Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with Costings confirm it will cost vicles, the MC he existings ly agreed to has prove financial To purchase Translators EU Financing Question Translators EU

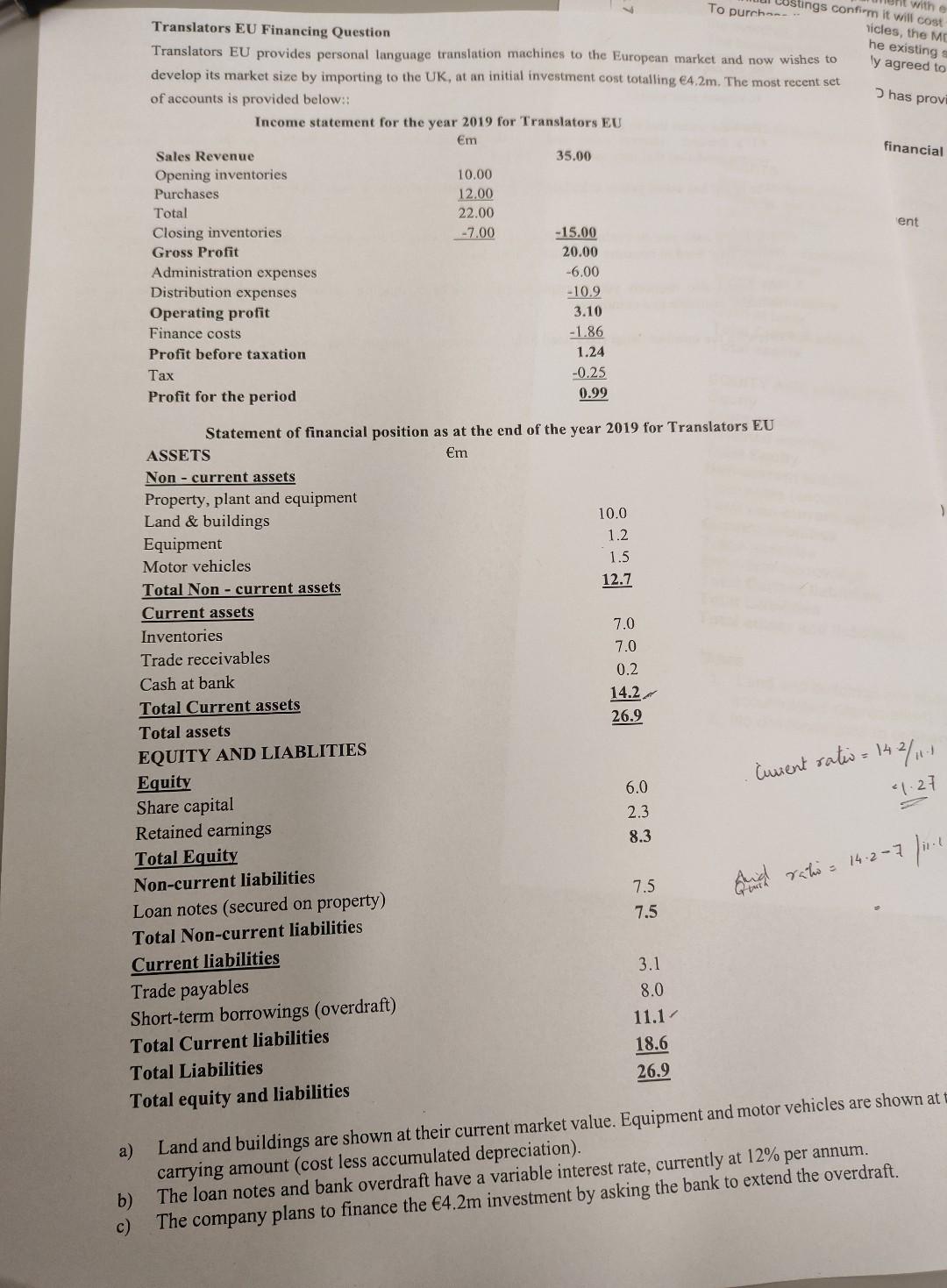

with Costings confirm it will cost vicles, the MC he existings ly agreed to has prove financial To purchase Translators EU Financing Question Translators EU provides personal language translation machines to the European market and now wishes to develop its market size by importing to the UK, at an initial investment cost totalling 4,2m. The most recent set of accounts is provided below: Income statement for the year 2019 for Translators EU Em Sales Revenue 35.00 Opening inventories 10.00 Purchases 12.00 Total 22.00 Closing inventories -7.00 -15.00 Gross Profit 20.00 Administration expenses -6.00 Distribution expenses -10.9 Operating profit 3.10 Finance costs -1.86 Profit before taxation 1.24 Tax -0.25 Profit for the period 0.99 ent 0 - Statement of financial position as at the end of the year 2019 for Translators EU ASSETS Em Non - current assets Property, plant and equipment Land & buildings 10.0 Equipment 1.2 Motor vehicles 1.5 Total Non-current assets 12.7 Current assets Inventories 7.0 Trade receivables 7.0 Cash at bank 0.2 Total Current assets 14.2 Total assets 26.9 EQUITY AND LIABLITIES Equity 6.0 Share capital 2.3 Retained earnings 8.3 Total Equity Non-current liabilities 7.5 Loan notes (secured on property) 7.5 Total Non-current liabilities Current liabilities 3.1 Trade payables Short-term borrowings (overdraft) 11.1 Total Current liabilities 18.6 Total Liabilities 26.9 Total equity and liabilities Curent ratio = 14 42% 1.27 and ratio = 14.2-7 live 8.0 a) Land and buildings are shown at their current market value.Equipment and motor vehicles are shown at t carrying amount (cost less accumulated depreciation). The loan notes and bank overdraft have a variable interest rate, currently at 12% per annum. The company plans to finance the 4.2m investment by asking the bank to extend the overdraft. b) c) You are required to: 1. Comment on the bank's possible views regarding them providing the funds requested. (Provide calculations to support your views) (12 Marks) 2. The bank states that to grant the additional finance, interest cover must be at least 1.5. Calculate Translators EU's forecast interest cover and provide an explanation of your findings to the board including a recommendation that may assist the company. (8 Marks) 3. The board has asked you to calculate the interest rate they need to obtain in order to achieve an interest cover of 1.5 (6 Marks) 4. The board asks you to evaluate whether they should borrow long term or short term. Provide them with 4 factors they need to consider in assisting their decision. (10 Marks) 5. The board also requests you to explain what long-term funding options, both external and internal, are normally available to a company. (7 Marks) 6. Reviewing the question what risks need to be considered to support your answers? (7 Marks) Total 50 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started