Question

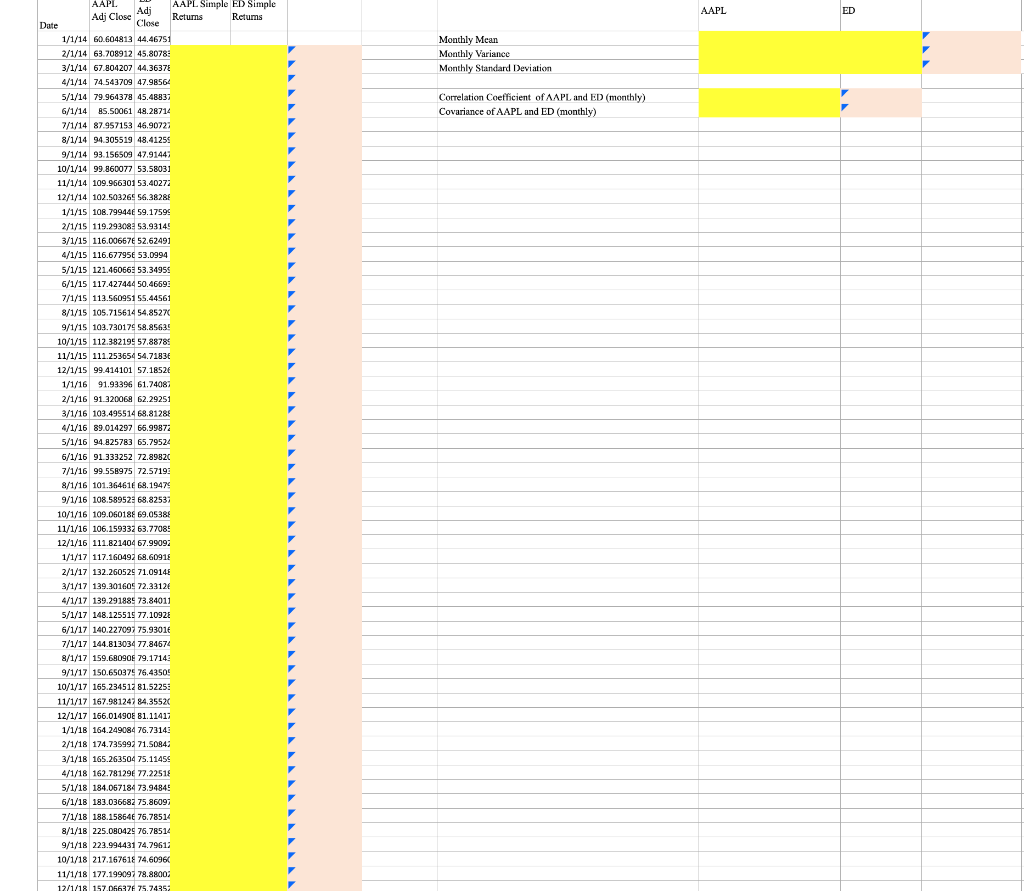

With adjusted closing prices of Apple Inc (AAPL) and Consolidated Edison Inc (ED) stocks for 01/01/2014-12/31/2018 (from YahooFinance!) in the template: Calculate the monthly simple

With adjusted closing prices of Apple Inc (AAPL) and Consolidated Edison Inc (ED) stocks for 01/01/2014-12/31/2018 (from YahooFinance!) in the template:

Calculate the monthly simple returns of each stock. (1 point)

Find the monthly average return, monthly return variance, and monthly standard deviation of each stock. (1 point)

Find the correlation coefficient of the two return series. (1 points)

Find the covariance of the two return series. (1 points)

Consider forming portfolios with these two assets. Let the weight of AAPL in the portfolio vary and take values between 0%-100% with increments of 5%. In other words, the weight of AAPL can be 0%, 5%, 10%,..95%,100%. The weight of ED is simply 100% minus weight of AAPL. Calculate the monthly average return, return variance and standard deviation of portfolios for all possible weights. (2pts)

Plot monthly average return versus monthly standard deviation values that you find in 5 to get the feasible set with these two stocks and title it as "Portfolio Risk vs Expected Return". Note: The average return should be y-axis and standard deviation should be x- axis (1.5 points)

Can all the portfolios on the feasible set be chosen by the investors? Why/ Why not? Which portion of the feasible set is the efficient frontier? Write your answer in a text box. (1pt)

How does the correlation between AAPL and ED effect the shape of the feasible set? For example, how would it look like if the two stocks were perfectly positively correlated (i.e. =1) or how would it look like if they were perfectly negatively correlated (i.e. =-1)? When do we have no diversification benefits? When do we have the maximum diversification benefits? Write your answer in a text box. (1.5pts)

AAPL ED Adj Close Adi Monthly Mean Monthly Variance Monthly Standard Deviation Correlation Coefficient of AAPL and ED (monthly) Covariance of AAPL and ED (monthly) AAPL AAPL Simple ED Simple Returns Retums Date Close 1/1/14 60.604813 44.46751 2/1/14 63.708912 45.8078 3/1/14 67.804207 44.3637E 4/1/14 74.543709 47.98564 5/1/14 79.964378 45.48837 6/1/14 85.50061 48.28714 7/1/14 87.957153 46.90727 8/1/14 94.305519 48.41255 9/1/14 93.156509 47.91443 10/1/14 99.860077 53.58031 11/1/14 109.966301 53,40273 12/1/14 102.503265 56.38288 1/1/15 108.79944 59.17595 2/1/15 119.2930853.93145 3/1/15 116.00667 52.62491 4/1/15 116.677950 53.0994 5/1/15 121.46066: 53.34955 6/1/15 117.427444 50.46693 7/1/15 113.560951 55.44561 8/1/15 105.715614 54.85270 9/1/15 103.730174 58.85639 10/1/15 112.382199 57.88785 11/1/15 111.253654 54.7183 12/1/15 99.414101 57.1852 1/1/16 91.93396 61.74083 2/1/16 91.320068 62.29251 3/1/16 103.495514 68.8128 4/1/16 89.014297 66.99872 5/1/16 94.825783 65.79524 6/1/16 91.333252 72.89820 7/1/16 99.558975 72.57199 8/1/16 101.36461 68.19479 9/1/16 108.58952: 68.82532 10/1/16 109.060188 69.05388 11/1/16 106.159332 63.77085 12/1/16 111.821404 67.99092 1/1/17 117.160492 68.60918 2/1/17 132.260529 71.0914 3/1/17 139.30160972.33120 4/1/17 139.291889 73.84011 5/1/17 148.125519 77.1092 6/1/17 140.227097 75.9301 7/1/17 144.813034 77.84674 8/1/17 159.68090F 79.17141 9/1/17 150.650379 76.43509 10/1/17 165.234512 81.5225: 11/1/17 167.981247 84.35520 12/1/17 156.01490E 81. 11417 1/1/18 164.249084 76.7314 2/1/18 174.735992 71.50843 3/1/18 165.263504 75.11459 4/1/18 162.78129 77.22518 5/1/18 184.067184 73.94845 6/1/18 183.036682 75.8609 7/1/18 188.15864 76.78514 8/1/18 225.080429 76.78514 9/1/18 223.994431 74,79612 10/1/18 217.167618 74,60966 11/1/18 177.199091 78.88003 12/1/18 157.066374 75.7435: AAPL ED Adj Close Adi Monthly Mean Monthly Variance Monthly Standard Deviation Correlation Coefficient of AAPL and ED (monthly) Covariance of AAPL and ED (monthly) AAPL AAPL Simple ED Simple Returns Retums Date Close 1/1/14 60.604813 44.46751 2/1/14 63.708912 45.8078 3/1/14 67.804207 44.3637E 4/1/14 74.543709 47.98564 5/1/14 79.964378 45.48837 6/1/14 85.50061 48.28714 7/1/14 87.957153 46.90727 8/1/14 94.305519 48.41255 9/1/14 93.156509 47.91443 10/1/14 99.860077 53.58031 11/1/14 109.966301 53,40273 12/1/14 102.503265 56.38288 1/1/15 108.79944 59.17595 2/1/15 119.2930853.93145 3/1/15 116.00667 52.62491 4/1/15 116.677950 53.0994 5/1/15 121.46066: 53.34955 6/1/15 117.427444 50.46693 7/1/15 113.560951 55.44561 8/1/15 105.715614 54.85270 9/1/15 103.730174 58.85639 10/1/15 112.382199 57.88785 11/1/15 111.253654 54.7183 12/1/15 99.414101 57.1852 1/1/16 91.93396 61.74083 2/1/16 91.320068 62.29251 3/1/16 103.495514 68.8128 4/1/16 89.014297 66.99872 5/1/16 94.825783 65.79524 6/1/16 91.333252 72.89820 7/1/16 99.558975 72.57199 8/1/16 101.36461 68.19479 9/1/16 108.58952: 68.82532 10/1/16 109.060188 69.05388 11/1/16 106.159332 63.77085 12/1/16 111.821404 67.99092 1/1/17 117.160492 68.60918 2/1/17 132.260529 71.0914 3/1/17 139.30160972.33120 4/1/17 139.291889 73.84011 5/1/17 148.125519 77.1092 6/1/17 140.227097 75.9301 7/1/17 144.813034 77.84674 8/1/17 159.68090F 79.17141 9/1/17 150.650379 76.43509 10/1/17 165.234512 81.5225: 11/1/17 167.981247 84.35520 12/1/17 156.01490E 81. 11417 1/1/18 164.249084 76.7314 2/1/18 174.735992 71.50843 3/1/18 165.263504 75.11459 4/1/18 162.78129 77.22518 5/1/18 184.067184 73.94845 6/1/18 183.036682 75.8609 7/1/18 188.15864 76.78514 8/1/18 225.080429 76.78514 9/1/18 223.994431 74,79612 10/1/18 217.167618 74,60966 11/1/18 177.199091 78.88003 12/1/18 157.066374 75.7435Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started