Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With information from above, calculate the BTCFs for each of the 5-year holding period. Include debt service to get final BTCF F D E C)

With information from above, calculate the BTCFs for each of the 5-year holding period. Include debt service to get final BTCF

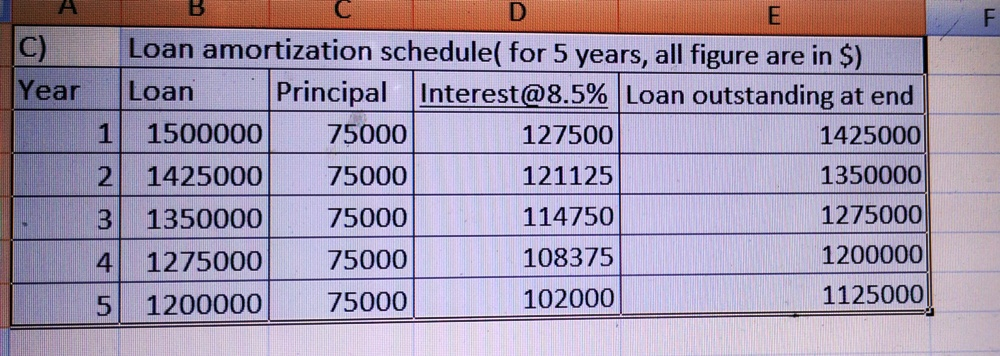

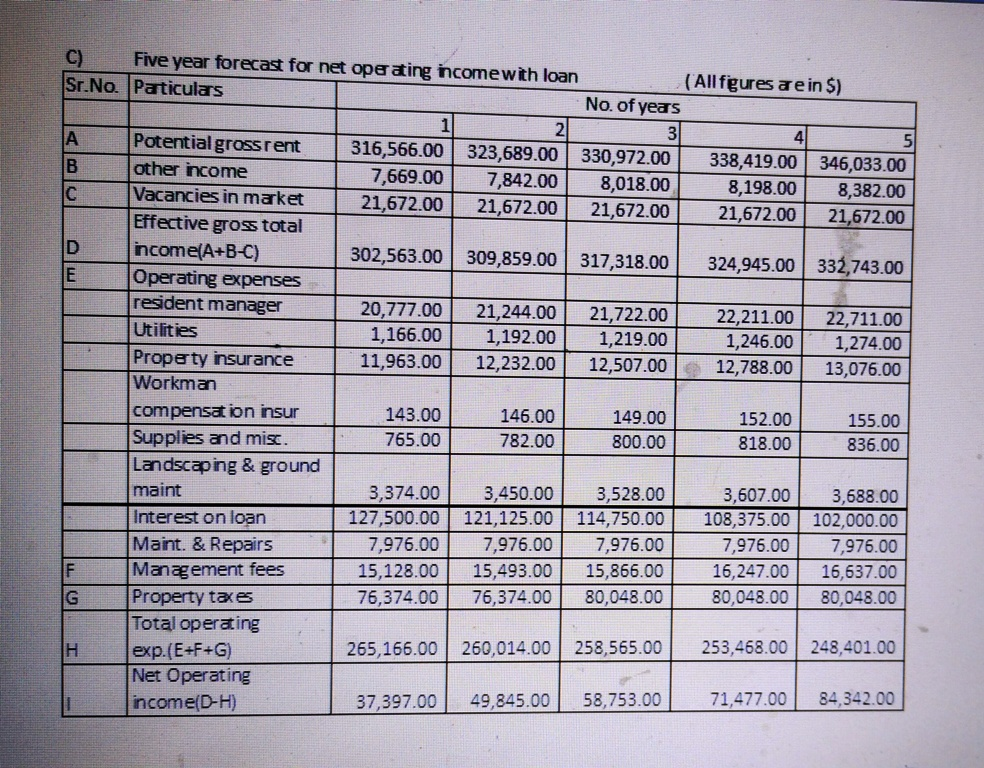

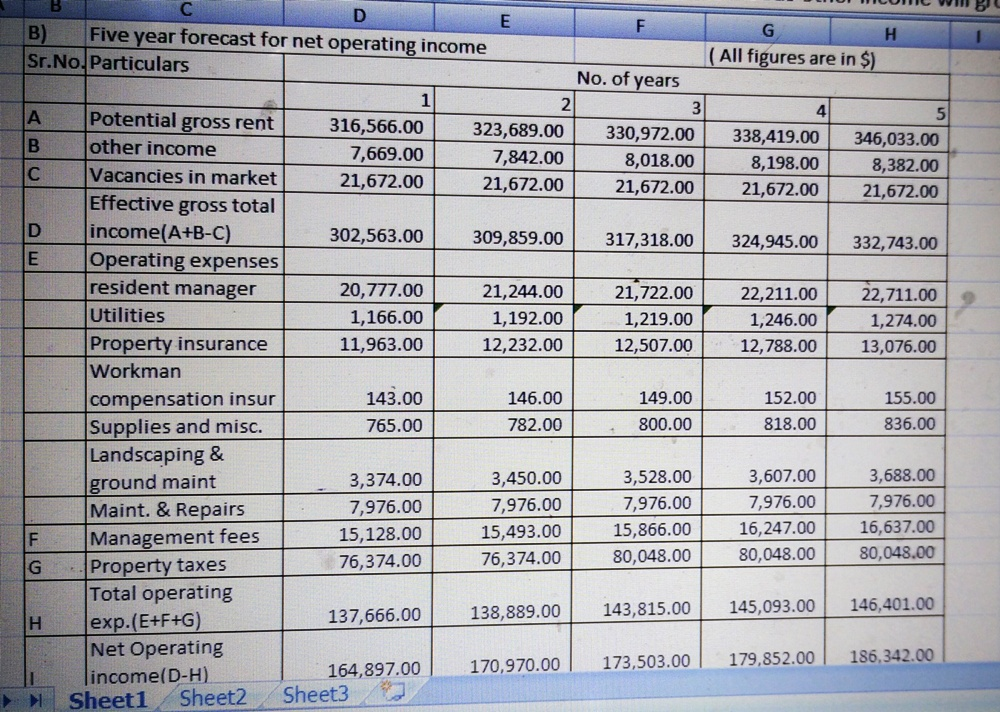

F D E C) Loan amortization scheduled for 5 years, all figure are in $) Year Loan Principal Interest@8.5% Loan outstanding at end 1 1500000 75000 127500 1425000 2 1425000 75000 121125 1350000 3 1350000 75000 114750 1275000 4 1275000 75000 108375 1200000 5 1200000 75000 102000 1125000 C) Five year forecast for net operating income with loan Sr.No. Paticulas (Allfigures a ein $) No. of years 1 2 3 A 5 Potentialgrossrent 316,566.00 323,689.00 330,972.00 338,419.00 346,033.00 B other income 7,669.00 7,842.00 8,018.00 8,198.00 8,382.00 C Vacancies in market 21,672.00 21,672.00 21,672.00 21,672.00 21,672.00 Effective gross total D income(A+B-C) 302,563.00 309,859.00 317,318.00 324,945.00 332,743.00 IE Operating expenses resident manager 20,777.00 21,244.00 21,722.00 22,211.00 22,711.00 Utilities 1,166.00 1,192.00 1,219.00 1,246.00 1,274.00 Property insurance 11,963.00 12,232.00 12,507.00 12,788.00 13,076.00 Workman compensation insur 143.00 146.00 149.00 152.00 155.00 Supplies and misc. 765.00 782.00 800.00 818.00 836.00 Landscaping & ground maint 3,374.00 3,450.00 3,528.00 3,607.00 3,688.00 Interest on loan 127,500.00 121,125.00 114,750.00 108,375.00 102,000.00 Maint. & Repairs 7,976.00 7,976.00 7,976.00 7,976.00 7,976.00 F Management fees 15,128.00 15,493.00 15,866.00 16, 247.00 16,637.00 G Property tae 76,374.00 76,374.00 80,048.00 80,048.00 80,048.00 Total operating H 265,166.00 exp.(E=F+G 260,014.00 258,565.00 253,468.00 248,401.00 Net Operating income(D-H) 37,397.00 49,845.00 58,753.00 71,477.00 84,342.00 F G H ( All figures are in $) No. of years 3 330,972.00 8,018.00 21,672.00 4 338,419.00 8,198.00 21,672.00 5 346,033.00 8,382.00 21,672.00 317,318.00 324,945.00 332,743.00 21,722.00 1,219.00 12,507.00 22,211.00 1,246.00 12,788.00 22,711.00 1,274.00 13,076.00 D E B) Five year forecast for net operating income Sr.No. Particulars 1 2 Potential gross rent 316,566.00 323,689.00 B other income 7,669.00 7,842.00 Vacancies in market 21,672.00 21,672.00 Effective gross total D income(A+B-C) 302,563.00 309,859.00 E Operating expenses resident manager 20,777.00 21,244.00 Utilities 1,166.00 1,192.00 Property insurance 11,963.00 12,232.00 Workman compensation insur 143.00 146.00 Supplies and misc. 765.00 782.00 Landscaping & ground maint 3,374.00 3,450.00 Maint. & Repairs 7,976.00 7,976.00 F Management fees 15,128.00 15,493.00 76,374.00 G 76,374.00 Property taxes Total operating 138,889.00 H 137,666.00 exp.(E+F+G) Net Operating 170,970.00 164,897.00 income(D-H) Sheet1 Sheet2 Sheet3 149.00 800.00 152.00 818.00 155.00 836.00 3,528.00 7,976.00 15,866.00 80,048.00 3,607.00 7,976.00 16,247.00 80,048.00 3,688.00 7,976.00 16,637.00 80,048.00 143,815.00 145,093.00 146,401.00 173,503.00 179,852.00 186,342.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started