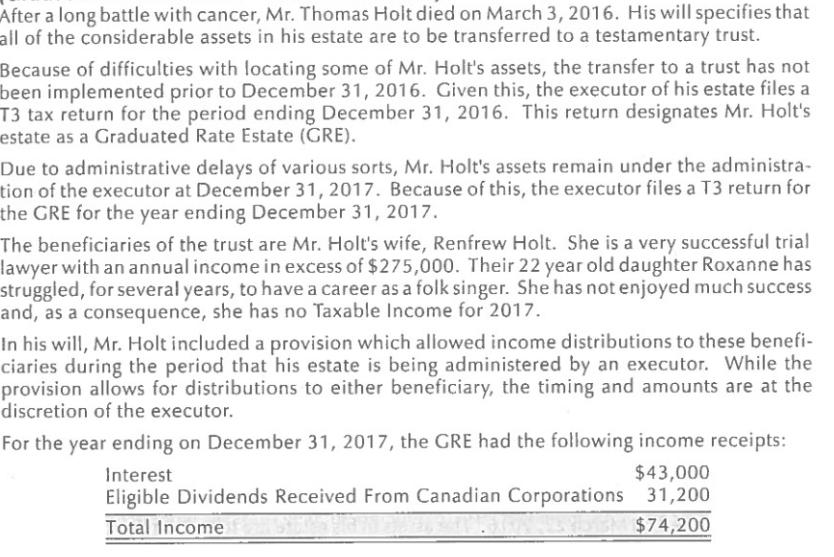

With a view to minimizing total Tax Payable for the GRE and the beneficiaries, determine the amounts and type of income that should be distributed to each beneficiary for 2017. Using the allocations you determined in Part A, calculate the total federal Tax Payable for the GRE and Roxanne Holt for the year ending on December 31, 2017. In addition, indi- cate any additional taxes that would be paid by Renfrew Holt for 2017 as the result of the GRE distributions. After a long battle with cancer, Mr. Thomas Holt died on March 3, 2016. His will specifies that all of the considerable assets in his estate are to be transferred to a testamentary trust. Because of difficulties with locating some of Mr. Holt's assets, the transfer to a trust has not been implemented prior to December 31, 2016. Given this, the executor of his estate files a T3 tax return for the period ending December 31, 2016. This return designates Mr. Holt's estate as a Graduated Rate Estate (GRE). Due to administrative delays of various sorts, Mr. Holt's assets remain under the administra- tion of the executor at December 31, 2017. Because of this, the executor files a T3 return for the GRE for the year ending December 31, 2017. The beneficiaries of the trust are Mr. Holt's wife, Renfrew Holt. She is a very successful trial lawyer with an annual income in excess of $275,000. Their 22 year old daughter Roxanne has struggled, for several years, to have a career as a folk singer. She has not enjoyed much success and, as a consequence, she has no Taxable Income for 2017. In his will, Mr. Holt included a provision which allowed income distributions to these benefi- ciaries during the period that his estate is being administered by an executor. While the provision allows for distributions to either beneficiary, the timing and amounts are at the discretion of the executor. For the year ending on December 31, 2017, the GRE had the following income receipts: Interest $43,000 Eligible Dividends Received From Canadian Corporations 31,200 Total Income KONG HIGENIETEN, BAIN, EN $74,200

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer To minimize the total tax payable for the Graduated Rate Estate GRE and the beneficiaries we need to determine the optimal distribution of inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started