Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With regard to Mr. DOE's job as a nurse, Mr. DOE receives an annual salary of $70,000. Mr. DOE's employer withheld: 1) $12,000 of

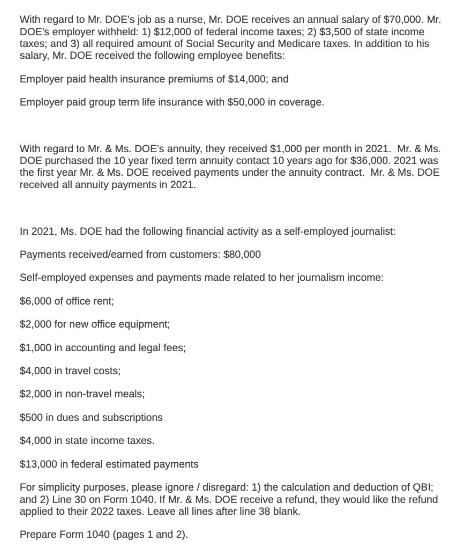

With regard to Mr. DOE's job as a nurse, Mr. DOE receives an annual salary of $70,000. Mr. DOE's employer withheld: 1) $12,000 of federal income taxes; 2) $3,500 of state income taxes; and 3) all required amount of Social Security and Medicare taxes. In addition to his salary, Mr. DOE received the following employee benefits: Employer paid health insurance premiums of $14,000; and Employer paid group term life insurance with $50,000 in coverage. With regard to Mr. & Ms. DOE's annuity, they received $1,000 per month in 2021. Mr. & Ms. DOE purchased the 10 year fixed term annuity contact 10 years ago for $36,000. 2021 was the first year Mr. & Ms. DOE received payments under the annuity contract. Mr. & Ms. DOE received all annuity payments in 2021. In 2021, Ms. DOE had the following financial activity as a self-employed journalist: Payments received/earned from customers: $80,000 Self-employed expenses and payments made related to her journalism income: $6,000 of office rent; $2,000 for new office equipment; $1,000 in accounting and legal fees; $4,000 in travel costs; $2,000 in non-travel meals; $500 in dues and subscriptions $4,000 in state income taxes. $13,000 in federal estimated payments For simplicity purposes, please ignore / disregard: 1) the calculation and deduction of QBI; and 2) Line 30 on Form 1040. If Mr. & Ms. DOE receive a refund, they would like the refund applied to their 2022 taxes. Leave all lines after line 38 blank. Prepare Form 1040 (pages 1 and 2).

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To prepare Form 1040 for Mr and Ms DOE based on the provided information well calculate their taxabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started