Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with detailed methods please! Project 5 - Bond amortization.xx - Microsoft Excel Insert Page Layout Form Review View Developer . cmi A 1 -A -

with detailed methods please!

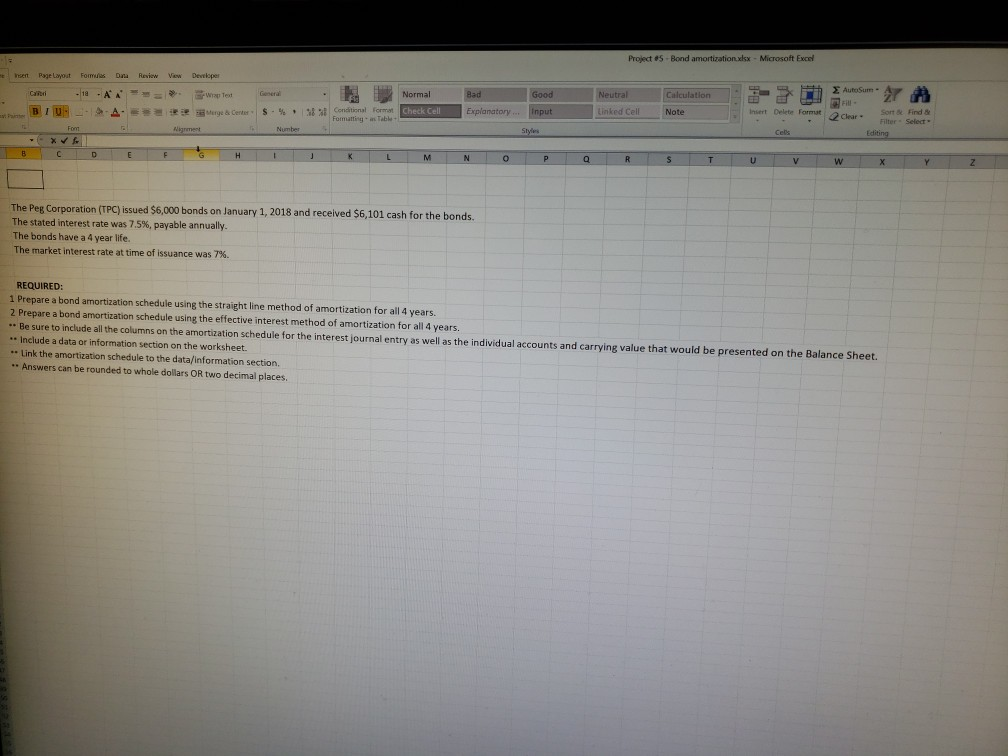

Project 5 - Bond amortization.xx - Microsoft Excel Insert Page Layout Form Review View Developer . cmi A 1 -A - From XA l n lignment l ge & Center General S. Number Normal Check Cell Bad Explanatory... Good Input Neutral Linked Cell Calculation Note Conditional Format Formatting Table Delete Format Clear SORT & Filter Editing Find & Scied a Cels TE6 H K M N O P a R S T U V W The Peg Corporation (TPC) issued $6,000 bonds on January 1, 2018 and received $6,101 cash for the bonds. The stated interest rate was 7.5%, payable annually. The bonds have a 4 year life. The market interest rate at time of issuance was 7%. REQUIRED: 1 Prepare a bond amortization schedule using the straight line method of amortization for all 4 years. 2 Prepare a bond amortization schedule using the effective interest method of amortization for all 4 years. .. Be sure to include all the columns on the amortization schedule for the interest journal entry as well as the individual accounts and carrying value that would be presented on the Balance Sheet. - Include a data or information section on the worksheet. Link the amortization schedule to the data/information section - Answers can be rounded to whole dollars OR two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started