Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with excel formulas please The first task is to analyse the feasibility of introducing a new product that is different from the company's current line

with excel formulas please

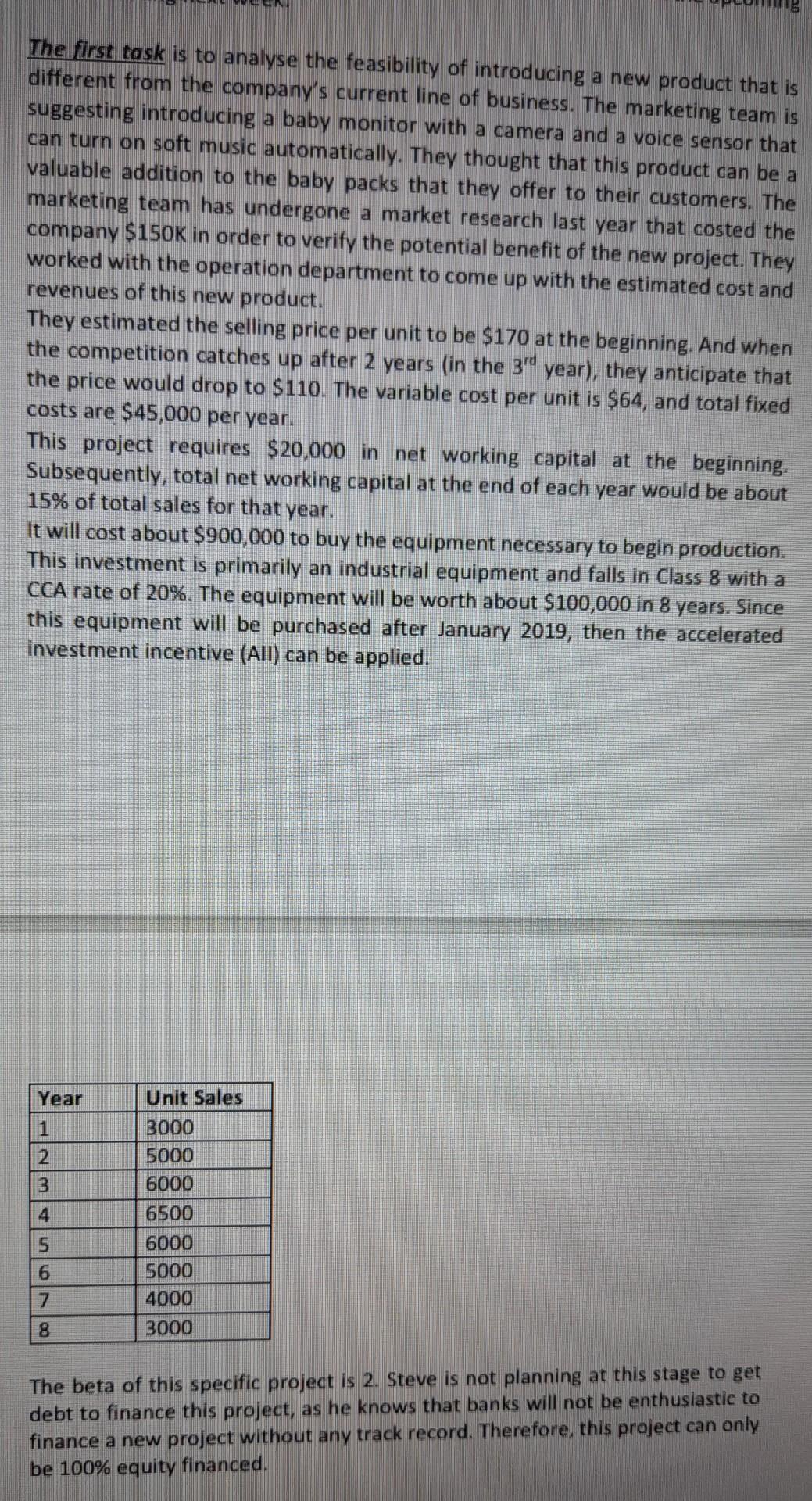

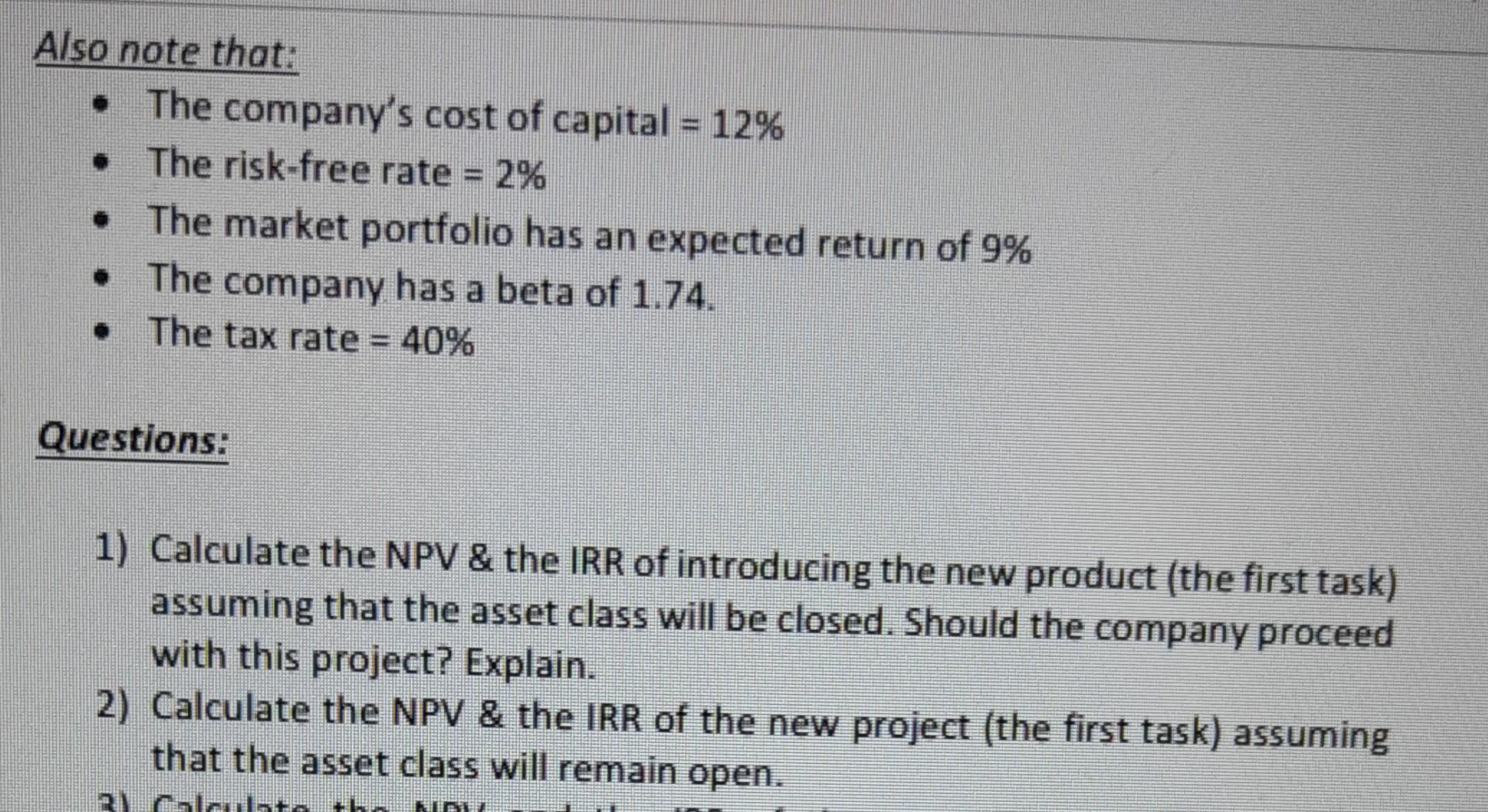

The first task is to analyse the feasibility of introducing a new product that is different from the company's current line of business. The marketing team is suggesting introducing a baby monitor with a camera and a voice sensor that can turn on soft music automatically. They thought that this product can be a valuable addition to the baby packs that they offer to their customers. The marketing team has undergone a market research last year that costed the company $150K in order to verify the potential benefit of the new project. They worked with the operation department to come up with the estimated cost and revenues of this new product. They estimated the selling price per unit to be $170 at the beginning. And when the competition catches up after 2 years (in the 3rd year), they anticipate that the price would drop to $110. The variable cost per unit is $64, and total fixed costs are $45,000 per year. This project requires $20,000 in net working capital at the beginning. Subsequently, total net working capital at the end of each year would be about 15% of total sales for that year. It will cost about $900,000 to buy the equipment necessary to begin production. This investment is primarily an industrial equipment and falls in Class 8 with a CCA rate of 20%. The equipment will be worth about $100,000 in 8 years. Since this equipment will be purchased after January 2019, then the accelerated investment incentive (AII) can be applied. The beta of this specific project is 2 . Steve is not planning at this stage to get debt to finance this project, as he knows that banks will not be enthusiastic to finance a new project without any track record. Therefore, this project can only be 100% equity financed. Also note that: - The company's cost of capital =12% - The risk-free rate =2% - The market portfolio has an expected return of 9% - The company has a beta of 1.74. - The tax rate =40% Questions: 1) Calculate the NPV \& the IRR of introducing the new product (the first task) assuming that the asset class will be closed. Should the company proceed with this project? Explain. 2) Calculate the NPV \& the IRR of the new project (the first task) assuming that the asset class will remain open. The first task is to analyse the feasibility of introducing a new product that is different from the company's current line of business. The marketing team is suggesting introducing a baby monitor with a camera and a voice sensor that can turn on soft music automatically. They thought that this product can be a valuable addition to the baby packs that they offer to their customers. The marketing team has undergone a market research last year that costed the company $150K in order to verify the potential benefit of the new project. They worked with the operation department to come up with the estimated cost and revenues of this new product. They estimated the selling price per unit to be $170 at the beginning. And when the competition catches up after 2 years (in the 3rd year), they anticipate that the price would drop to $110. The variable cost per unit is $64, and total fixed costs are $45,000 per year. This project requires $20,000 in net working capital at the beginning. Subsequently, total net working capital at the end of each year would be about 15% of total sales for that year. It will cost about $900,000 to buy the equipment necessary to begin production. This investment is primarily an industrial equipment and falls in Class 8 with a CCA rate of 20%. The equipment will be worth about $100,000 in 8 years. Since this equipment will be purchased after January 2019, then the accelerated investment incentive (AII) can be applied. The beta of this specific project is 2 . Steve is not planning at this stage to get debt to finance this project, as he knows that banks will not be enthusiastic to finance a new project without any track record. Therefore, this project can only be 100% equity financed. Also note that: - The company's cost of capital =12% - The risk-free rate =2% - The market portfolio has an expected return of 9% - The company has a beta of 1.74. - The tax rate =40% Questions: 1) Calculate the NPV \& the IRR of introducing the new product (the first task) assuming that the asset class will be closed. Should the company proceed with this project? Explain. 2) Calculate the NPV \& the IRR of the new project (the first task) assuming that the asset class will remain openStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started