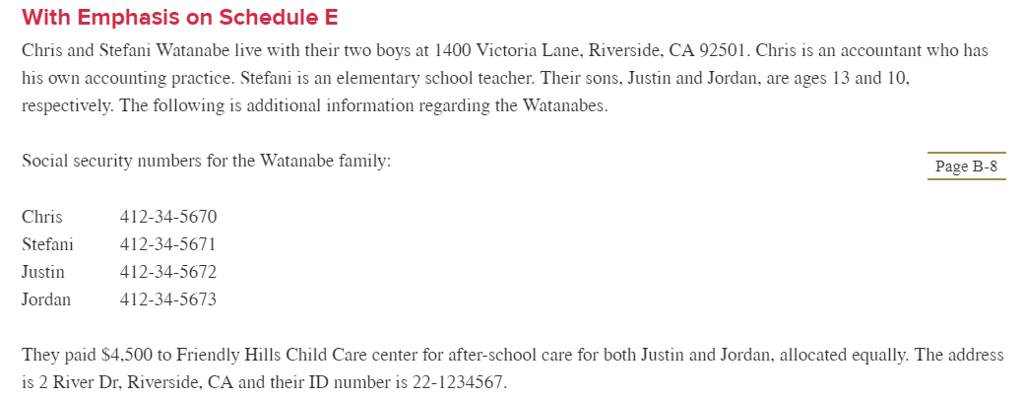

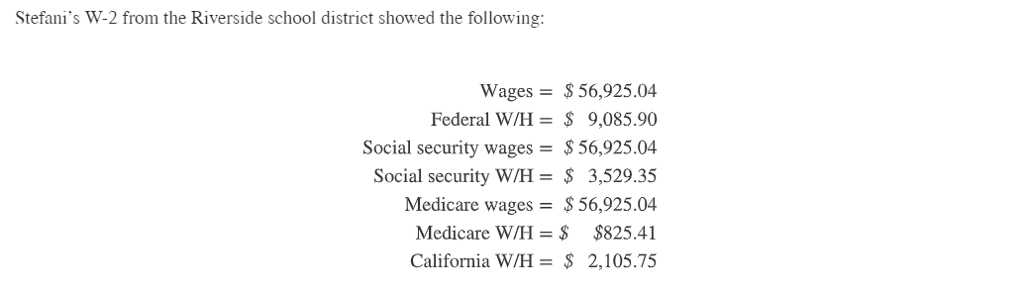

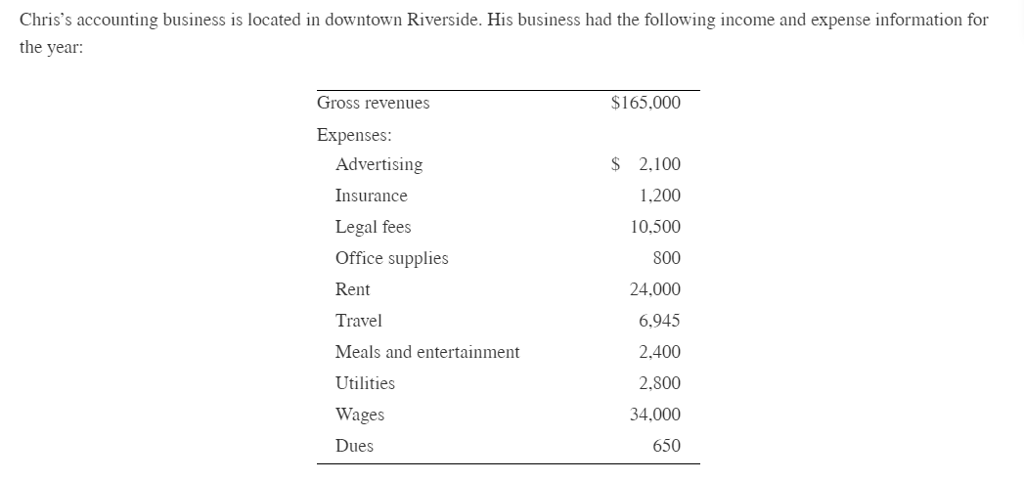

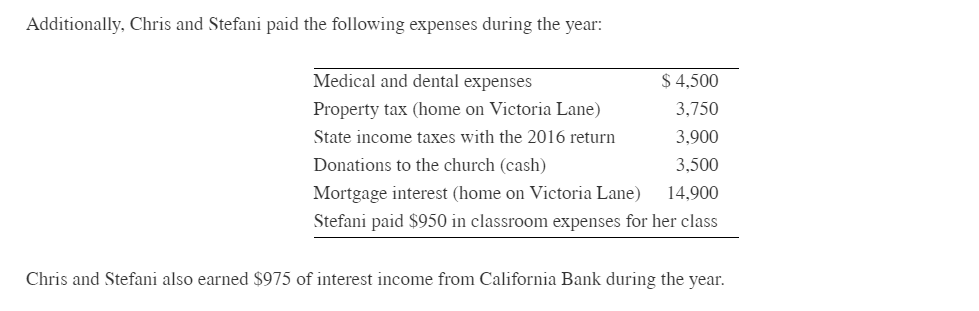

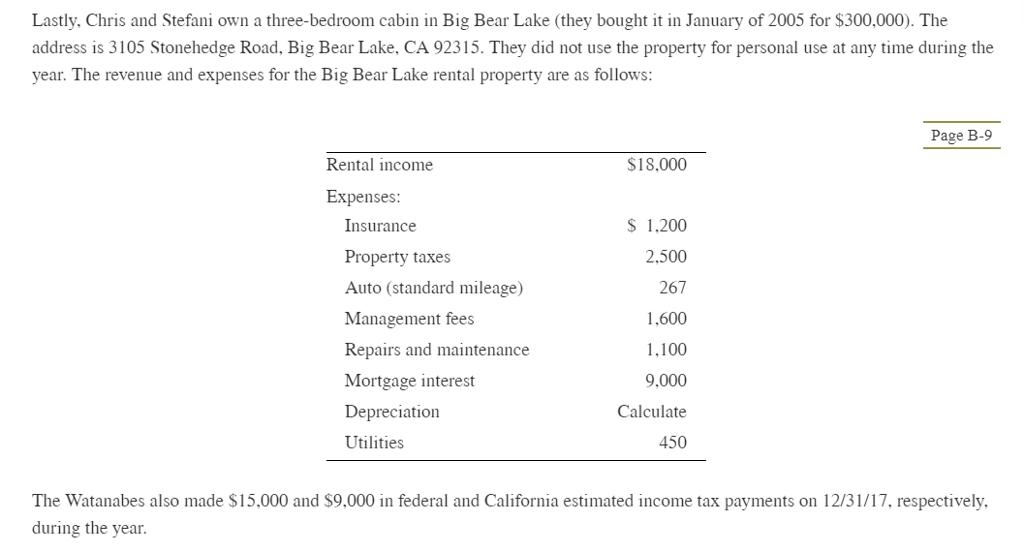

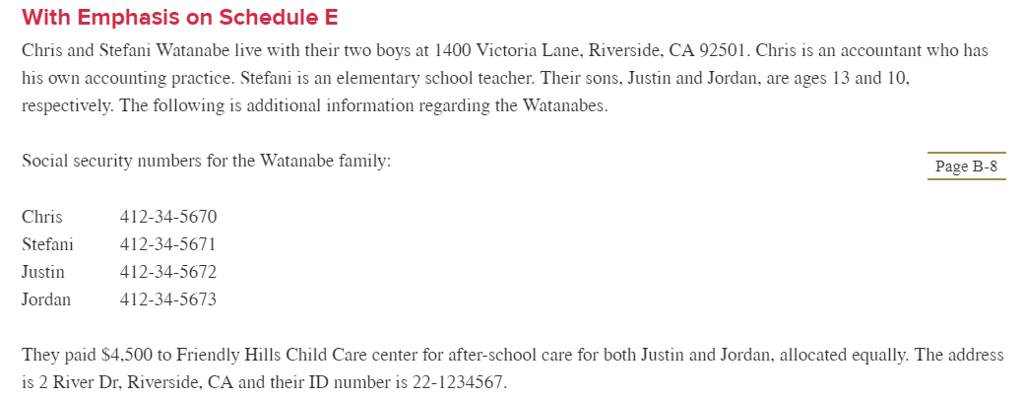

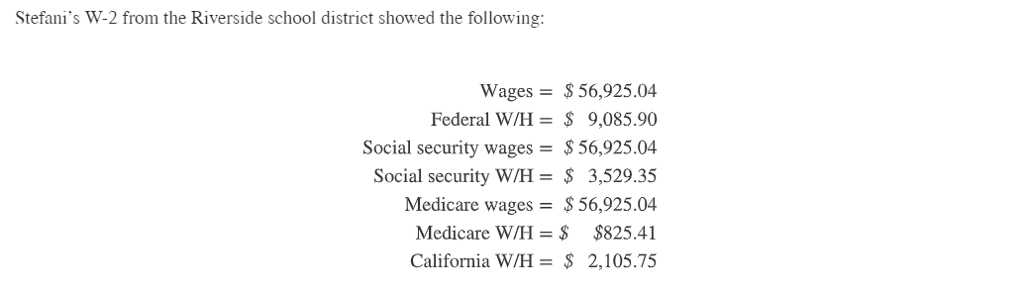

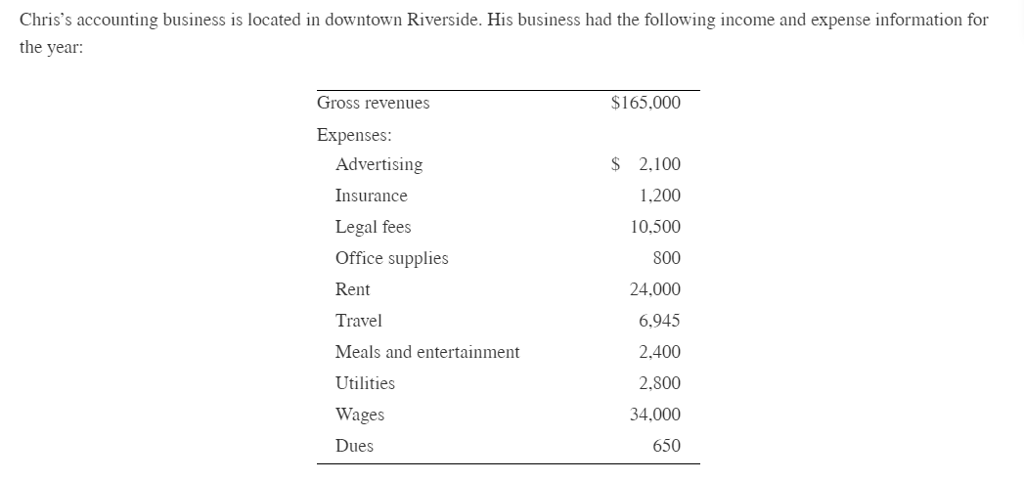

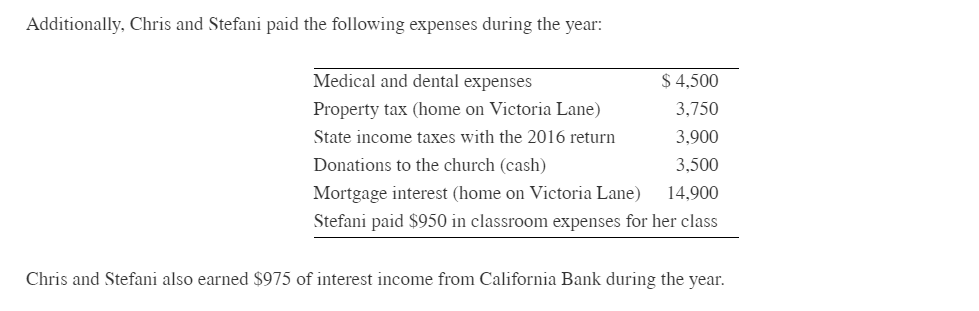

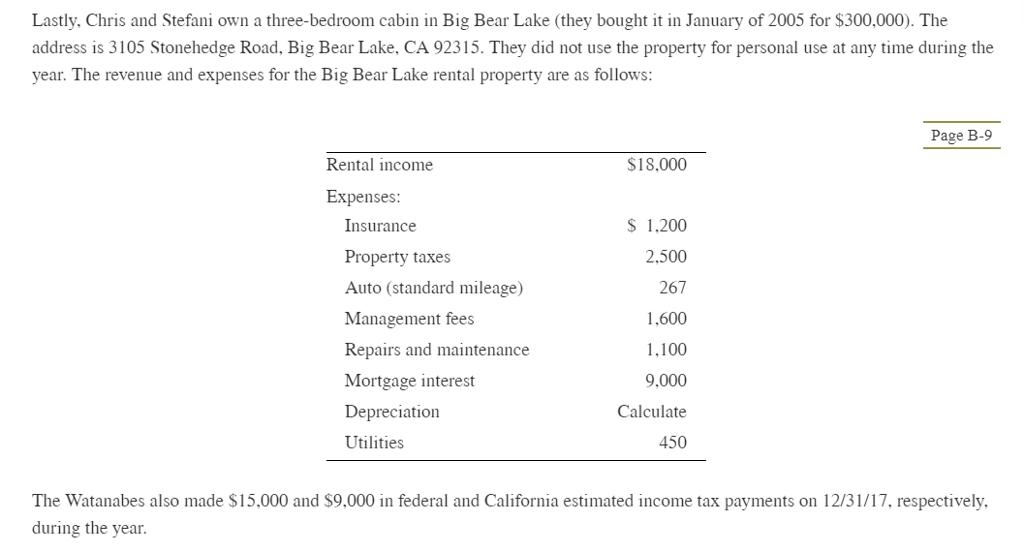

With Emphasis on Schedule E Chris and Stefani Watanabe live with their two boys at 1400 Victoria Lane, Riverside, CA 92501. Chris is an accountant who has his own accounting practice. Stefani is an elementary school teacher. Their sons, Justin and Jordan, are ages 13 and 10 respectively. The following is additional information regarding the Watanabes. Social security numbers for the Watanabe family: Page B-8 Chris Stefani 412-34-5671 Justin 412-34-5672 ordan 412-34-5673 412-34-5670 They paid $4,500 to Friendly Hills Child Care center for after-school care for both Justin and Jordan, allocated equally. The address is 2 River Dr, Riverside, CA and their ID number is 22-1234567. Stefani's W-2 from the Riverside school district showed the following: Wages-S 56,925.04 Federal W/H $ 9,085.90 Social security wages56,925.04 Social security W/H 3,529.35 Medicare wages-$56,925.04 Medicare WH-$ $825.41 California WH- 2,105.75 Chris's accounting business is located in downtown Riverside. His business had the following income and expense information for the year: Gross revenues $165,000 xpenses: Advertising Insurance Legal fees Office supplies Rent Travel Meals and entertainment Utilities Wages Dues $ 2.100 1.200 10,500 800 24.000 6,945 2.400 2.800 34,000 650 Additionally. Chris and Stefani paid the following expenses during the year: S 4,500 3,750 3,900 3,500 Mortgage interest (home on Victoria Lane) 14,900 Stefani paid $950 in classroom expenses for her class Medical and dental expenses Property tax (home on Victoria Lane) State income taxes with the 2016 return Donations to the church (cash) Chris and Stefani also earned $975 of interest income from California Bank during the year Lastly, Chris and Stefani own a three-bedroom cabin in Big Bear Lake (they bought it in January of 2005 for $300,000). The address is 3105 Stonehedge Road, Big Bear Lake, CA 92315. They did not use the property for personal use at any time during the year. The revenue and expenses for the Big Bear Lake rental property are as follows Page B-9 Rental income $18,000 Expenses Insurance Property taxes Auto (standard mileage) Management fees Repairs and maintenance Mortgage interest Depreciation Utilities S 1.200 2.500 267 1.600 1,100 9.000 Calculate 450 The Watanabes also made $15,000 and $9,000 in federal and California estimated income tax payments on 12/31/17, respectively during the year Required Prepare the Watanabes' federal tax return for 2017. Use Form 1040, Schedule A, Schedule C, Schedule E, Schedule SE, and any additional schedules or forms they may need. The Watanabes had qualifying health care coverage at all times during the tax year. They do not want to contribute to the presidential election campaign, and they do not want anyone to be a third-party designee. For any missing information, make reasonable assumptions With Emphasis on Schedule E Chris and Stefani Watanabe live with their two boys at 1400 Victoria Lane, Riverside, CA 92501. Chris is an accountant who has his own accounting practice. Stefani is an elementary school teacher. Their sons, Justin and Jordan, are ages 13 and 10 respectively. The following is additional information regarding the Watanabes. Social security numbers for the Watanabe family: Page B-8 Chris Stefani 412-34-5671 Justin 412-34-5672 ordan 412-34-5673 412-34-5670 They paid $4,500 to Friendly Hills Child Care center for after-school care for both Justin and Jordan, allocated equally. The address is 2 River Dr, Riverside, CA and their ID number is 22-1234567. Stefani's W-2 from the Riverside school district showed the following: Wages-S 56,925.04 Federal W/H $ 9,085.90 Social security wages56,925.04 Social security W/H 3,529.35 Medicare wages-$56,925.04 Medicare WH-$ $825.41 California WH- 2,105.75 Chris's accounting business is located in downtown Riverside. His business had the following income and expense information for the year: Gross revenues $165,000 xpenses: Advertising Insurance Legal fees Office supplies Rent Travel Meals and entertainment Utilities Wages Dues $ 2.100 1.200 10,500 800 24.000 6,945 2.400 2.800 34,000 650 Additionally. Chris and Stefani paid the following expenses during the year: S 4,500 3,750 3,900 3,500 Mortgage interest (home on Victoria Lane) 14,900 Stefani paid $950 in classroom expenses for her class Medical and dental expenses Property tax (home on Victoria Lane) State income taxes with the 2016 return Donations to the church (cash) Chris and Stefani also earned $975 of interest income from California Bank during the year Lastly, Chris and Stefani own a three-bedroom cabin in Big Bear Lake (they bought it in January of 2005 for $300,000). The address is 3105 Stonehedge Road, Big Bear Lake, CA 92315. They did not use the property for personal use at any time during the year. The revenue and expenses for the Big Bear Lake rental property are as follows Page B-9 Rental income $18,000 Expenses Insurance Property taxes Auto (standard mileage) Management fees Repairs and maintenance Mortgage interest Depreciation Utilities S 1.200 2.500 267 1.600 1,100 9.000 Calculate 450 The Watanabes also made $15,000 and $9,000 in federal and California estimated income tax payments on 12/31/17, respectively during the year Required Prepare the Watanabes' federal tax return for 2017. Use Form 1040, Schedule A, Schedule C, Schedule E, Schedule SE, and any additional schedules or forms they may need. The Watanabes had qualifying health care coverage at all times during the tax year. They do not want to contribute to the presidential election campaign, and they do not want anyone to be a third-party designee. For any missing information, make reasonable assumptions