Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With more people working from home, JD HiFi is considering investing in a new project that improves the speed of home delivery service. The

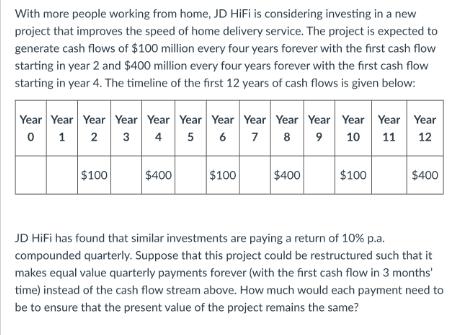

With more people working from home, JD HiFi is considering investing in a new project that improves the speed of home delivery service. The project is expected to generate cash flows of $100 million every four years forever with the first cash flow starting in year 2 and $400 million every four years forever with the first cash flow starting in year 4. The timeline of the first 12 years of cash flows is given below: Year Year Year Year Year Year Year Year Year Year Year Year Year 3 4 5 6 7 8 9 10 11 12 0 1 2 $100 $400 $100 $400 $100 $400 JD HiFi has found that similar investments are paying a return of 10% p.a. compounded quarterly. Suppose that this project could be restructured such that it makes equal value quarterly payments forever (with the first cash flow in 3 months' time) instead of the cash flow stream above. How much would each payment need to be to ensure that the present value of the project remains the same?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the equal value quarterly payments needed to ensure that the present value of the proje...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started